BOE Processing

Introduction

Generally, the county will send valuation notices to tax payers, to intimate them that value in notice is going to be taxed for that tax year.

Work Flow of Appeals Processing:

If the taxpayer is not satisfied with value sent by the county board, they have a right to make appeals for that values in front of Board of Equalization (BOE). If the Local Board (County board) doesn’t agree with tax payer’s (owner’s) expected value, then the taxpayer will approach State Board. If the Owner doesn’t satisfy with the value provided by State Board then they can go for Court.

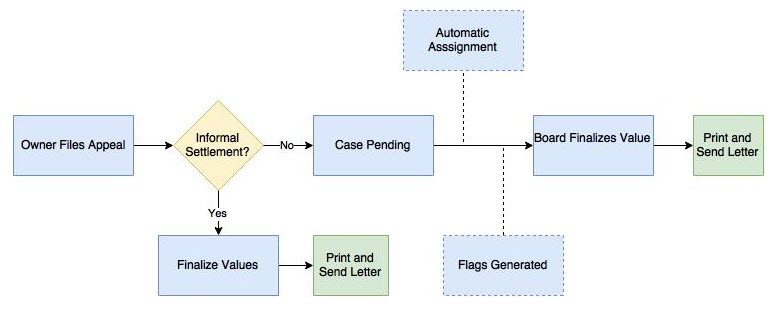

Typically, in Alabama, before any hearing takes place, tax payer and appraiser will discuss and come up with value which is called “Informal Settlement”. Then County board will generate “Informal Settlement letter” to tax payers to notify them with the Board Finalized Values. If taxpayer and appraiser discussed and not resolved in informal settlement, that case will go to pending and the board will schedule the hearing for that case. Cases are automatically assigned to appraiser users based on different neighborhood and territories.

After scheduling the hearing, Board will send field visit users to field by generating “Protest Field Check” flag to review the field. (This can be done through changing building condition or override the values manually). These flags are created to notify the field review users to attend the field reviews for those parcels. After field review, the respective users will come up with values, so that county board should accept that changed values and update in Capture, or apply their own values. Once the values are finalized, Board will send letter to tax payers to notify them with the Finalized Values. In any case, Board value will be the final value of the property for that respective tax year.

BOE Workflow