Current Use Processing

Introduction

Current Use can be applied to the land acres categorized as farmland, pasture land, and timberland for the production of agricultural products. Current Use is applied to the property owners rather than the parcel. Therefore, the taxpayer must apply for current use and be approved. New owners must apply for Current Use even when the previous owner was already approved.

Current Use can be applied either to whole parcels or to specific land items. Unit price of current use can be differentiated by using the CU Schedule. Splitting Land Items will be used for different land types tied to a single parcel.

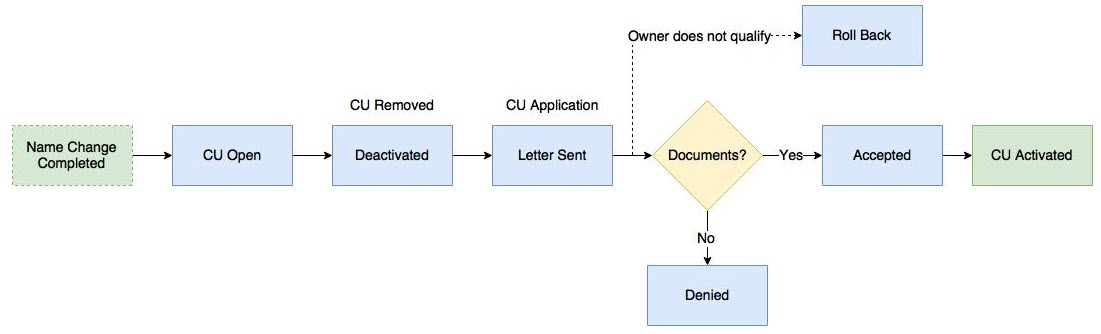

Current Use Workflow