BOE Processing

Page Topics:

Workflow

Setup Case

This workflow will guide the user through creating BOE notices, setup batch for BOE, creating single case and multiple cases, Informal Settlements, Hearings, Schedule hearing and finalizing the values for real property.

Creating Board Notices:

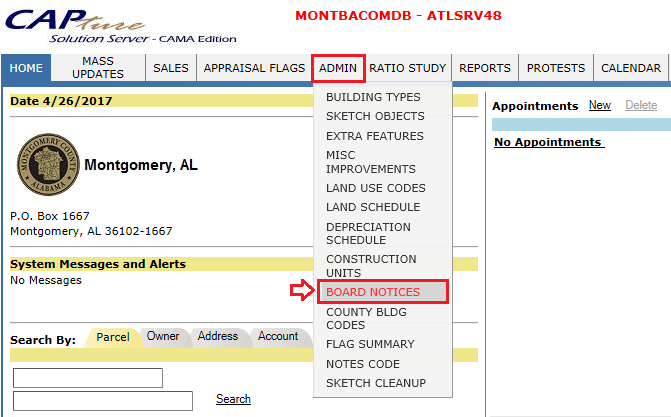

To create Board Notices, Login as user who has privilege to create Board Notices and Hover over on ADMIN -> BOARD NOTICES.

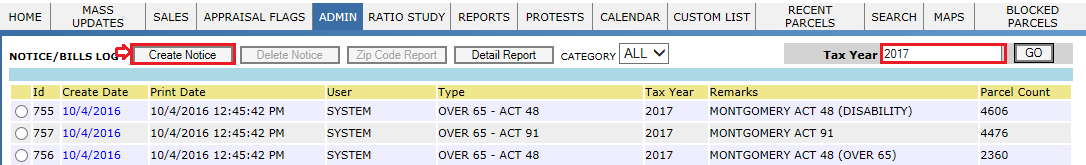

Select the respective Tax year and click on Create Notice button.

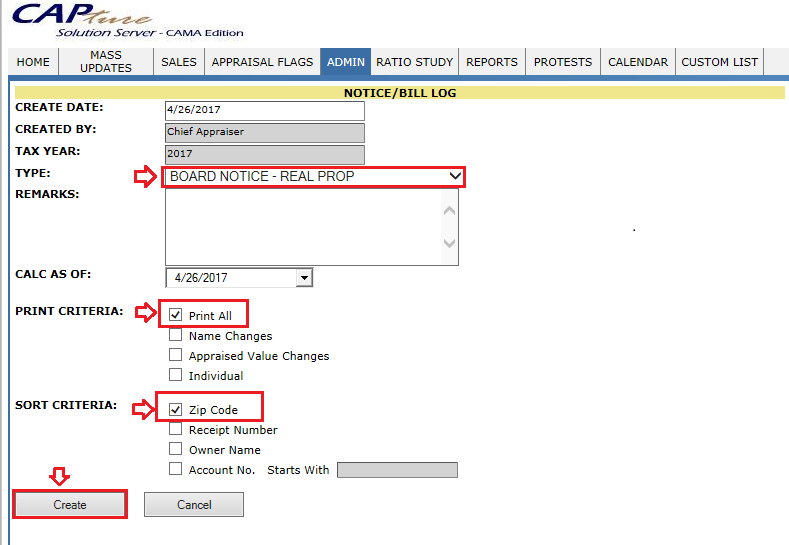

To create BOE notice for Real or Personal property, select the respective remarks from drop down list and check (mark) the print criteria (print all), sort criteria (zip code) and then click on Create button.

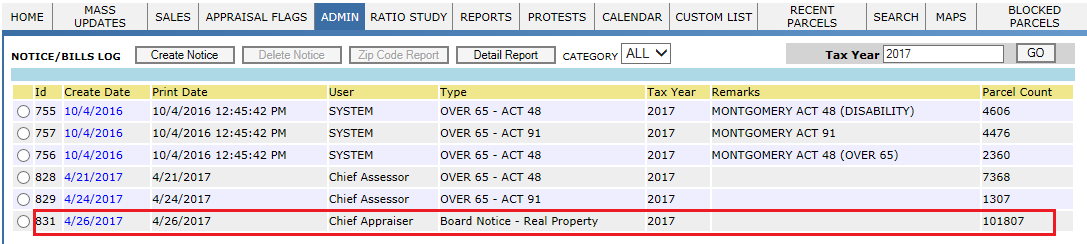

Created Notice will be shown under NOTICE/BILLS LOG.

There are two ways to send Board Notices.

(i) In house/ Access printing: This contains access file which includes ID, batch no. etc.

(ii) Third party printing: It creates a dump file for real and personal property. Each county will have a specific format to create that file.

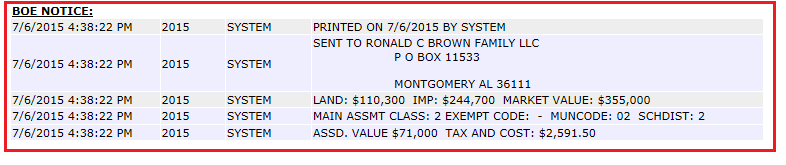

Printing of these Notices should be audited in Parcel Audit trial and the notice value will be snapshotted during printing. Here is the example contains Board Notices sent to property owner (tax payer).

Advanced Audit Trail:

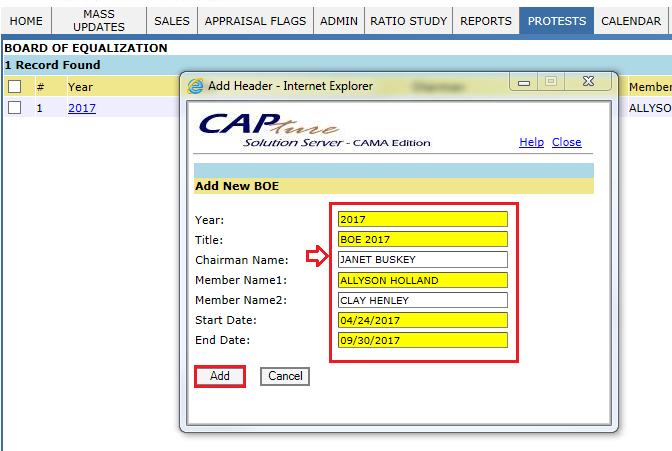

Setting up BOE Header

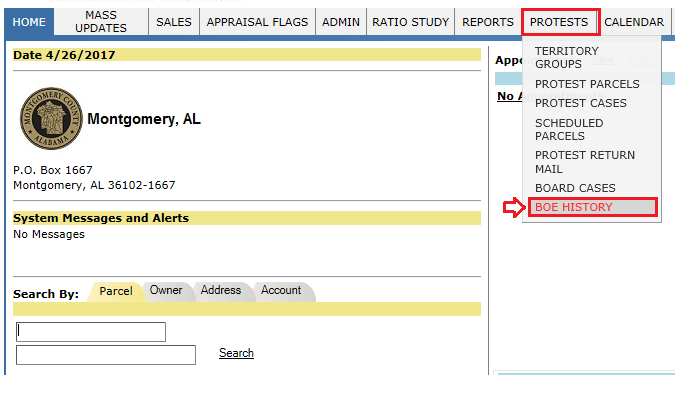

To set up BOE header with respective tax year, hover over on PROTESTS -> BOE HISTORY

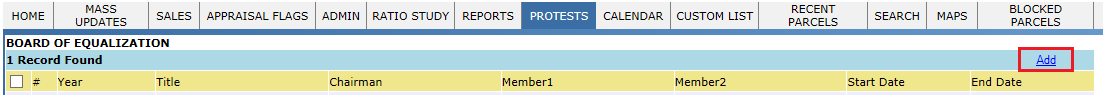

Click on Add link to setup new BOE.

Then Add new BOE window will be displayed. Fill the information as per the requirement and click on Add.

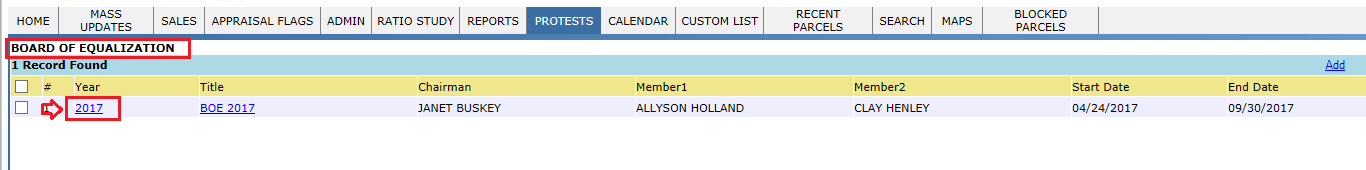

The new BOE will be shown here. Now click on Tax year (2017) hyperlink to open BOE dashboard and create cases.

Creating single case with single parcel:

Processing the case through Informal Settlement.

Before any hearing takes place, in county office both user (appraiser user) and tax payer will sit together and discuss and come up with a value. Then County board will finalize the values through informal settlement.

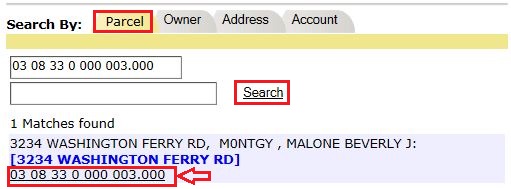

Search and select the Parcel to which the appeal should be created.

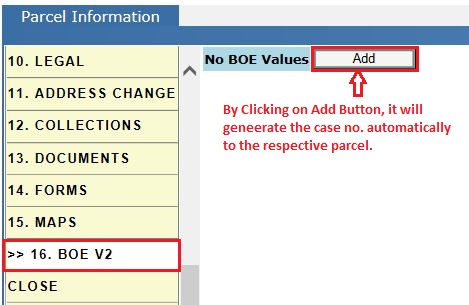

In PRC - BOE tab, by Clicking on Add button will create the Case Automatically to the respective parcel.

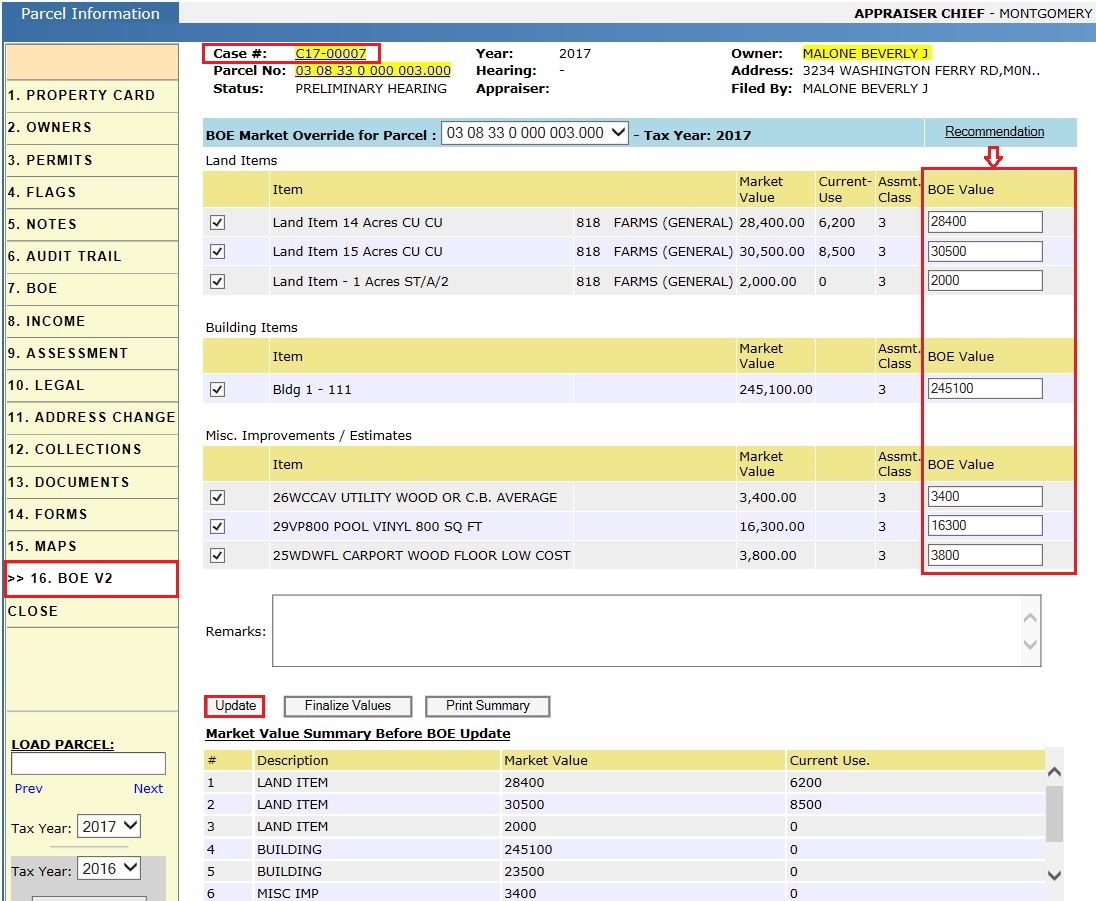

After creating the case, clicking on Update button will generate BOE values i.e., current market value of each item (land, bldg. and Misc. Imp) before applying BOE changes with respect to Assmt class.

Here each item should be represented individually with respective assmt class (to avoid the mixed class issue). So, that taxes will be calculated accordingly.

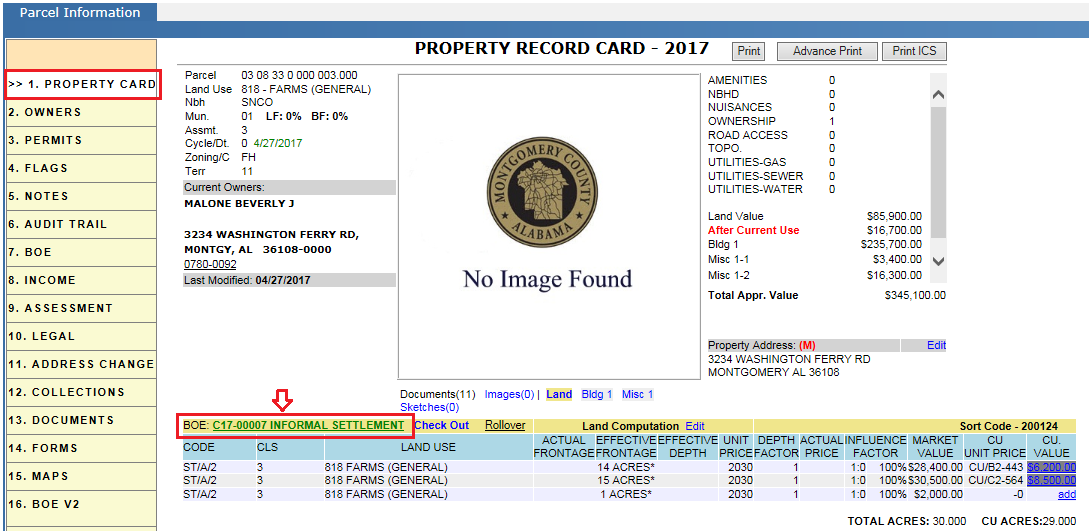

After updating BOE values, click on PROPERTY CARD to see the case information. Click on the case no. hyperlink to open Case Dashboard and modify or update any information related to respective case. (Here case status is marked as Informal Settlement which is shown below)

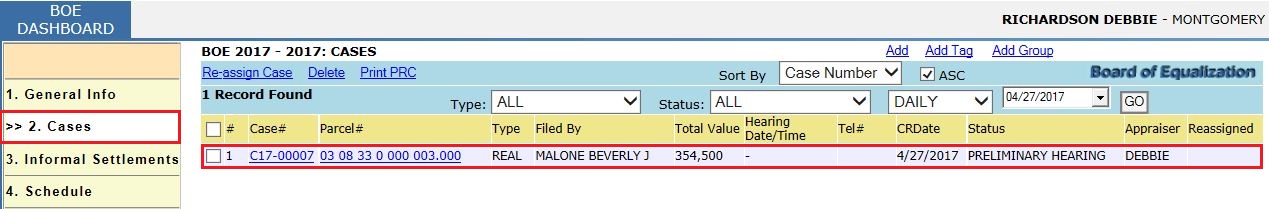

We can also process respective cases, by Logged in as respective User, go to PROTESTS -> BOE HISTORY and Click on Tax year link. In BOE Dash board go to Cases Tab and process the case by clicking on Case no hyperlink.

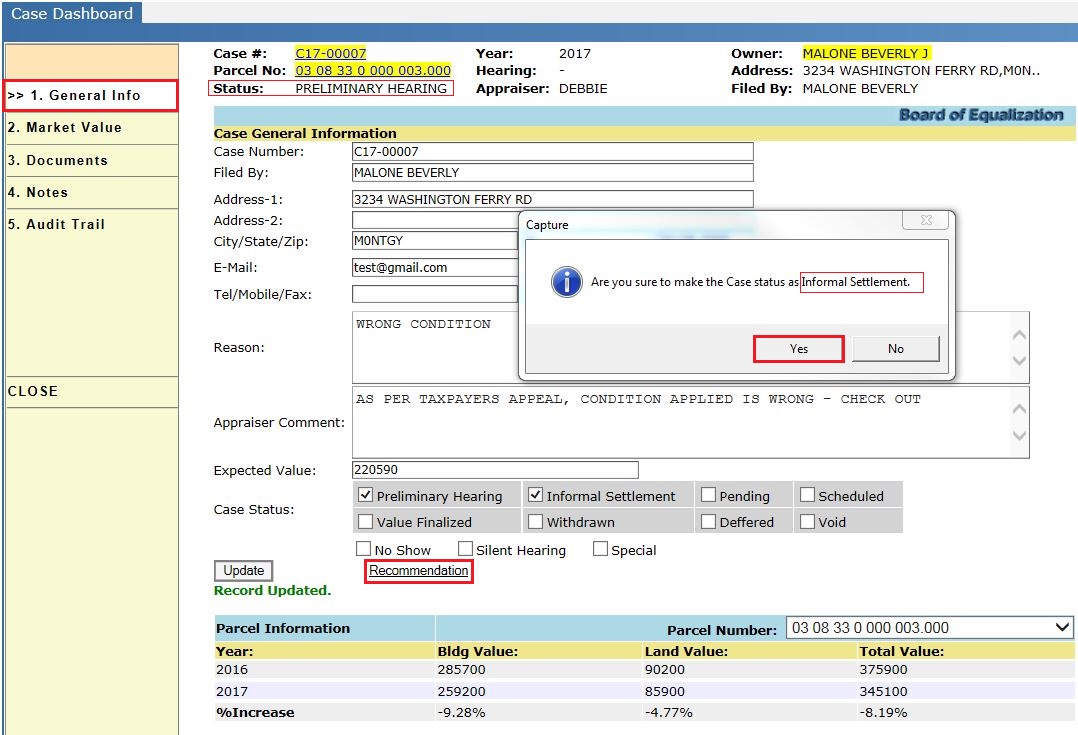

In Case Dash Board, General info do the necessary changes like Filed by, Address, email Id (To email the notices), Expected Value etc. Then select the Case status as Informal Settlement and click on Yes to mark the case status from Preliminary Hearing (default status) to Informal Settlement.

Here expected value is the value which taxpayer and appraiser come up with.

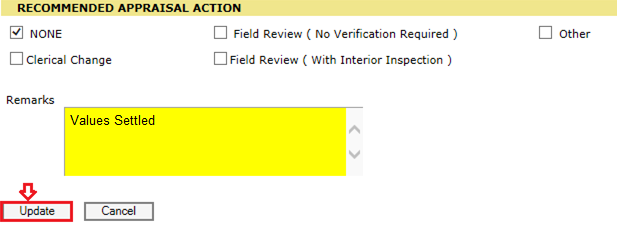

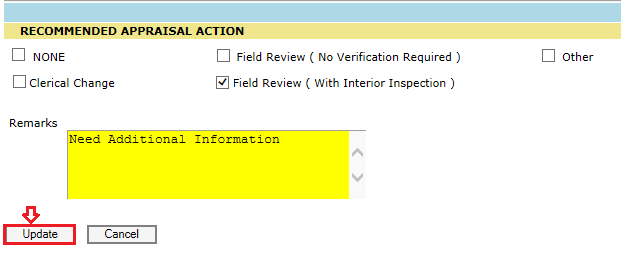

Click on Recommendation link to select recommended appraisal action.

Recommendation - Here the recommended appraisal action (Field review) will be updated as per the requirement.

Here, Board is finalizing the values which comes through informal settlement between tax payer and appraiser.

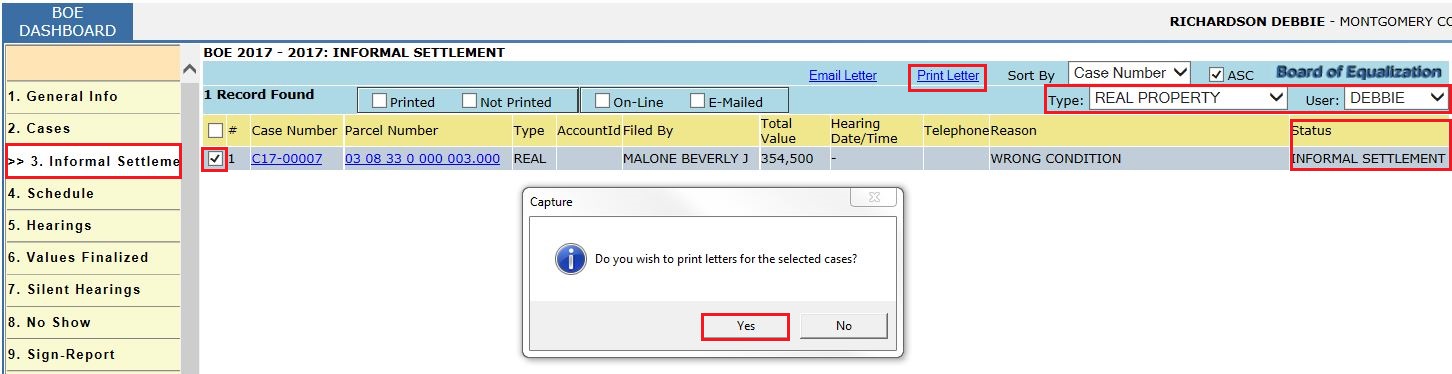

In BOE Dashboard - Informal Settlement tab, Verify the case with status as Informal Settlement. The new BOE values applied to the parcel will be printed using Print Letter hyperlink which will be sent to tax payer.

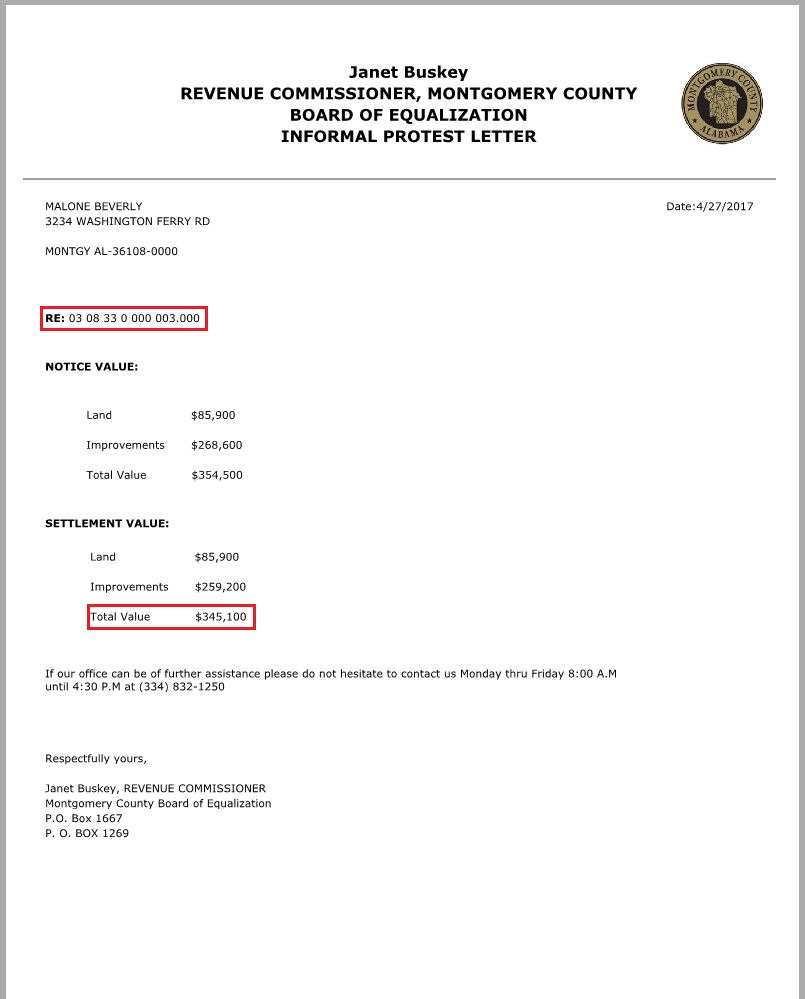

Informal Settlement Letter:

It contains the Board Notice values and BOE Settlement Values of the respective parcel.

Here the Settlement Values are settled by Appraiser and taxpayer’s through Informal Settlement.

Processing Informal Settlement Case, Schedule Hearing, Field Review (Optional) and Finalise values.

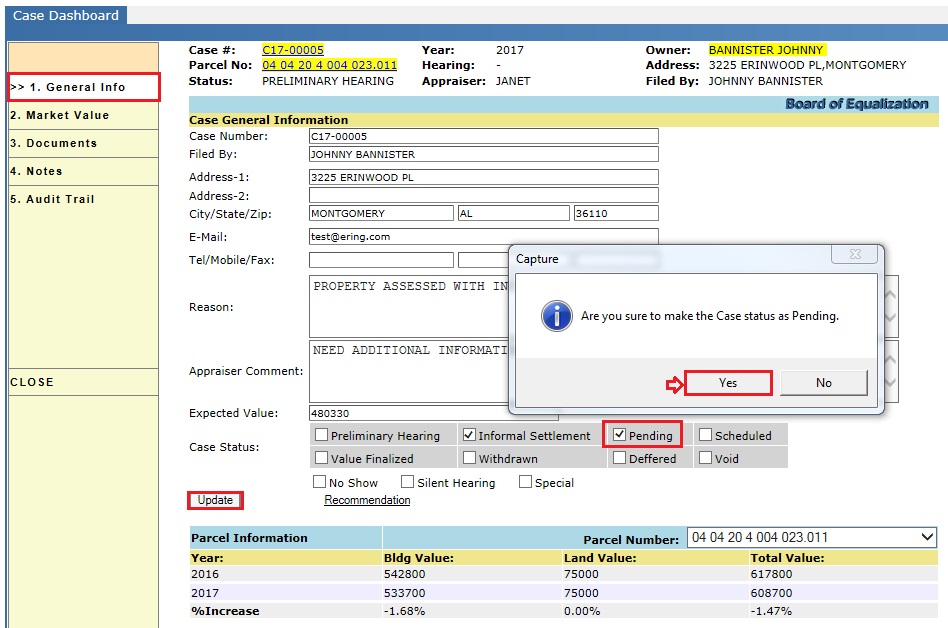

Once the tax payer filed for protest, the tax payer and appraiser discuss informally called “Informal settlement” and not able to resolve the case, that case will be handled by Board and case status will be changed from informal settlement to Pending and then goes to Schedule.

Here mark the case status as Pending and click on Yes and then Update.

Verify Case Dashboard Audit trail for change in Case status – Pending is audited.

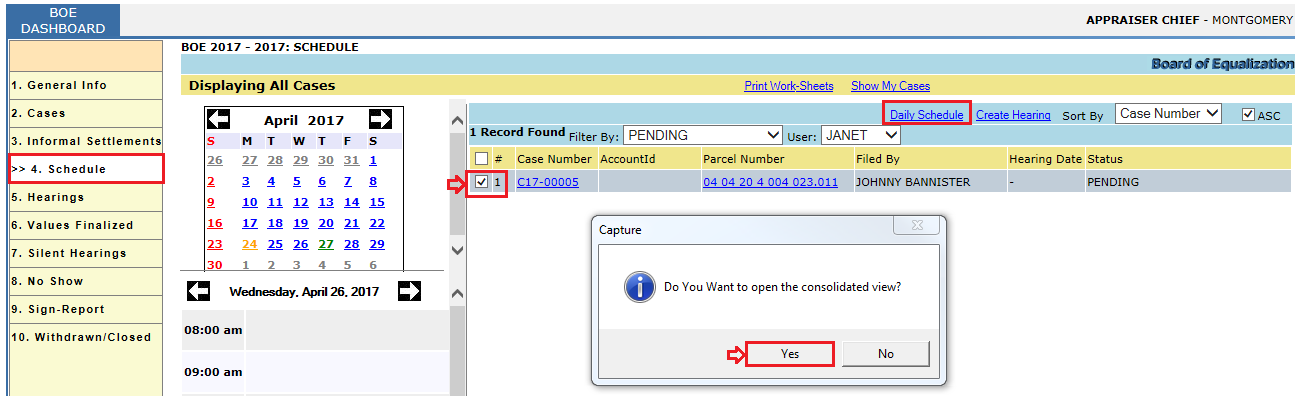

Now Schedule the Hearing for pending case. Login with assigned User, go to PROTESTS -> BOE HISTORY and Click on Tax year link, In BOE Dash board go to Schedule Tab and schedule the hearing by selecting Case no and click on Daily Schedule. It will show a pop-up as below screen shot, click on Yes to proceed.

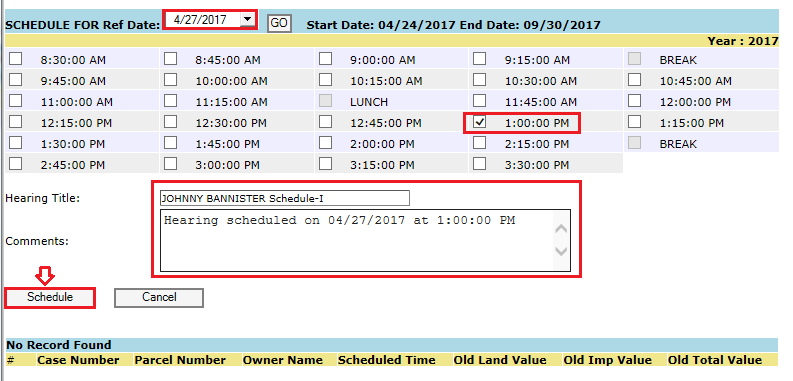

Now, select the Schedule for ref date and time, enter Hearing Title and Comments and click on Schedule button.

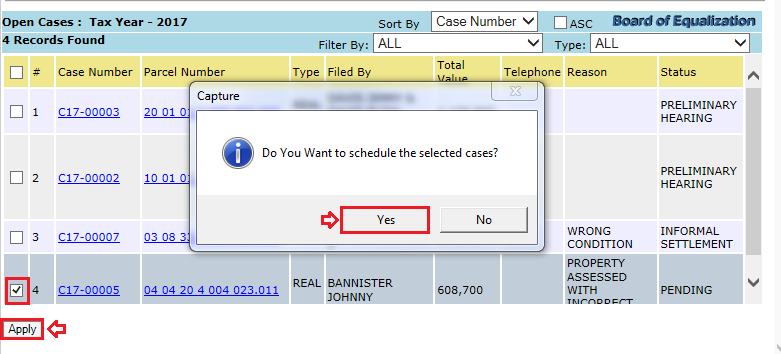

Then it will open a window which contains all the open cases. Select the respective case and click on Apply and then it will show the pop-up window as below, click on Yes to proceed.

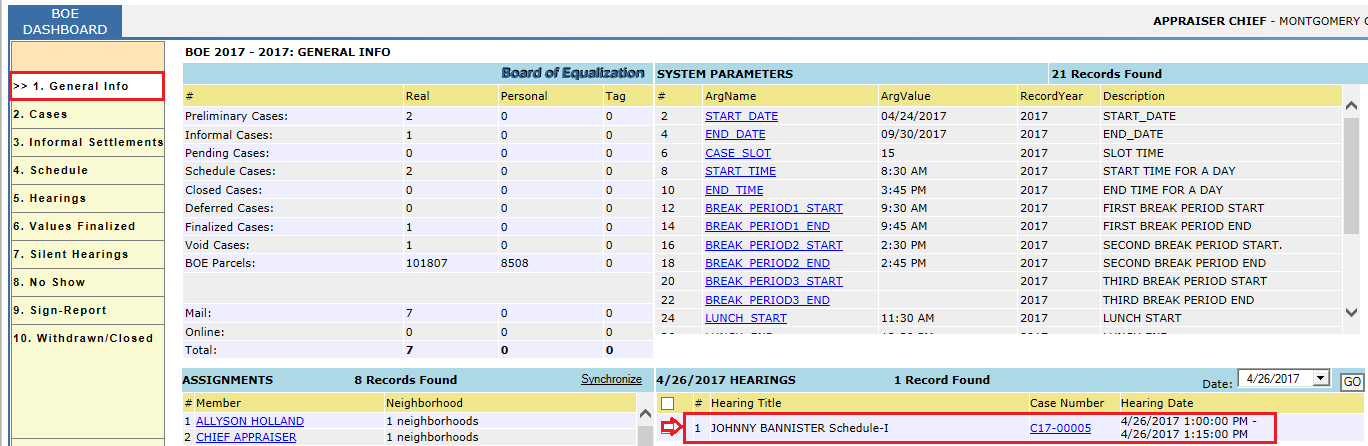

The scheduled case will be shown under BOE Dashboard- General Info - Hearings.

After creating schedule for Hearing, if the appraiser user needs additional information to process the case, then mark the recommendation appraisal action as Field Review which is an optional case.

Then respective PROTEST FIELD CHECK FLAGS will be generated on the parcel. Then the field review users go to Field and note down any changes (changes may include changing building condition or any other) and come up with a value.

Then Board will finalize the values comes from Field review users or apply their own value.

To apply appraisal action to the case, click on case no. link which is available under BOE Dashboard- General Info (Hearings).

Recommendation - Here the recommended appraisal action (Field Review) will be updated as per the appraiser requirement.

Verify Case Dashboard Audit trail for change in Case status – Scheduled and Recommendation - Field Review auditing.

Once we mark the action as Field review, it will generate PROTEST FIELD CHECK FLAGS on PRC Flags Tab.

As the case is marked for Field Review, the respective field visit users will go to the field (property) and update the status of changes made to the property.

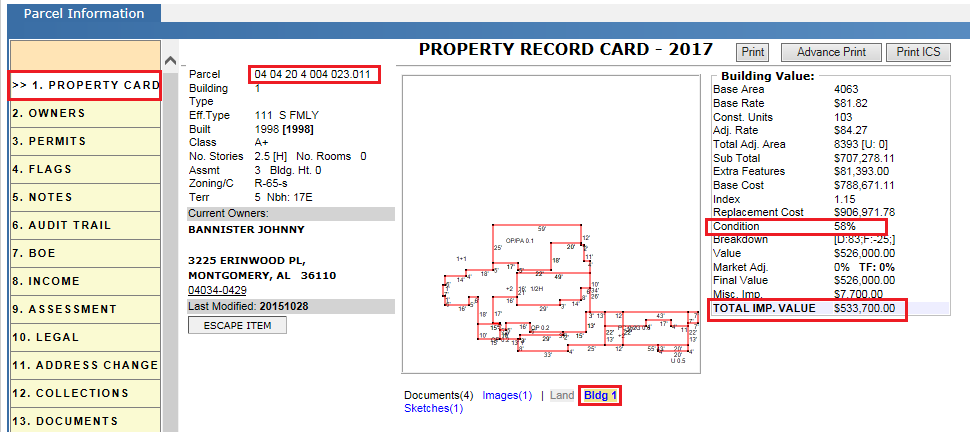

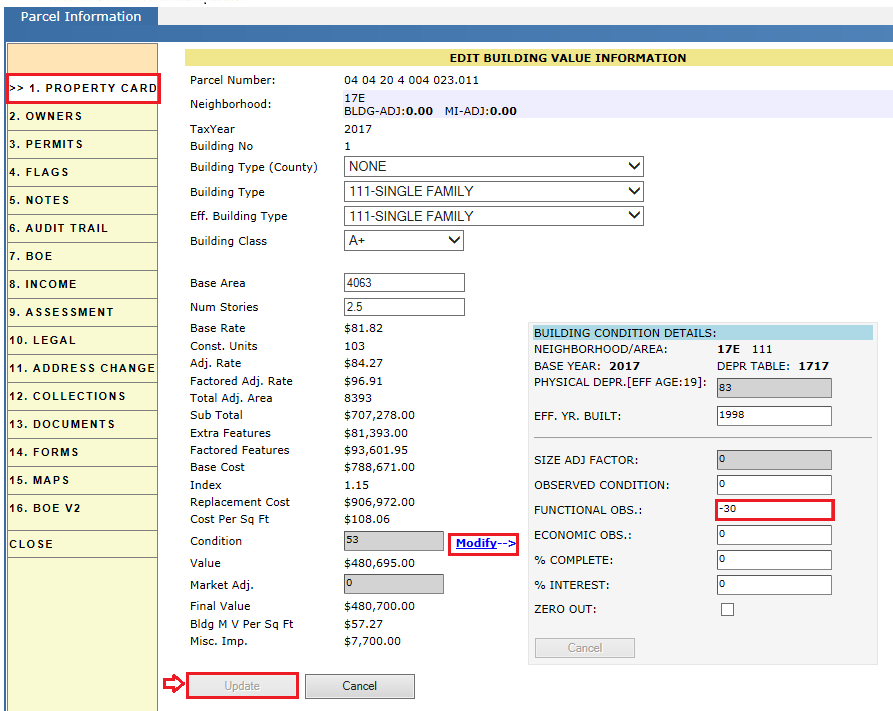

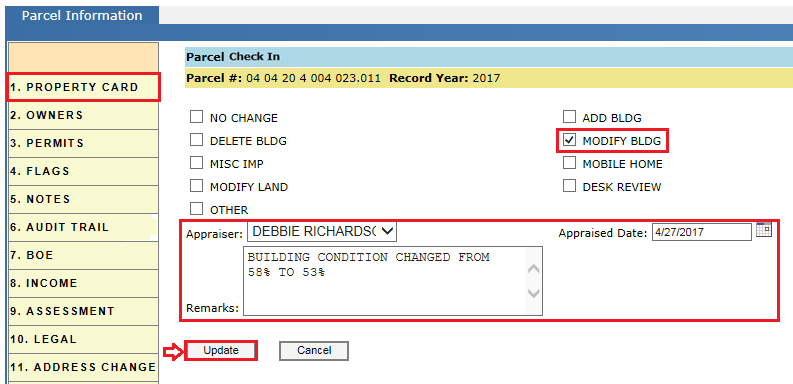

Check out the parcel and click on Bldg 1 link and click on Building value hyper region to modify the condition of building.

Before applying BOE changes, the value of the property is $533,700.

Here, modifying the building condition based on requirement will change the total improvement value of the property.

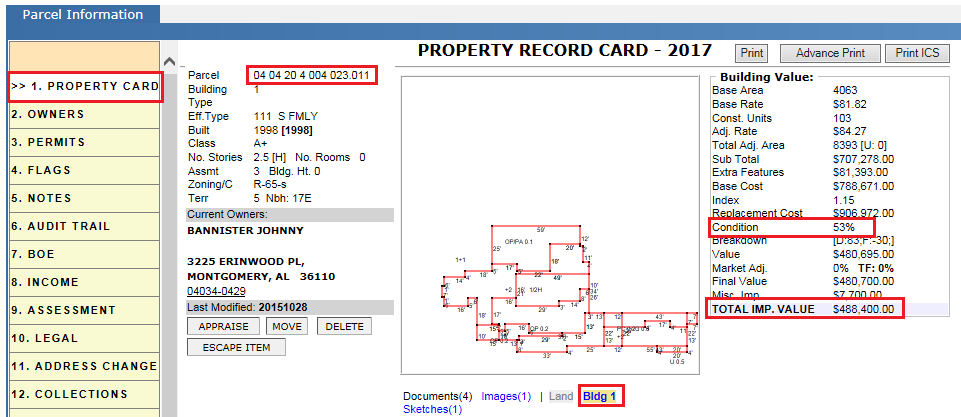

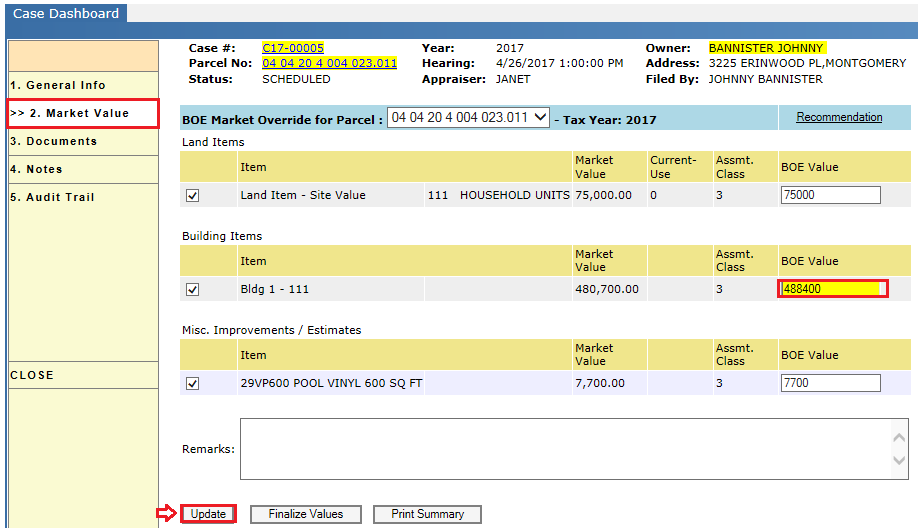

After applying BOE changes (Building condition changes), the value of the property is $488,400.

Check in the parcel after making the required changes.

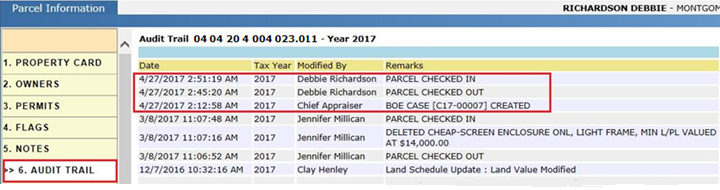

Audit Trail of PRC:

After completing required changes, click on case no. hyperlink to open Case Dashboard (which is available on PRC).

Now, go to Case Dashboard- Market Value, override the new improvement value (value obtained after BOE changes) and click on Update button. (Here the status of the case is Scheduled)

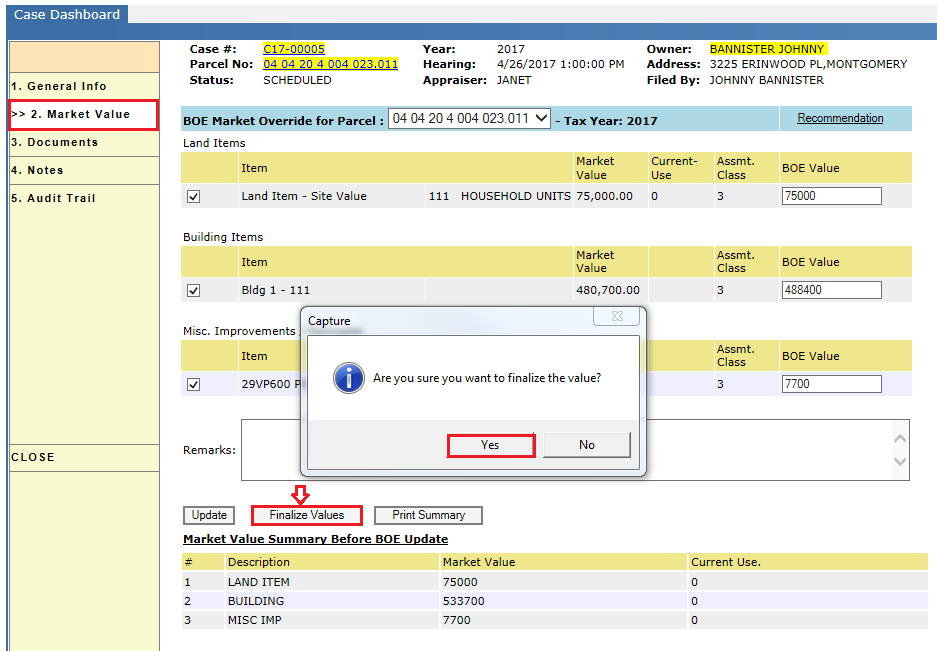

After updating the values, click on Finalize Values button to finalize the values. Click on Yes to proceed.

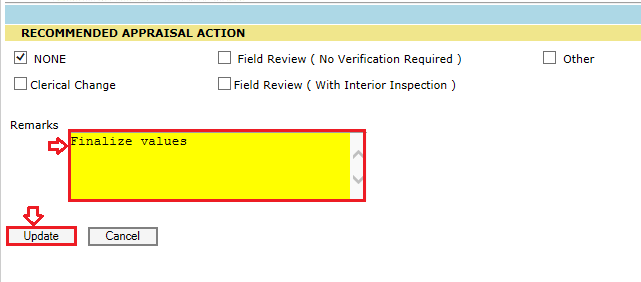

Then recommendation window will be opened. Mark the respective appraiser action and enter remarks and click on Update button.

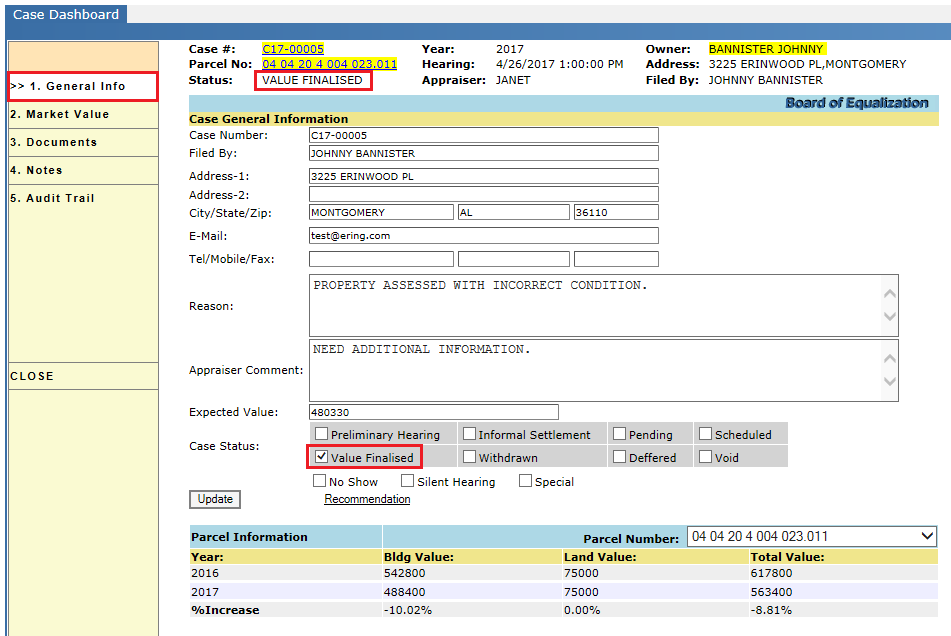

Now, the status of the case will be changed from Scheduled to Value Finalized.

Verify Case Dashboard Audit trail to check case status changed to value finalized information.

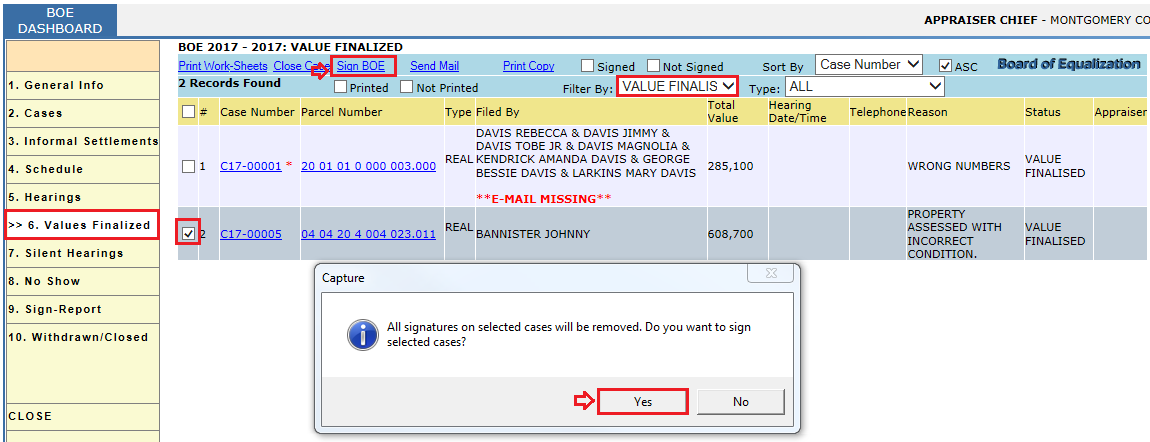

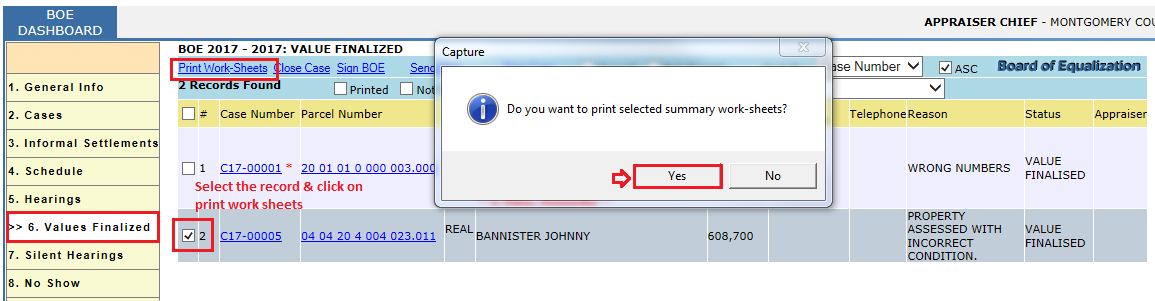

The respective case marked for Finalise values will be shown under BOE Dashboard- Values Finalized. Select the record and click on Sign BOE link to finalize the values of property. It will show a pop-up window, click on Yes to proceed.

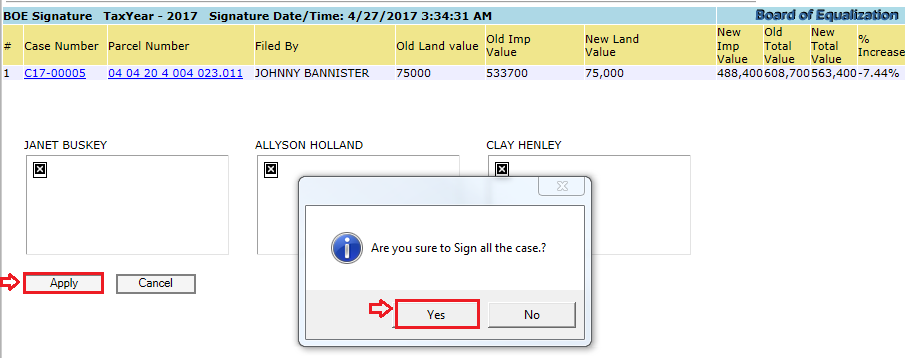

It will open a BOE signature window. Click on Apply to proceed and then Yes.

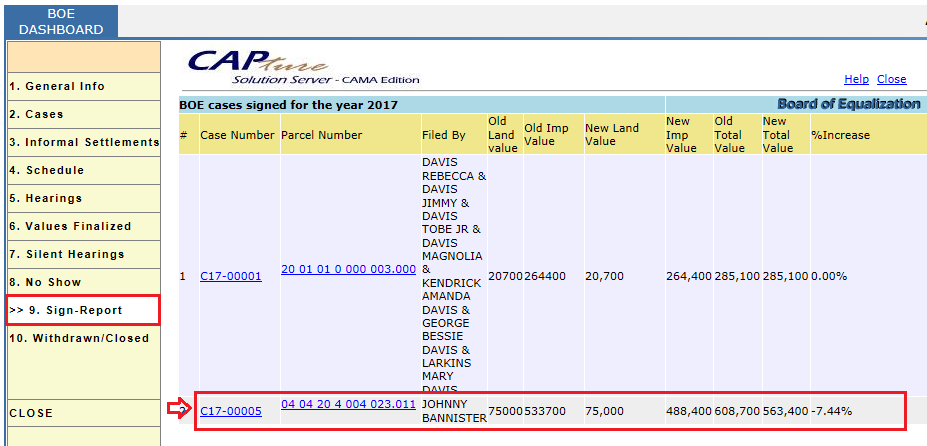

After Signing the case, the respective case will be shown under BOE Dashboard- Sign-Report.

Now, select the record (BOE Dashboard- Values Finalized) to print the worksheet which contains finalized values which will be sent to tax payer to notify the finalized value of the property.

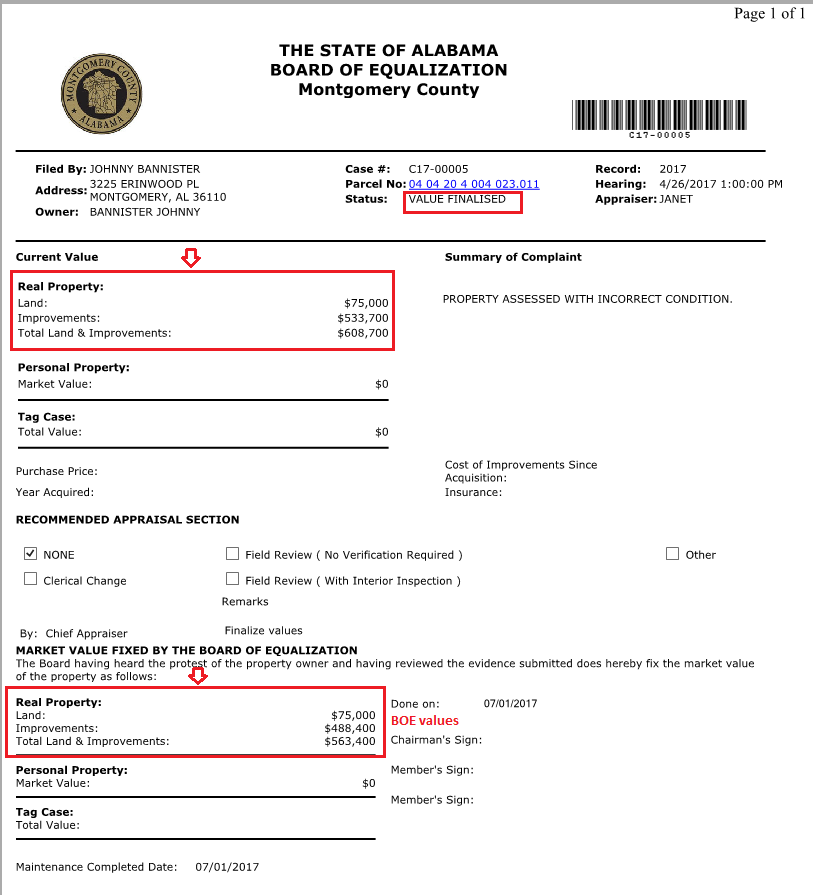

Finalized Values Letter:

It contains the Current value (Before applying BOE changes) of the property and Market value fixed by the BOE (Board of Equalization).

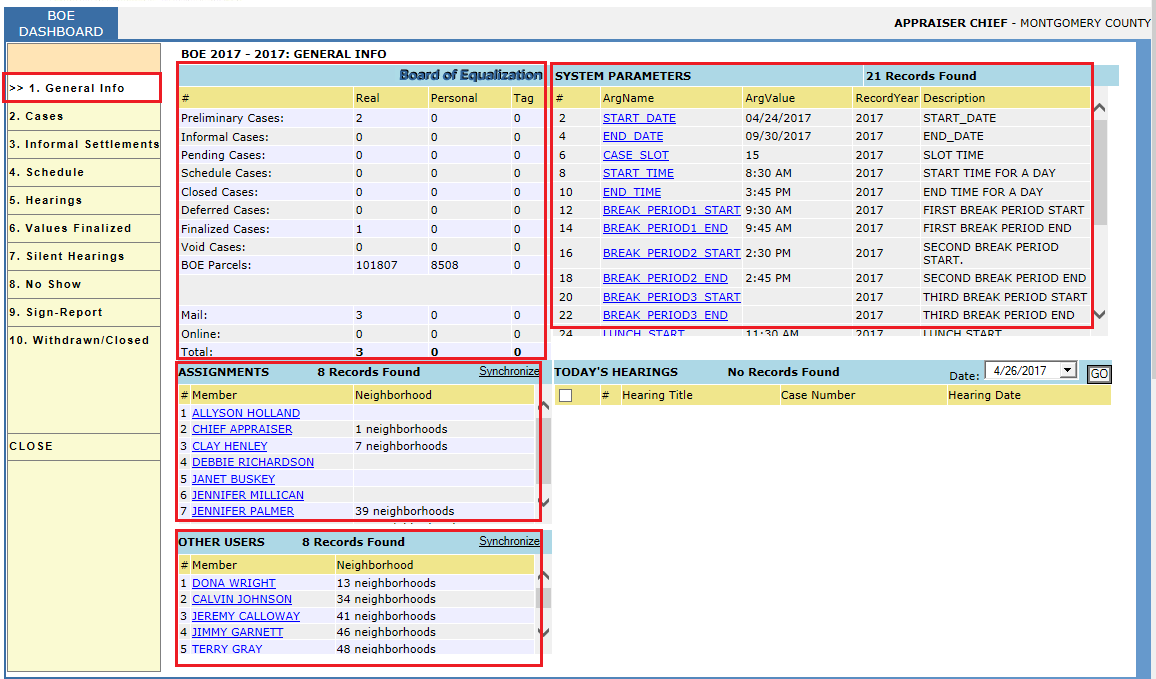

BOE Dashboard (General Info):

Board of Equalization: The first hyper Region of BOE Dashboard shows the summary of BOE like all Cases counts based on Real and personal Property and BOE’s counts through Mail and Online.

System Parameters: This shows the records with respective tax year, date and time.

Assignments: This shows assignment records based on Users with respective no. of neighborhoods.

Other Users: This shows records based on other Users with respective neighborhood.

Today’s Hearings: This shows current date scheduled records (cases).

Silent Hearings Tab: Hearings which happened silently comes under this tab.

No Show Tab: Scheduled Hearings values are not showed

Withdrawn/Closed Tab: This tab contains Closed/ Withdrawn cases

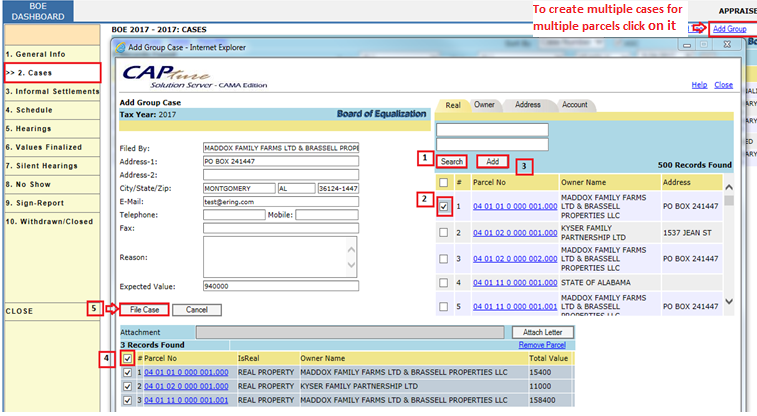

Creating multiple cases with multiple parcels:

Click on Cases tab and click on Add Group link that will show an Add Group Case window. Now search, select and add the parcels. After adding the parcels select the records and click on File case to create new cases with each parcel.

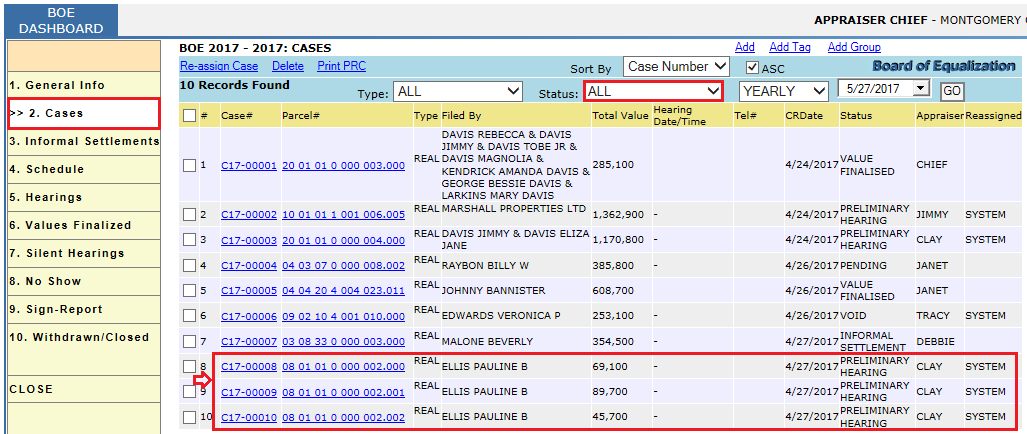

Created cases will be shown under Cases tab with respect to status (Initial status of any case will be preliminary hearing).

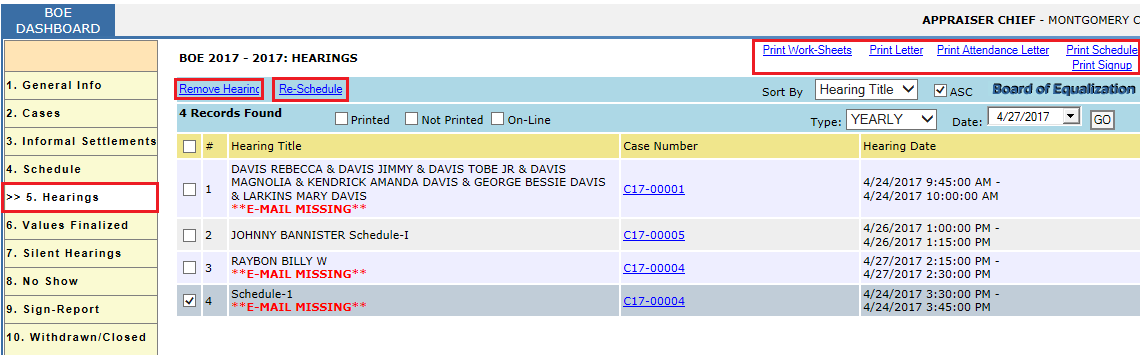

BOE Dashboard- Hearings tab contains all the scheduled hearings and Remove Hearing enables us to remove the scheduled hearing and Re-schedule link allows the user to re schedule the respective case.

All the print links are used to print respective letters (select the record and proceed with print).