Page Topics:

Litigations

Introduction

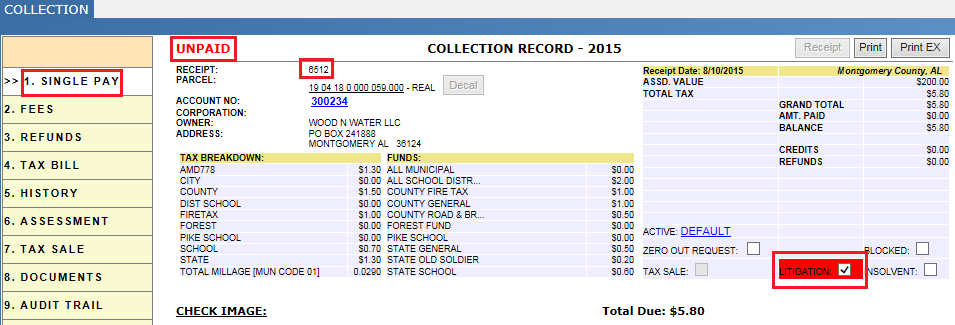

Litigations are real property or personal property accounts that are under court protection and are excused from paying taxes currently. User can mark the receipt as litigation in the Current tax year. Notices and certified mail are not sent to those who are under litigation protection and interest does not accrue on unpaid taxes. User will take the credit on this receipt. The Property which is marked as Litigation won’t go for Tax sale.

Credits: Whenever the collector does not collect an amount from the abstract, it must be taken credit for. Credits include errors, insolvents, litigations, parcels sold to state in tax sale, petitions, budgets, and commissions withheld.

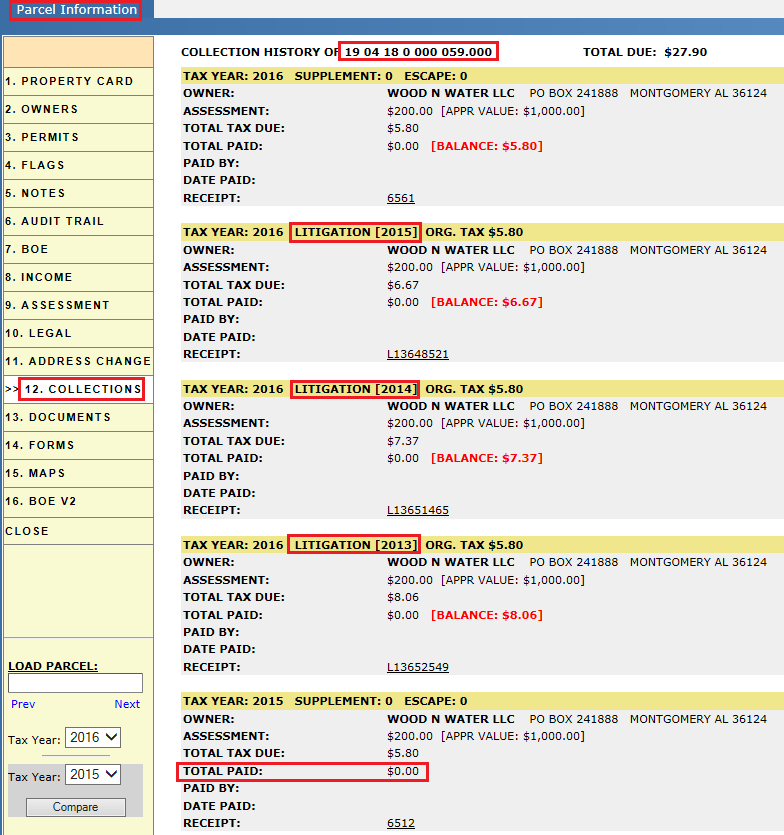

If a taxpayer’s parcel is put into litigation protection in the 2015 collection cycle, then the 2015 taxes are unpaid and the receipt will be marked as in litigation. Credit will be taken on the 2015 taxes. When 2016 is abstracted, then a litigation receipt is created with a base year (The year the taxes went unpaid) of 2015 and a regular tax bill for 2016 is created. Litigation Receipt Created for a parcel that is unpaid in a previous year due to an ongoing legal process. Litigation receipts begin with an “L.” (Ex: L13648521). During the Final Settlement process, litigations are treated as a credit and subtracted from the amount owed. These litigation parcels have already been settled in the year that they went into litigation. Since credit has already been taken, they do not need to be abstracted again. Payments for prior year litigation receipts are disbursed separately from the regular taxes that are collected.

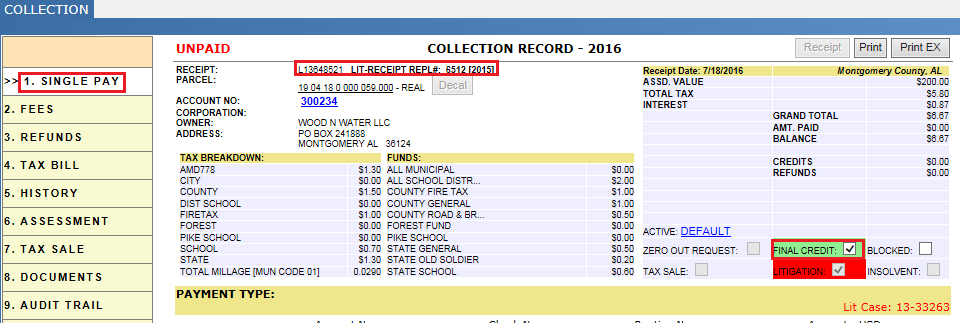

Litigation: If during the collection cycle a parcel goes into litigation, then the receipt is marked as litigation by selecting the corresponding checkbox by respective collection user.

Full Litigation Payment:

Taxes will be paid either partially or in full on a current year litigation parcel or account. If the receipt is paid in full, it will be disbursed and settled like a regular receipt

Part Litigation payment:

If a litigation is partially paid, then the best way to handle it is to un disburse the money and hold on to it then apply it to next year’s litigation receipt. Either wait until the entire receipt is paid before disbursing the funds or take credit on the full receipt during Final Settlement.

Example for part pay: In 2012, a parcel under litigation protection was taken credit for at $1,000.00. In 2013, that amount is rolled over and a litigation receipt is created. What happens if in 2013, $850 of that $1,000 is paid? Roll the part payment on the litigation forward and in 2014 create an “L” receipt for $150. Litigation receipts are not abstracted so you do not have to remove payment.

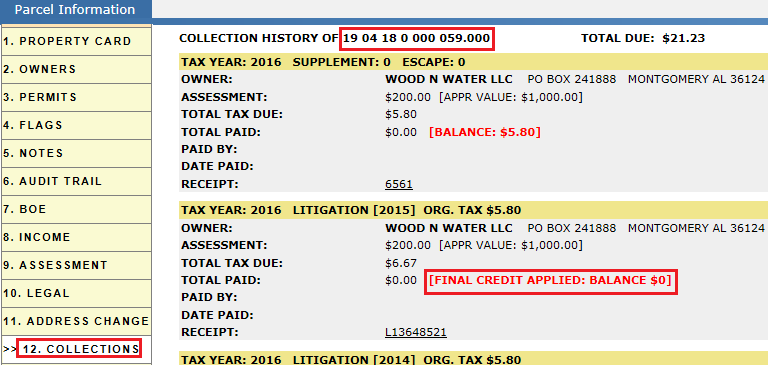

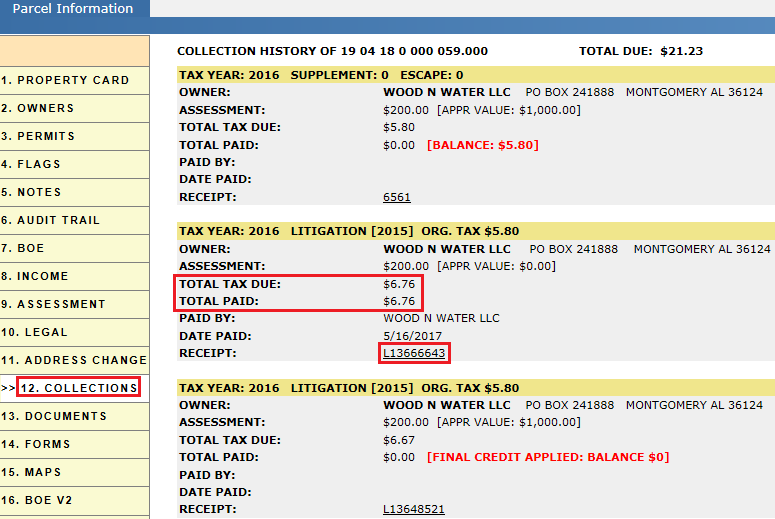

Case 1: Consider a parcel/ Account (19 04 18 0 000 059.000) which has multiple unpaid litigations (Brought forward), take the Final credit on any one of the litigation receipts (2015). Create New litigation for the property on which final credit has been taken, Paying the tax due on litigation receipt.

Brought forward: Consider the current collection year as 2016, If a receipt is under litigation in 2013 and the taxes are unpaid, system will automatically be brought forward the tax due by generating litigation receipts in every collection year along with regular receipts (When parcels got rolled over). As this property went to litigation in base year 2013, it should have 2013, 2014 and 2015 litigation receipts.

Example:

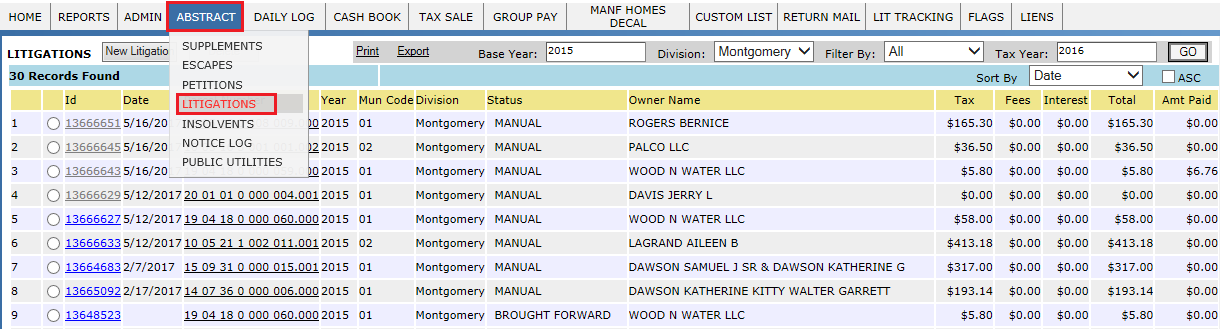

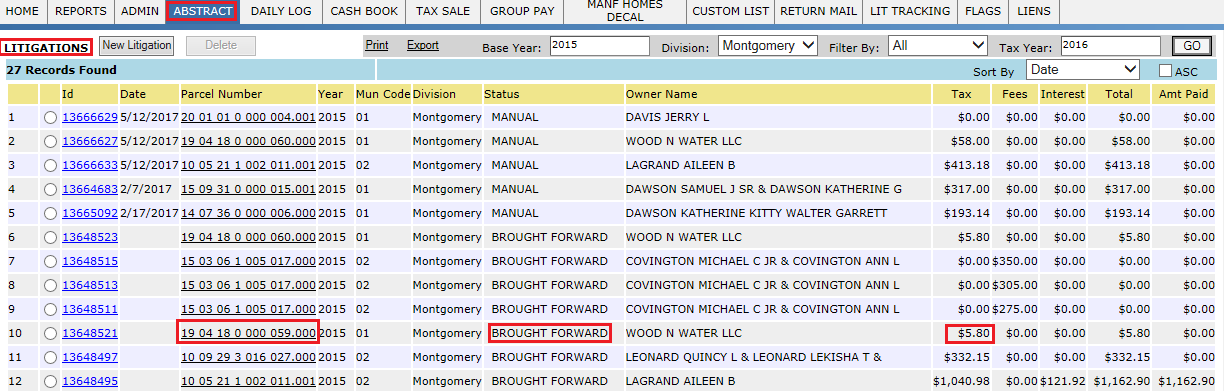

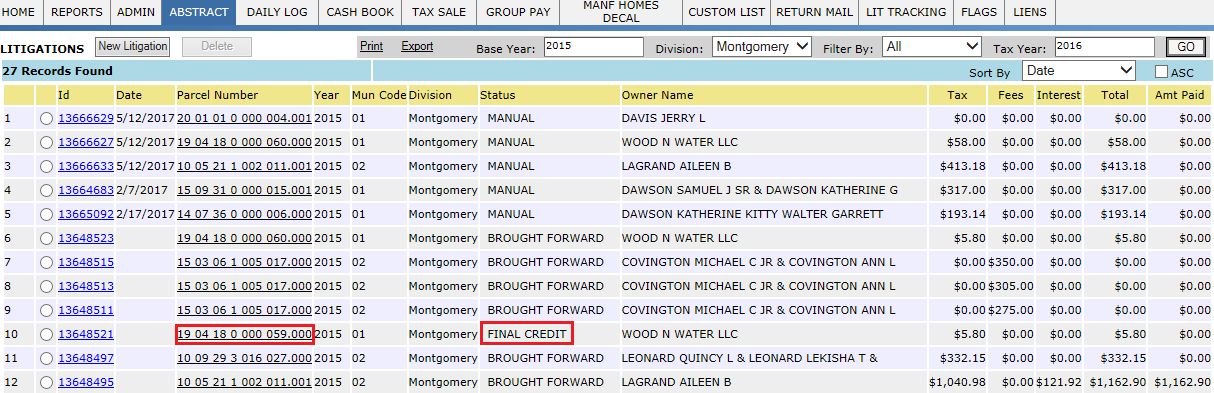

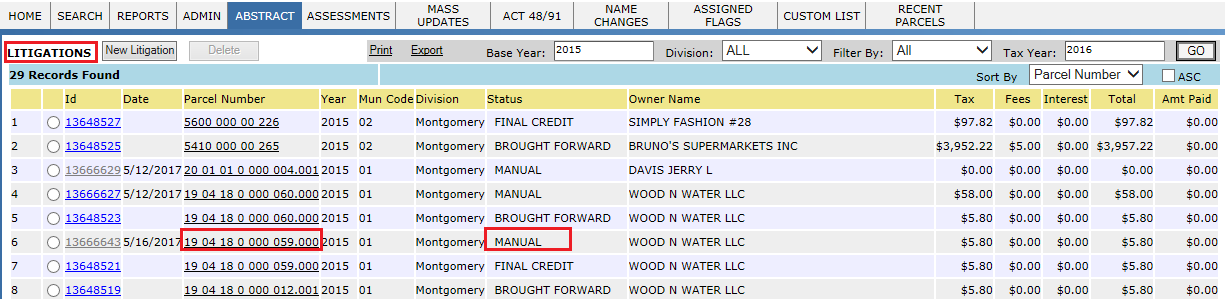

Status of this property under Litigation report:

Final Credit

Check mark Final Credit from the litigation receipt.

Verification:

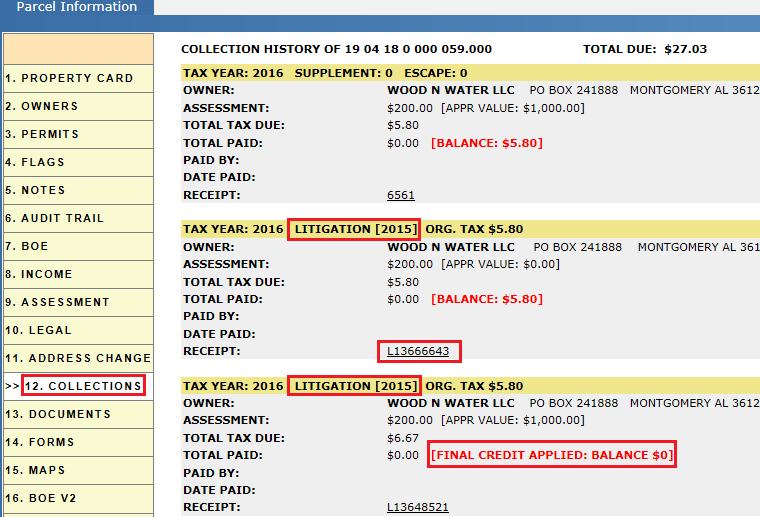

In parcel: It should show the [Final credit Applied: Balance $0] under respective receipt.

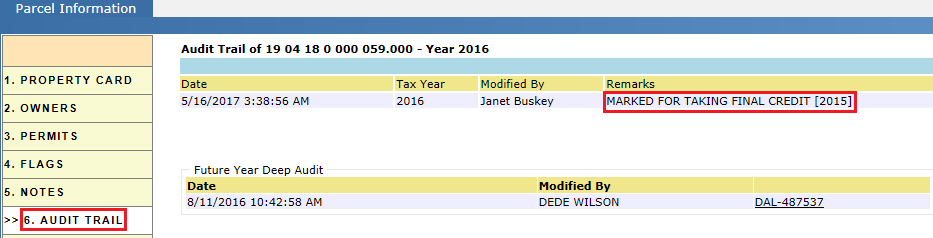

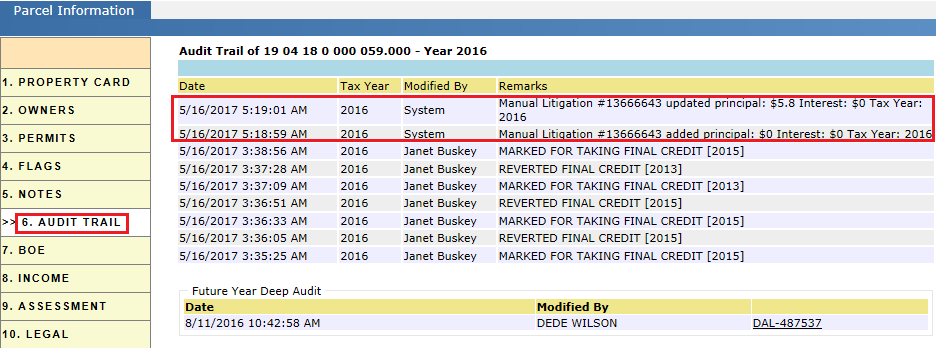

Audit trail of parcel: It should contain the details regarding final credit taken.

In Litigation report: Status of that property should change from Brought forward to Final credit.

Creating New Litigations

If the final credit is taken on the Litigation receipt, that taxes due on that receipt will be considered as zero. Then if tax payer come back and want to pay the taxes on that property (Pick up), Respective User will create New litigation receipt for that property.

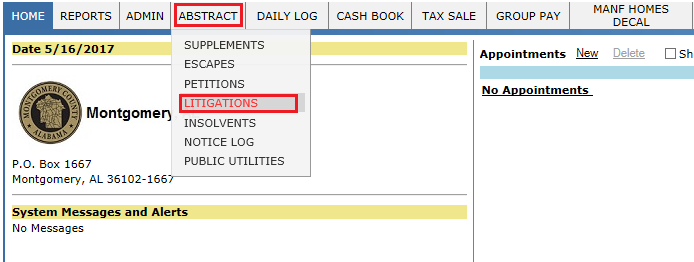

Step 1: Hover over the Abstract and click on Litigations tab.

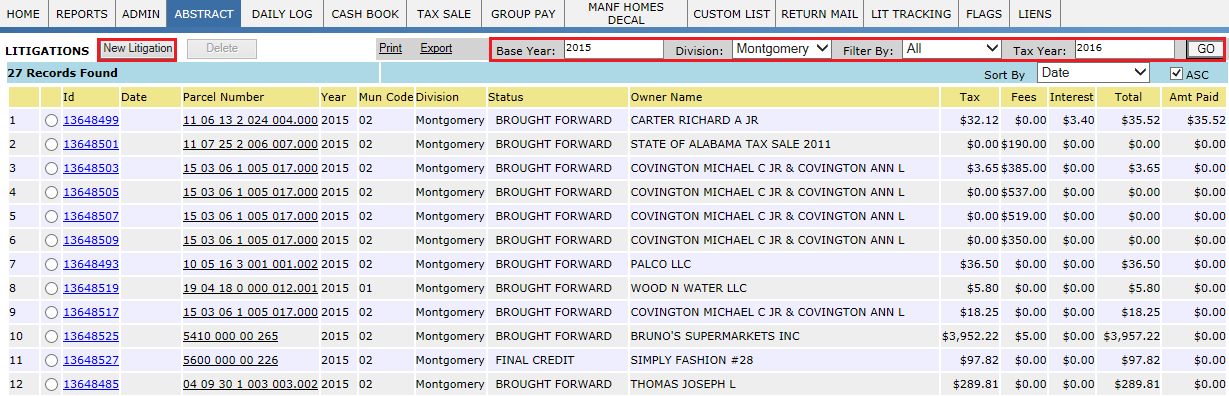

Step 2: Fill the respective fields and click on Go. Then click on New Litigation Button. Creation of New litigation cannot be available for prior tax years.

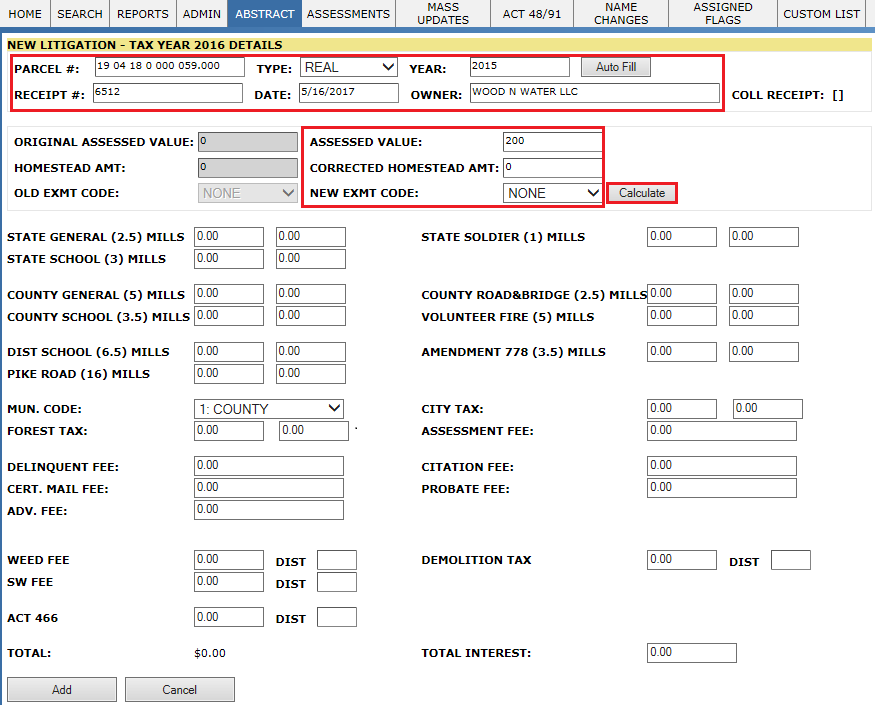

Step 3: Fill the required fields like parcel No, Type, Receipt No, and Year, click on Auto fill. It will retrieve the date and Owner name automatically. Enter the assessed value on that property for the year in which litigation should be created, if any data related to exemptions got changed user should update that and click on Calculate.

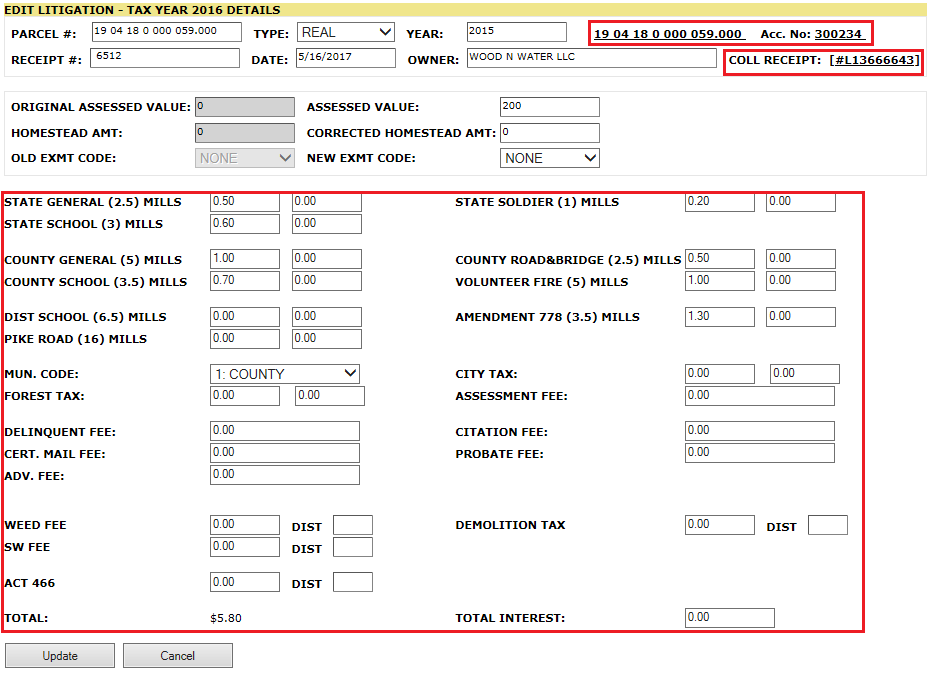

Step 4: Once user click on Calculate, New litigation receipt, Parcel No and Acc. No got generated and tax breakdown will be done based on millage rates. If user need to update any information, change the required information and click on Update.

Verification:

In Litigation report: Once the new litigation got created, one new entry will be added into the litigation report with the status Manual with respective tax amount without any interest or fees.

In Parcel: The New litigation receipt created for 2015 can be seen under Collections tab of parcel.

In parcel Audit trail: It should contain the details regarding manual litigation creation and taxes applied on it.

Paying tax due on Litigation receipt:

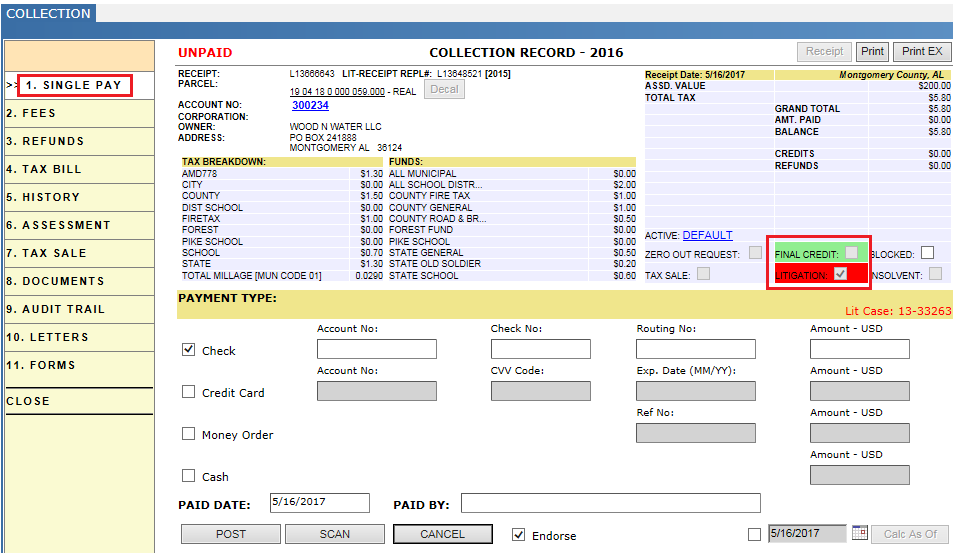

Step 1: Open the receipt and verify the balance amount before calculating fees and interest.

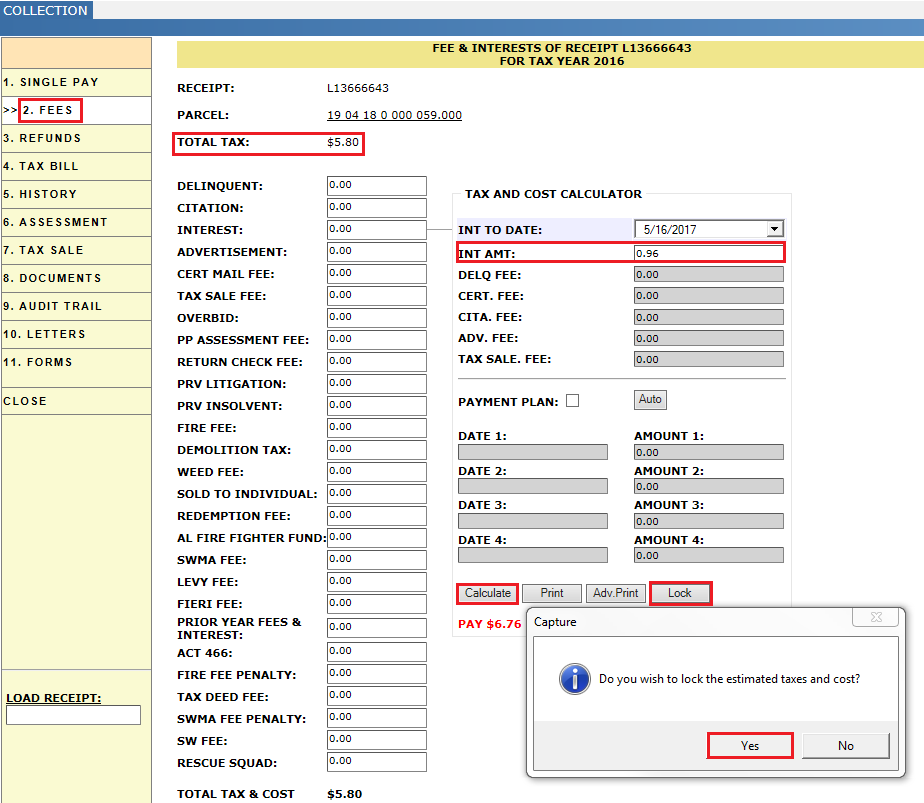

Step 2: In the fees tab of the receipt click on calculate and lock the new tax due.

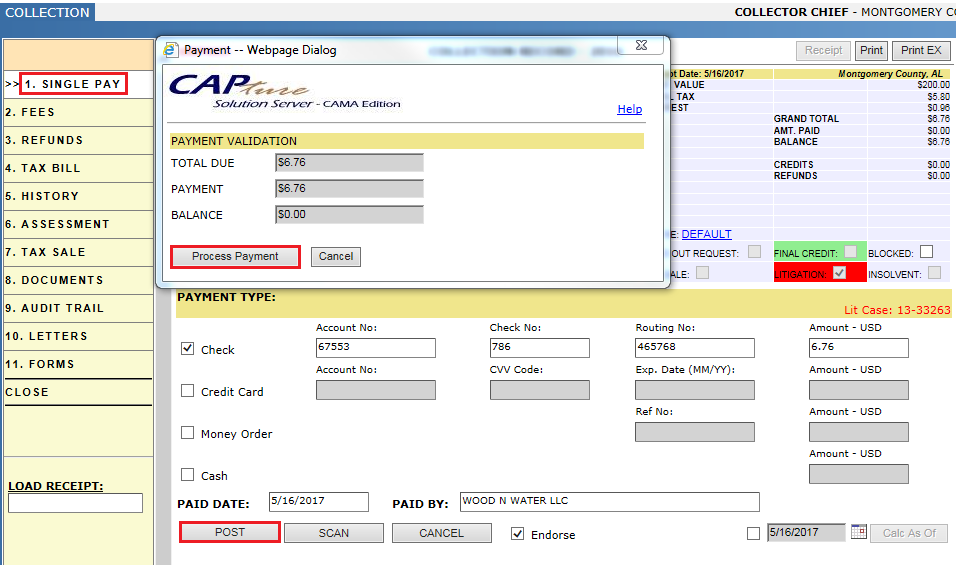

Step 3: Select the payment type and fill the required details then Process the payment.

Verification:

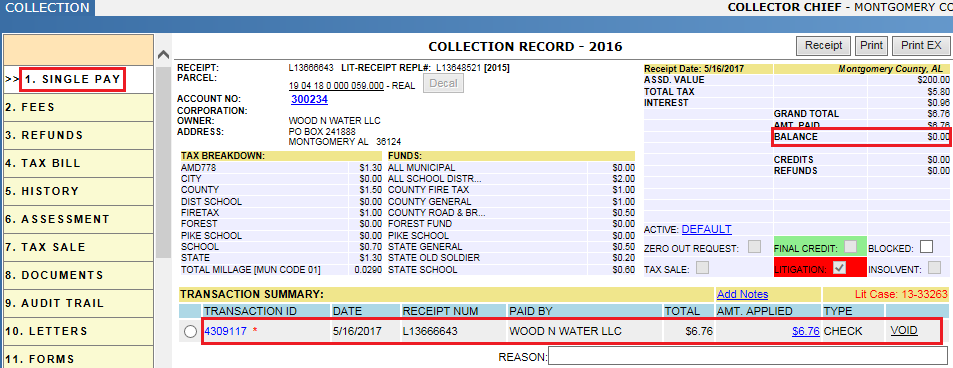

In Receipt: Transaction will be created for the payment in the receipt under transaction summary.

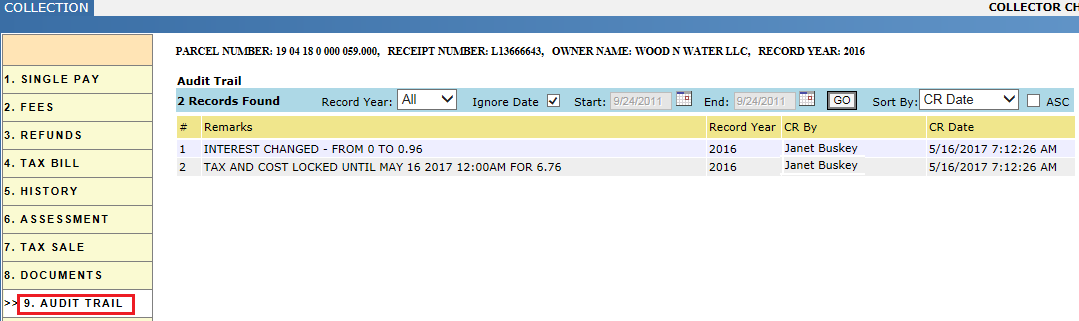

Receipt audit trail: It should contain the details of change in interest value and locking the new tax values.

In parcel dash board: The amount paid in litigation receipt should be changed with respect to the amount paid by the tax payer.

Litigation Protection Roll Off

Case 2: Consider a parcel/Account litigation protection rolls off (No protection on that receipt).

As for all parcels going to tax sale must be advertised for three consecutive weeks and by March 30th based on capture setup, tax sale parcels will already have been advertised. So, this litigation parcel won’t go for tax sale. The parcel would have to be supplemented and then zeroed out to error out the tax bill. Then create an escape to collect those taxes in 2013. This escape receipt can be created in the current collection year or if any complications occurred it can be created in next collection year along with the regular receipt.

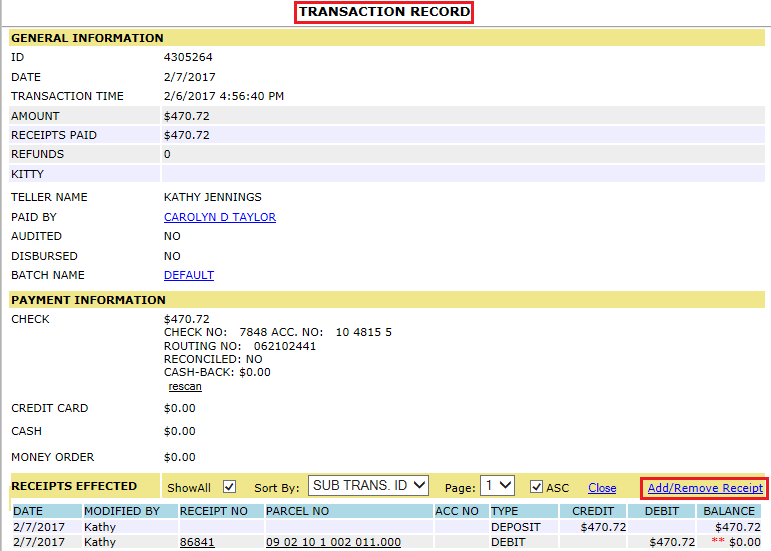

Single Payment on Multiple Litigations

Case 3: Consider 5 parcels are in Bankruptcy having different owners. Court will appoint some trustees; each trustee will cover the parcels under certain area. So, these trustees can pay the tax due of some litigation parcels by writing the check with sum of all tax dues by giving a list which contains, what amount should be paid on each parcel. If the trustee pay the full amount of all parcels user can make that transaction by Group pay. But if trustee write the check for partial amount (In the list trustee mentioned what amount should apply for each parcel), user can’t do the Group pay (Because in group pay receipts got paid serially by paying full amount). In that case, user should do single pay by using Add/ Remove receipts.

Consider, Parcel 1 of tax due $2000

Parcel 2 of tax due $1500

Parcel 3 of tax due $3000

Parcel 4 of tax due $2500

Parcel 5 of tax due $1000

Total tax due of these parcels is $10,000. Trustee write the check with amount $6000 with list as below:

For Parcel 1 of tax due $1000

Parcel 2 of tax due $500

Parcel 3 of tax due $2000

Parcel 4 of tax due $2000

Parcel 5 of tax due $500

For reference:

To process this user should pay one receipt with the total amount of check (After paying the full amount of that receipt reaming amount will go to the refunds of that transaction). Then by using the add/ remove receipt, user should remove the receipt which has paid. Then that receipt got unpaid and total amount (Check amount) will go under refunds. Now, by using the add button user add all the receipts with the amount provided by trustee.

Reports

Litigations: Hover over Abstract --> Litigations.

This report will give all the litigation receipts with respect to base year and tax year, with the status like manual, brought forward, final credit. This report is also used to create new litigation by respective users.