Current Use Processing

Workflow

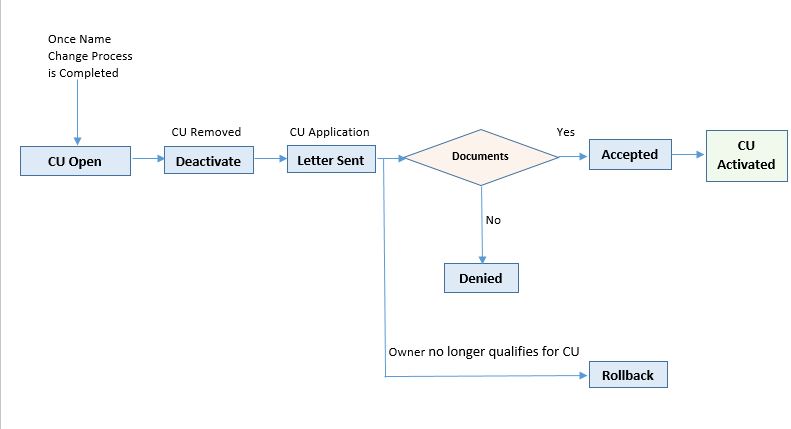

Sale on Current Use Parcel

Current Use is not removed from the parcel during a Name Change from within the Deed Register. A CU Name Change flag is created to notify the appraiser for reviewing the parcel and deactivating the current use. After deactivating the current use, the same appraiser prints a letter and sends it to the new owner indicating Current Use was removed from the property. The new owner will need to apply for Current Use in order to retain the exemption on the property.

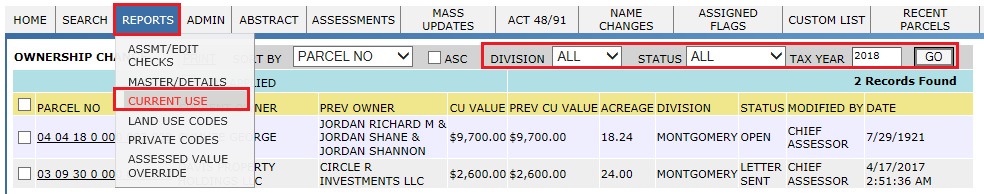

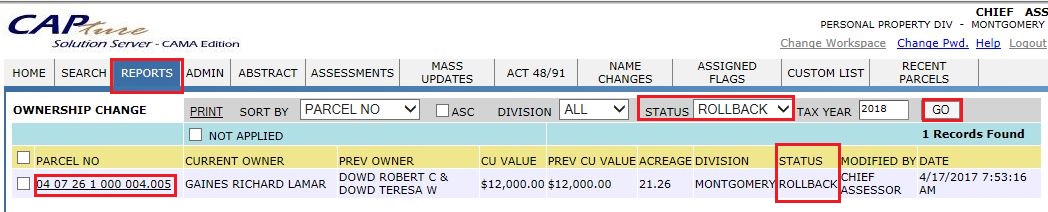

Step -1: Before working on CU Changes, hover over Reports and click on CURRENT USE. Select the respective filters (STATUS, TAX YEAR and DIVISION) to display the CU parcels.

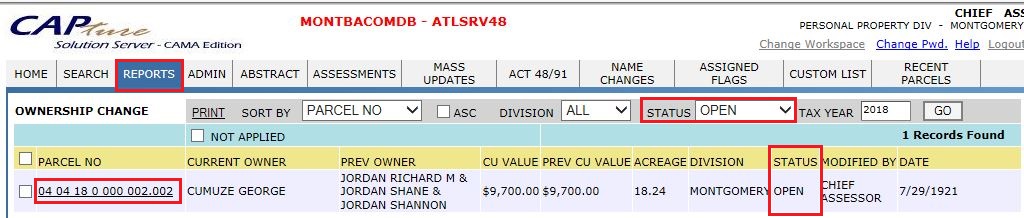

View Open CU Parcels by selecting STATUS: OPEN and click GO.

Flow Chart of Current Use:

Step - 2: Select a parcel to work the CU Changes.

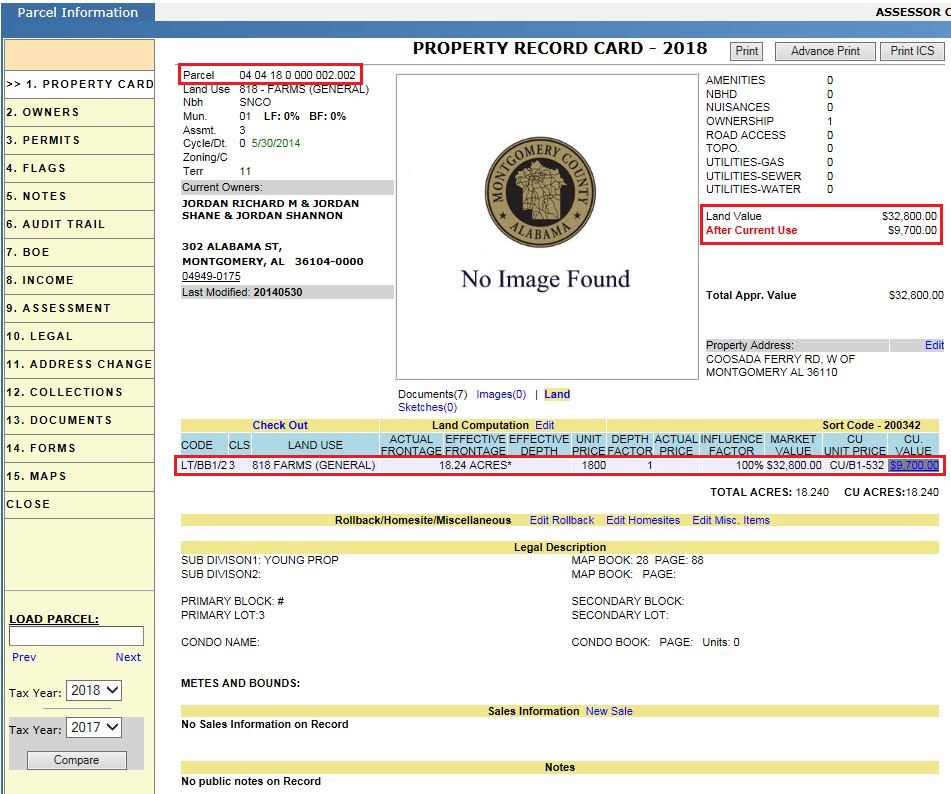

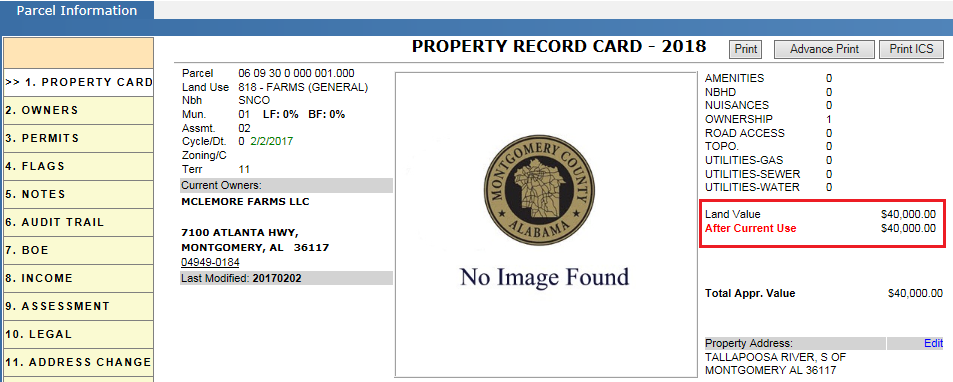

Note: If a parcel has CU, Land value After Current Use will be taken as CU Value. If the parcel does not have any CU value then After Current Use value will be same as the Land Value.

Note: (Consider this as 2018 tax year) If the user wants to apply current use on 2017 and the parcel is already rolled over to 2018 then Capture will indicate that a Future Year record year exists. In this case, the user should manually apply current use to 2018.

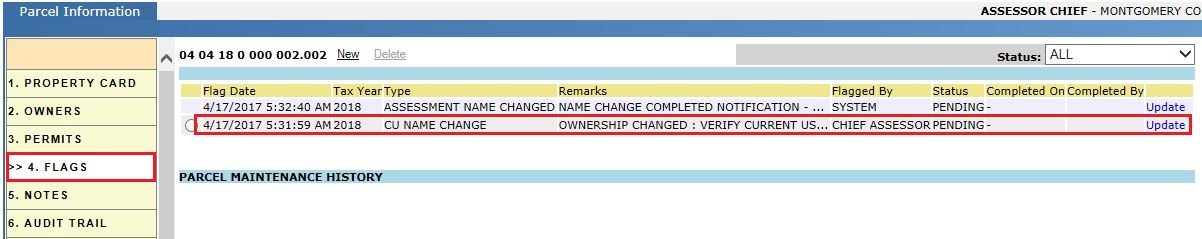

Verify the Flags:

Once the Name Change is marked complete, a CU flag is automatically generated called, "CU NAME CHANGE – Ownership Changed: Verify Current use Old." The appraiser will manually deactivate the current use on the parcel after being prompted by this flag. Letters are mailed to the new owners stating that the CU was deactivated on their property. The new owner has to apply for current use to be granted the exemption.

Note: CU flag generation is optional.

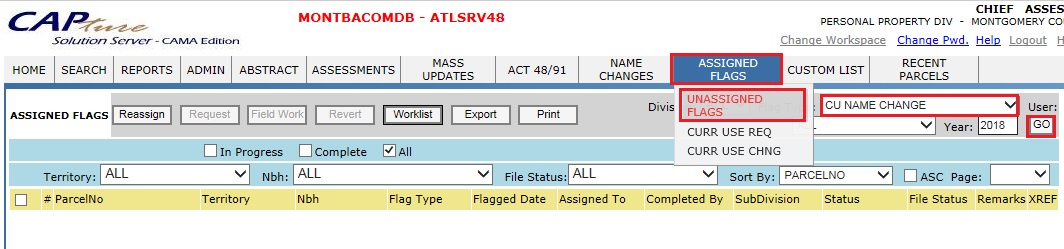

Verify the Flags Report:

Flags generated during the Name Change process appear in the Assessment Work Space, on ASSIGNED FLAGS -> UNASSIGNED FLAGS. Most counties assign only one user to perform the current use. Counties with multiple CU users will assign the flags from within the UNASSIGNED FLAGS page. The supervisor selects a user and clicks the Assign button.

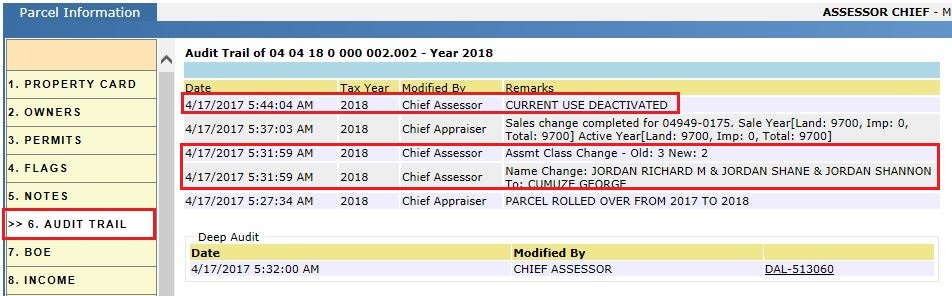

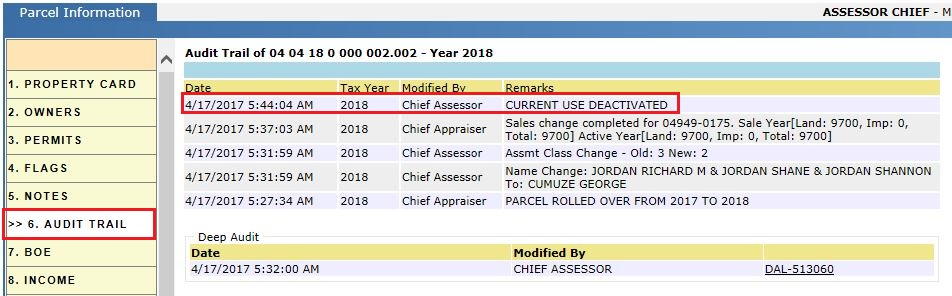

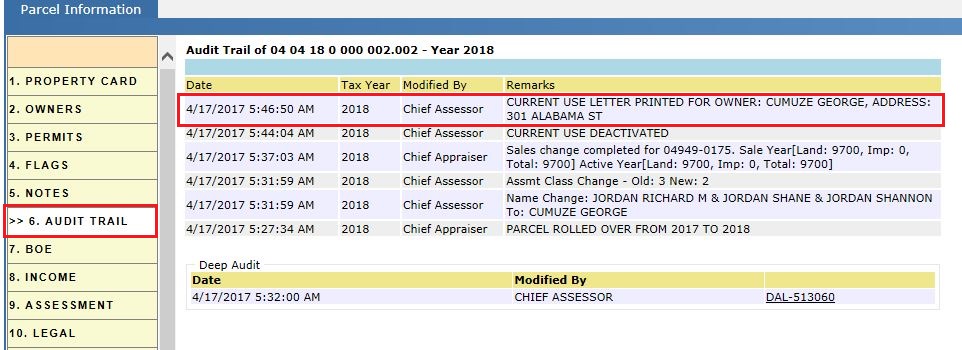

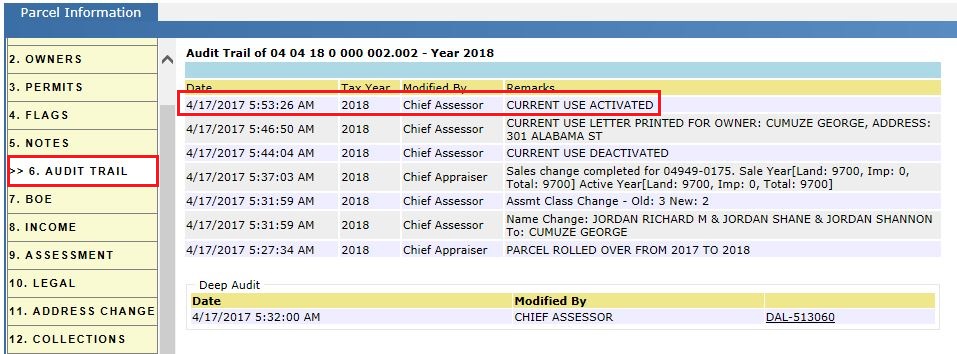

Verify the Audit Trail: When Name Change is completed through deed processing, it should be audited on the parcel with respective details.

Note: Current Use Deactivated is a manually process and not automatically performed by Capture.

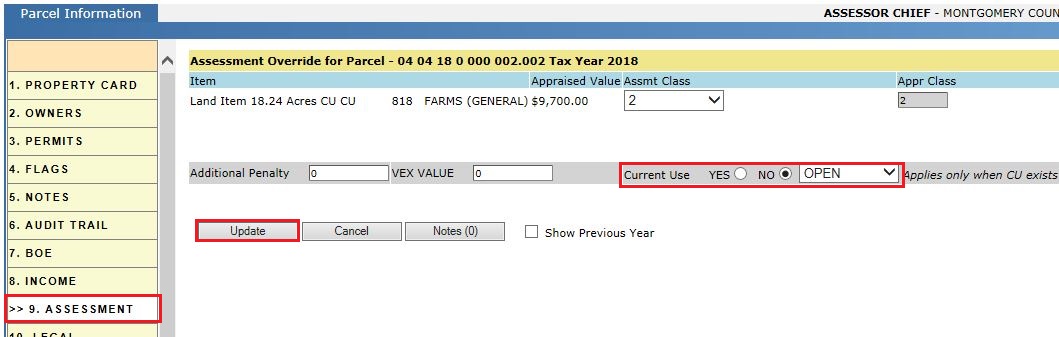

Step - 3: Go to PRC's Assessment tab and click on the CU hyper-region to update the current use status.

Deactivate the CU by selecting the Current Use ‘No’ radio button then clicking Update.

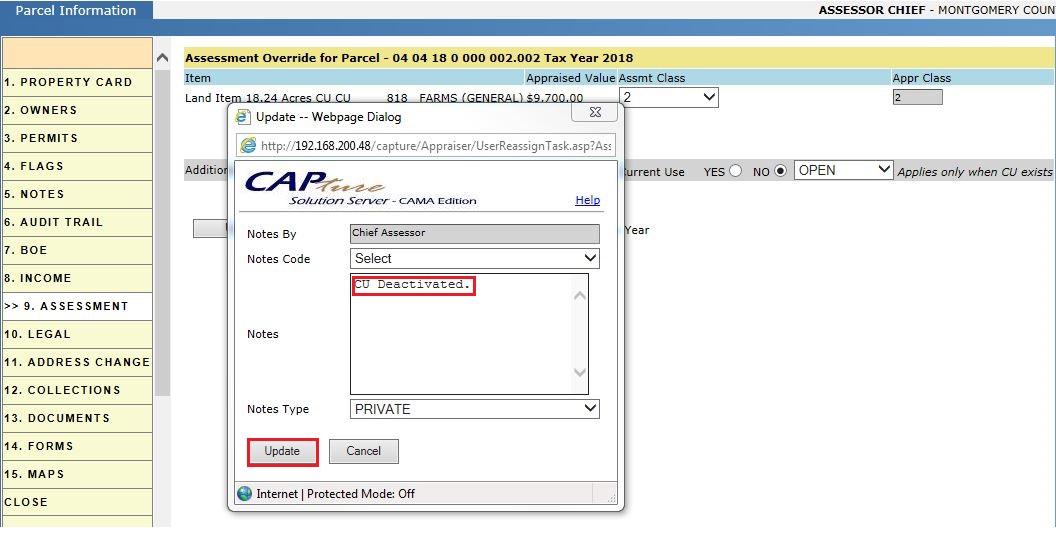

Add Notes and click Update.

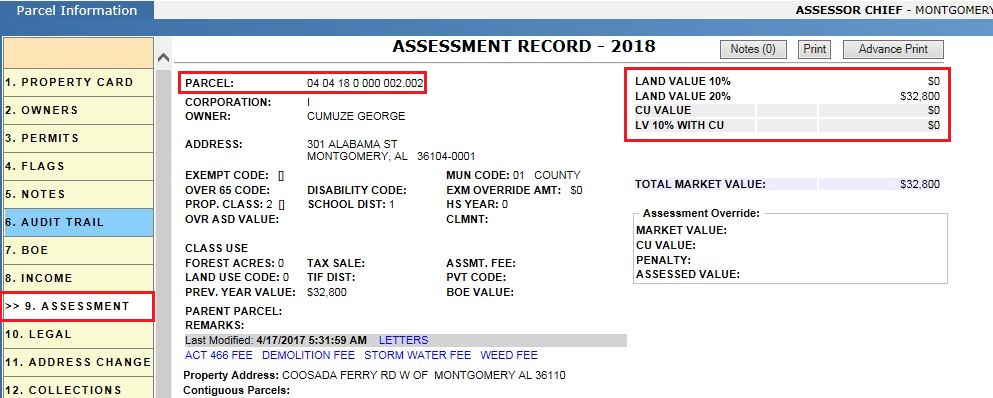

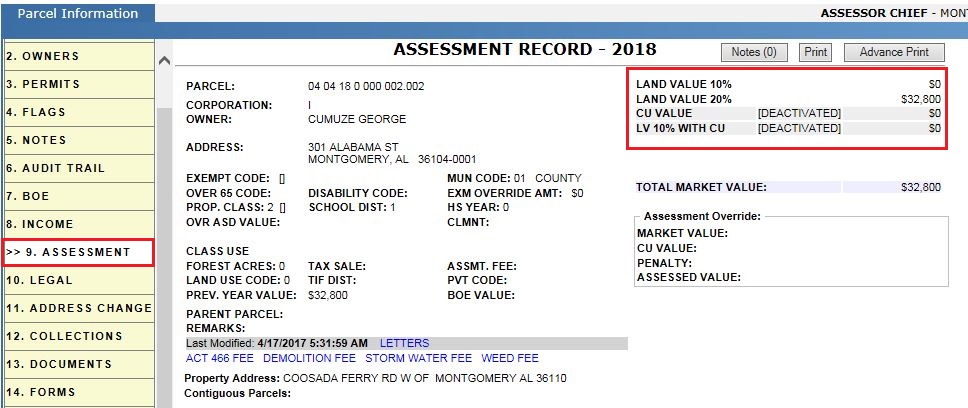

Verify from the PRC's Assessment tab, ensuring Current Use is Deactivated.

Verify the Audit Trail for Current Use DEACTIVATED.

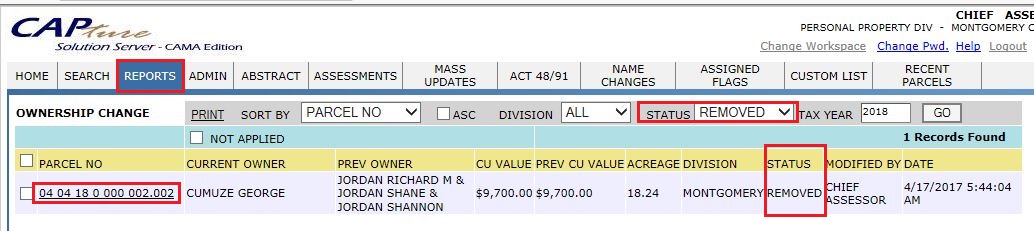

After Deactivating the Current Use, the parcel Status on the reports change from Open to Removed.

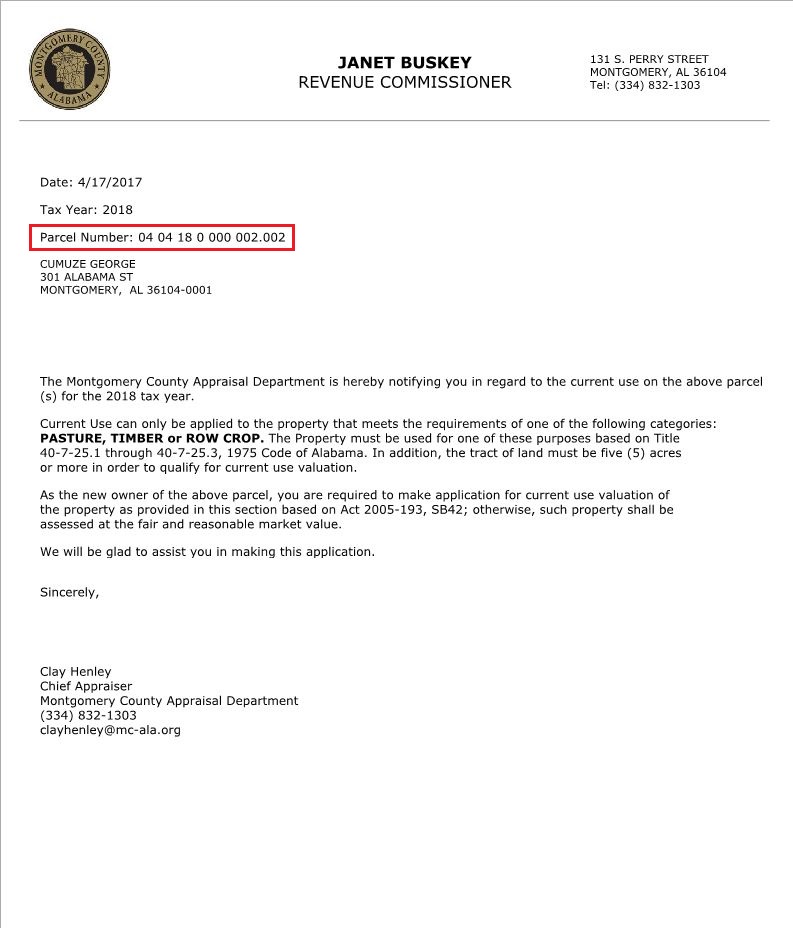

Step - 4: Select a deactivated current use parcel and click PRINT. Send the Current Use Application to the new owner.

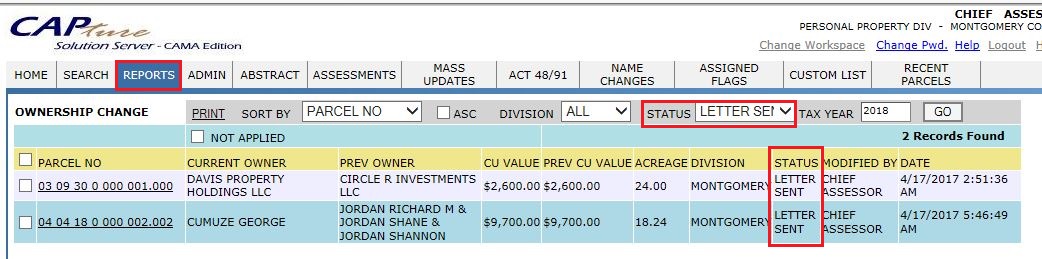

After sending the letters to the new owners, the parcels' Status are changed from Removed to Letter Sent.

Verify the Audit Trail for Current Use LETTER PRINTED.

Batch Print/Mass Print: Printing All parcels at a time.

Sample CU Application Letter for the new owner:

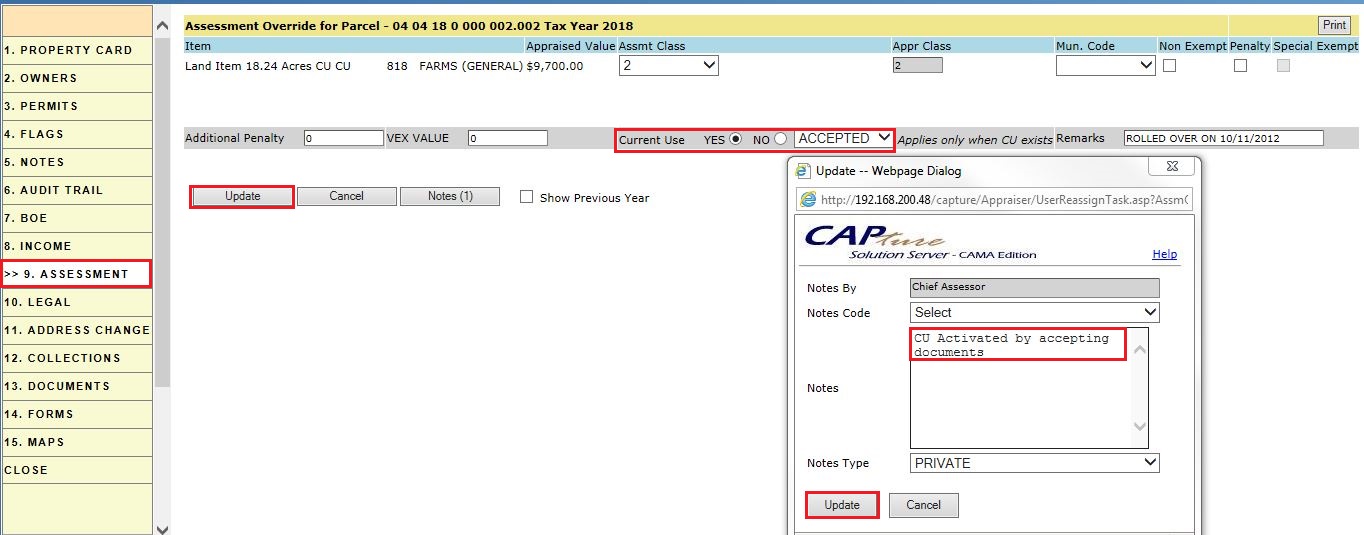

Step - 5: The owner has to come to the Assessor’s Office to apply for CU, making sure to bring the CU Application and documents for proof. The assessor verifies the details, scans and attaches documentation from the Documents tab. CU is applied to the parcel when the assessor approves it and manually activates the current use.

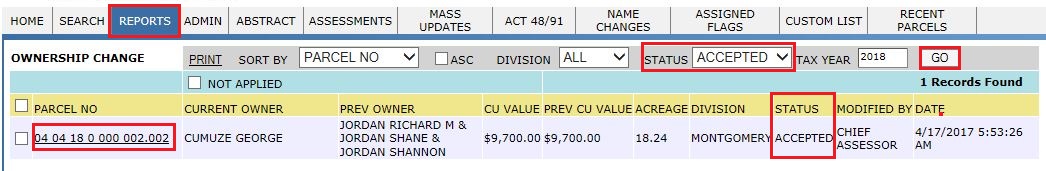

Accepted applications are reported on Reports->Ownership Change (Status = Accepted).

Verify the Audit Trail for CU Activated:

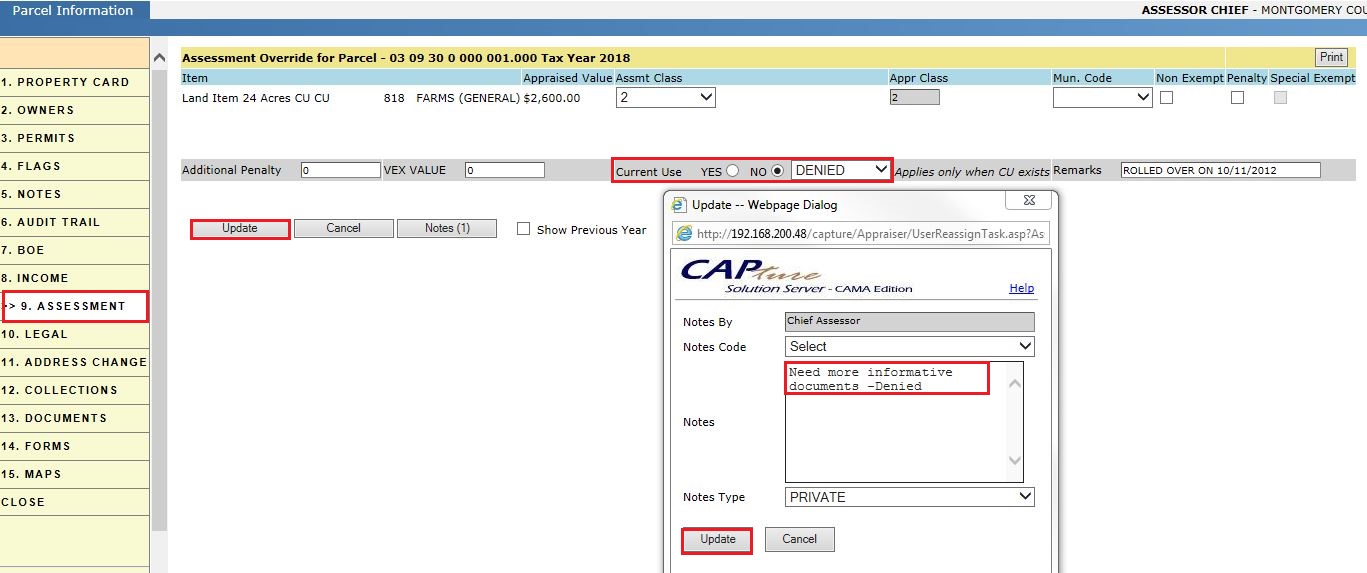

When not Accepted, the CU Application is marked Denied.

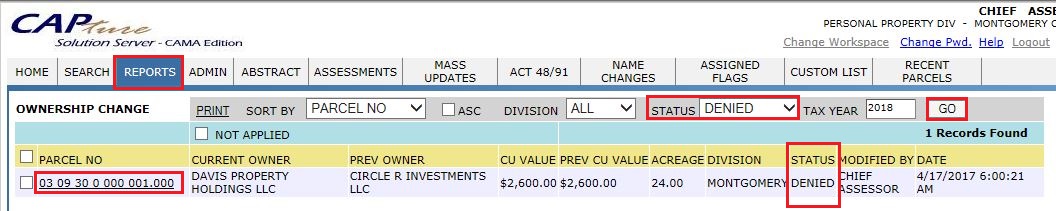

The CU Denied parcels are grouped on Reports->Ownership Change (Status = DENIED).

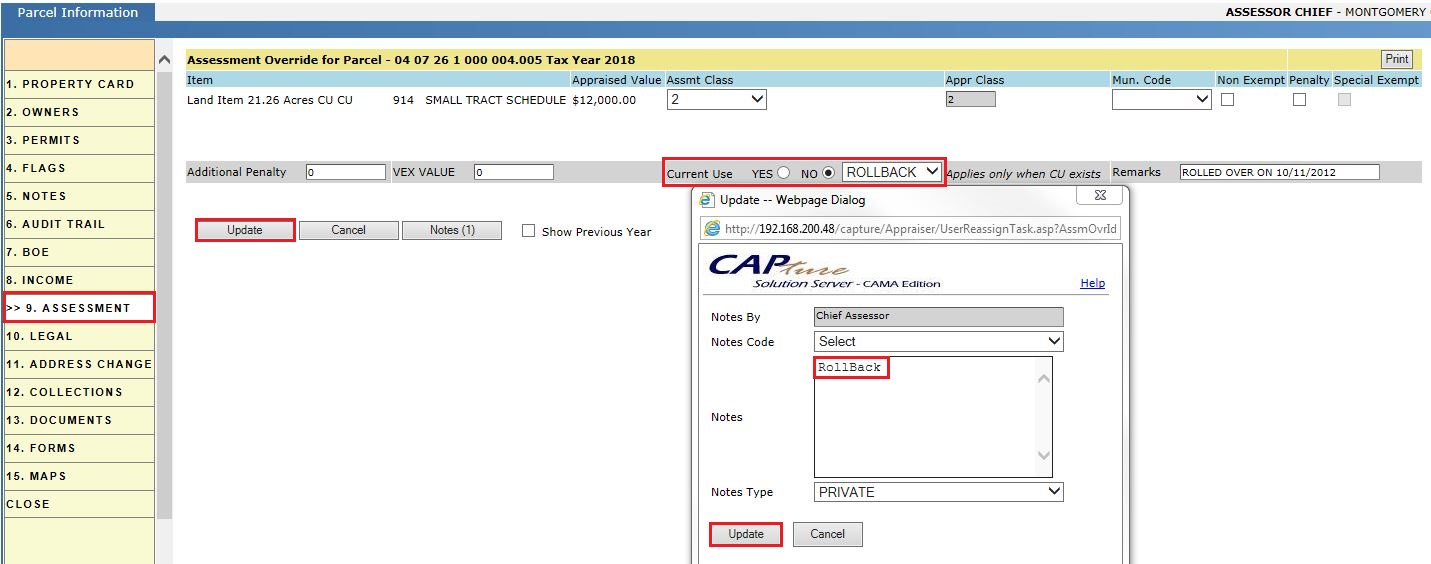

Rollback allows the county to collect the taxes that were discounted due to current use for up to three years back. Rollback parcels will show on Reports->Current Use Under (Status = ROLLBACK).

CU Rollback parcels on Reports->Ownership Change (Status = ROLLBACK).

Adding Current Use to a Single Land Item

Case :2 - Parcel with no current use

(a) Splitting the land item and adding current use to a single land item:

Step -1: Log in as a user who has privileges to do Add/Update Current Use.

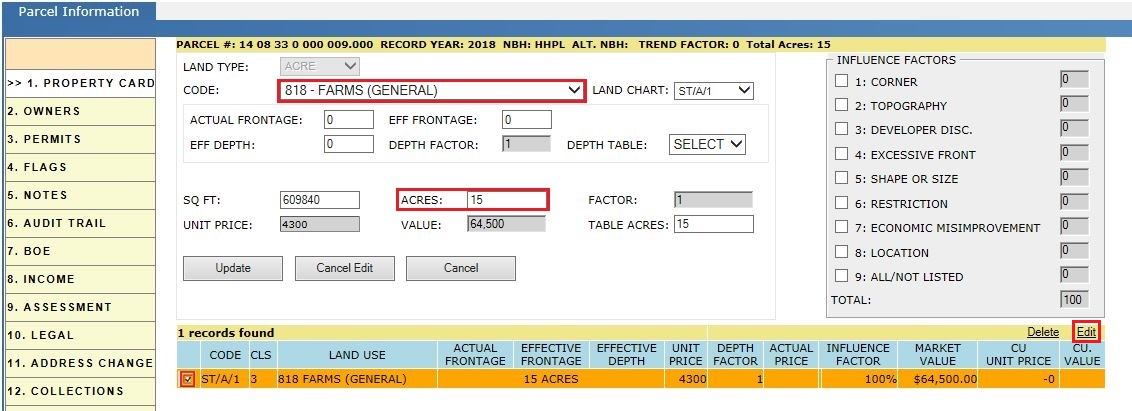

Example: A Parcel with a land item of 15 acres is split into two land items. One land item with 8 acres and the other with 7 acres. CU is applied to the 8 acre land item.

Step 2: Checkout the parcel and edit the land item.

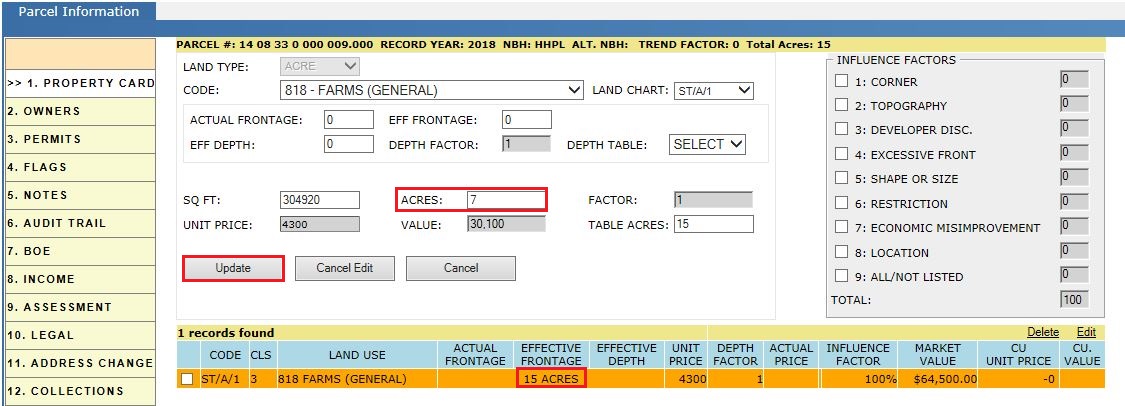

Step 3: Change the acreage of the existing land item. As this item is going to split into 8 and 7 acres, make the acreage as 7 for existing item and click on Update.

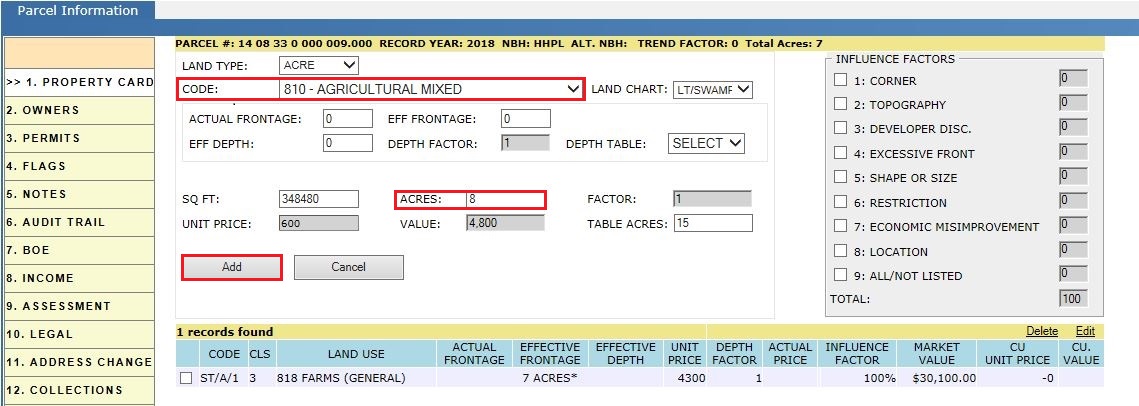

Step 4: Add the new land item with 8 Acres. Select the fields (Land type, Code, Land chart and Acres) as per the requirement then click Add.

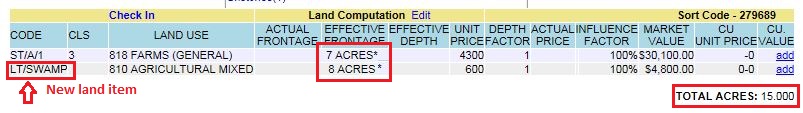

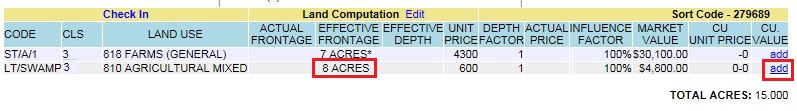

Verify the Land computation section after adding new land item.

Step 5: Add Current Use to the land item that has 8 acres. by selecting the Add link (under CU value).

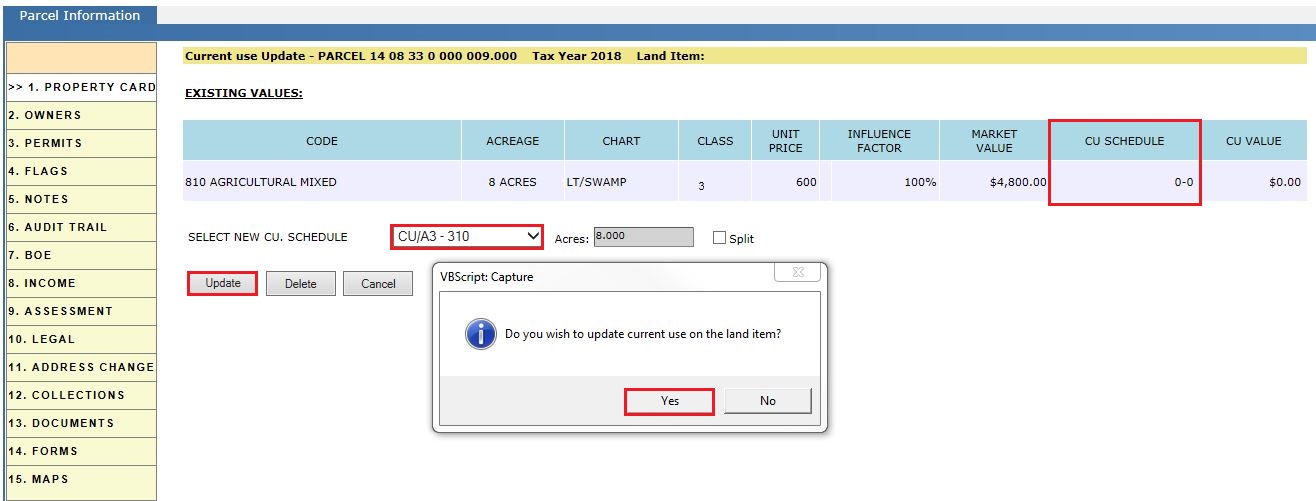

Step 6: Select the CU Schedule required and click Update. A pop up will appear to confirm adding the CU on land item, click Yes.

Verify the Audit Trail after adding the current use.

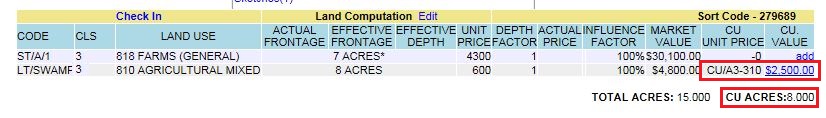

Verify the CU Acres in the Land Computation section and verify the calculations.

Calculations for CU value:

CU value = CU Unit price * Acres

= $310 * 8 =$2480 = $2500 (Rounded)

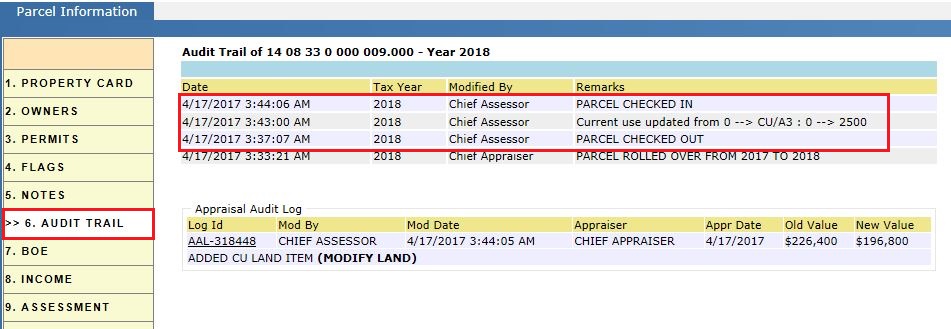

Audit Trail of parcel after adding current use:

Provides details of the check out, check in, and CU update information.

Current Use Split

(b) Splitting the land item and applying CU to two land items (using Split):

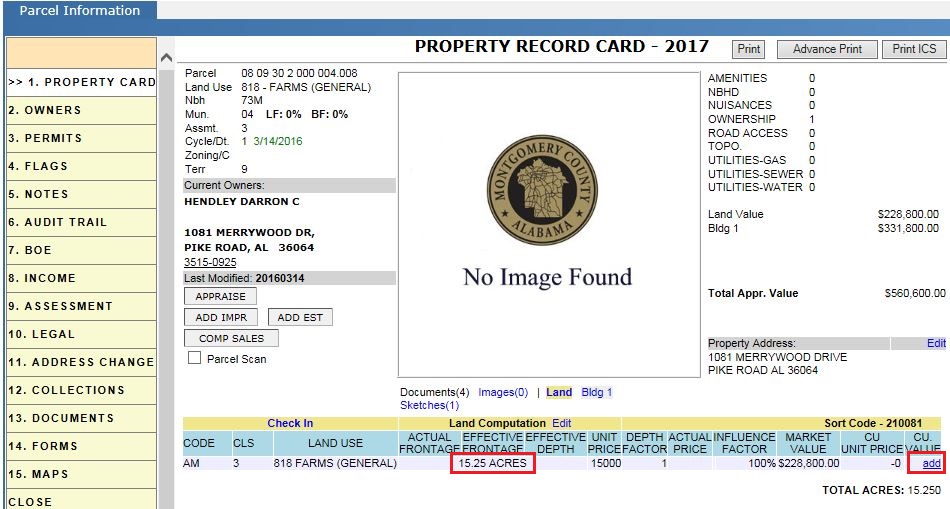

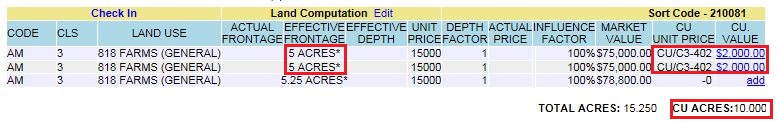

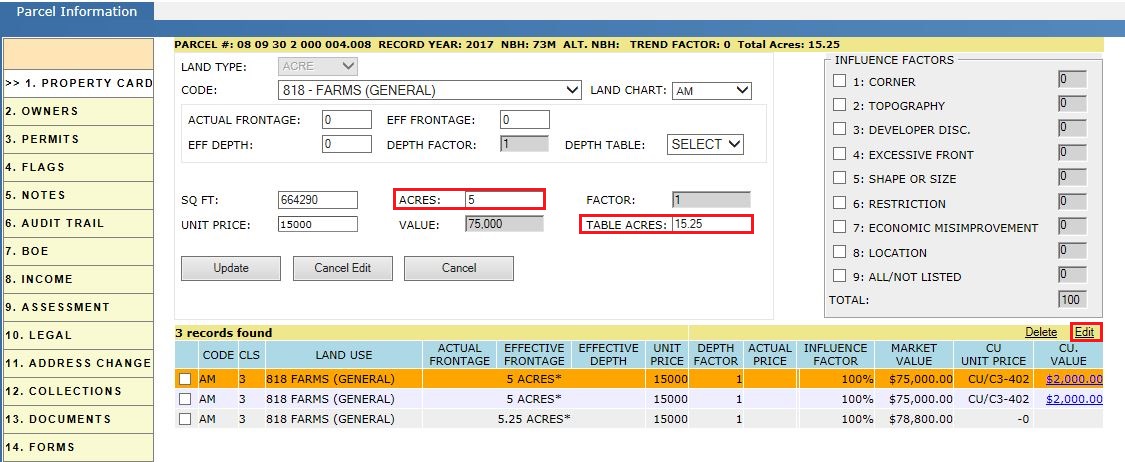

A Parcel 15.25 acres is split into three land items by using the split checkbox in the CU region. Two land items of 5 acres with CU and the other land item with 5.25 acres is automatically created.

Step 1: Check Out the parcel and click the add link for the land item.

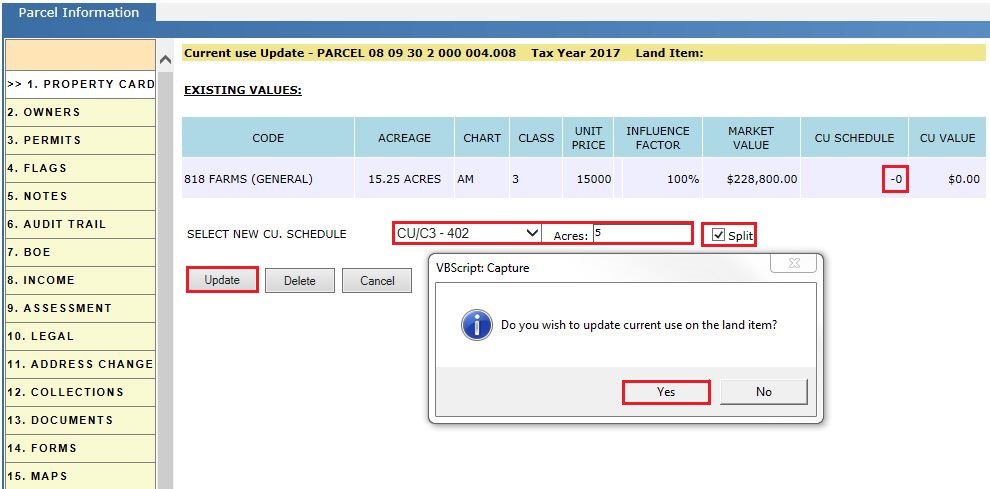

Step 2: Checkmark the split then change the acreage and land schedule as per the requirement. Click Update. A Pop up will appear to confirm adding the CU to the land item. Click Yes (Same procedure for creating 2nd CU land item).

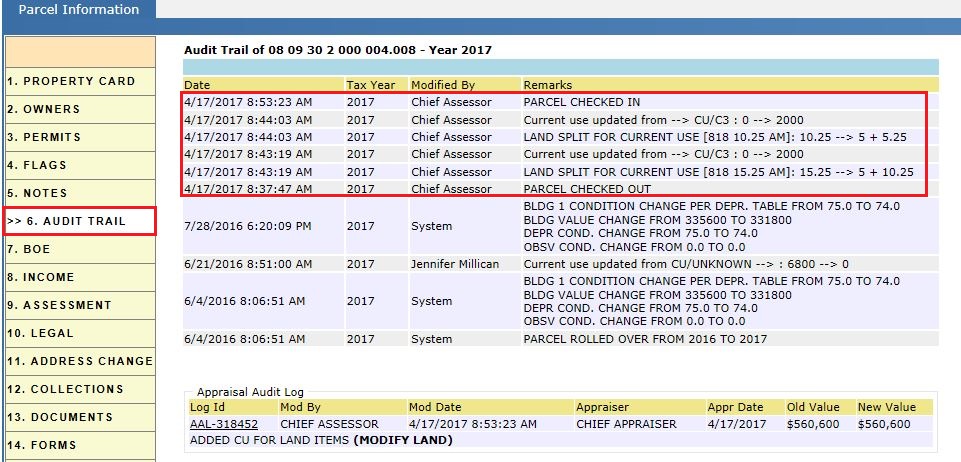

Verify the Audit Trail.

Split in CU region:

Table acreage is applied to split parcels when the split checkbox is used. Table acreage is the total acreage of existing land items. Both of the land items will take the same unit price in this process.

Consider a parcel of land 15.25 acres. Split the land into 5.5 and 5.25 acres respectively using the split checkbox. The table acreage for those three land items totals 15.25 acres and unit price is $15,000.

Step 3: Click Yes. Current Use is applied to the selected land item and a new land item is created for the remaining acreage with the same code and land use.

Verify the CU Value and CU Acres in the Land Computation section:

Verify the table acres by editing the land item.

Note: CU Value added to the land item will not be used until the CU is activated (See steps for activating CU).

Updating Existing CU item:

Update the existing CU value following the above two steps. Change the required fields (CU Schedule, Acres) and click Update.

Audit Trail of the parcel while splitting the land and adding CU:

It should display the details of Check Out, Check In, along with the CU information.

Splitting the Land for CU is audited.

Updating Current Use information is audited as well.

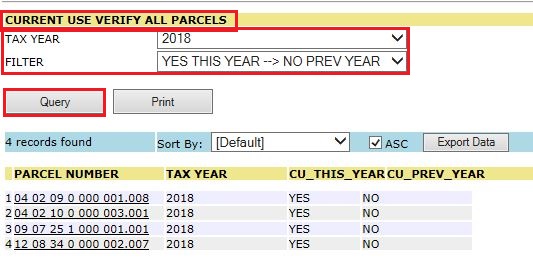

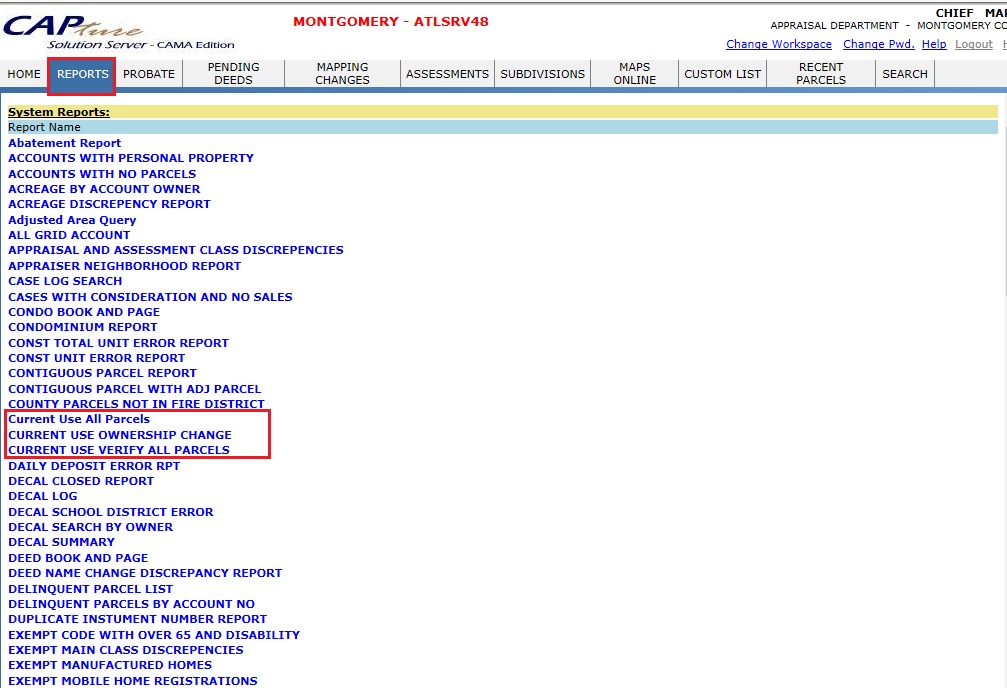

Reports Used: There are three kinds of CU reports: CU All Parcels, CU Ownership Change and Current Use Verify all Parcels.

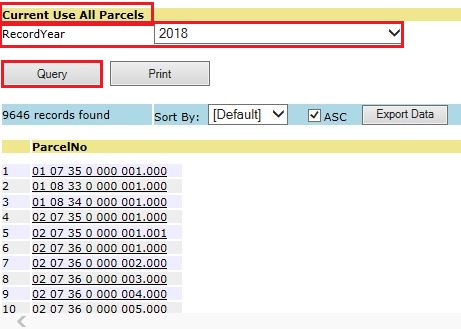

Current Use All Parcels: This Report shows all Current Use Parcels per selected Record Year.

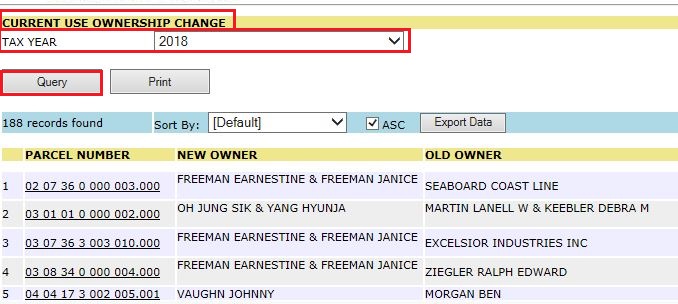

CU Ownership Change: This Report shows all ownership changes with CU per Tax Year.

Current Use Verify all Parcels: This Report compares two years based on Filter like YES THIS YEAR NO PREV YEAR, etc.