Page Topics:

Insolvents

Introduction

In Final Settlement, the amount originally abstracted to be collected is a charge. Money that was abstracted but not collected is a credit (except for remittances).

Charges:

Most of the charges include escapes, supplements, and interest.

Credits:

Credits include errors, insolvents, litigations, parcels sold to state in tax sale, petitions, budgets, and commissions withheld.

In terms of Remittance, Insolvents are subtracted from Total Abstracted amount. Insolvents are personal property accounts that are delinquent and have not paid taxes. When personal property account taxes remain unpaid, the account goes insolvent. As insolvent is a credit, so if $900,000 is abstracted and there is $100,000 in personal property accounts marked as insolvent, then $100,000 is subtracted from the abstracted amount. That means $800,000 remains on the charge after the $100,000 credit is taken. The year the account went insolvent is the base year. When an account is unpaid, the current receipt can be marked Insolvent but an insolvent receipt will not be generated until the next tax collection cycle (next tax year), if the tax bill remains unpaid. All insolvent receipts are identified with an “I” and are brought forward. When an account is marked insolvent, any applicable fees and interest will be applied from the day the account went delinquent. For example, if an account goes insolvent in tax year 2016, then interest begins calculating on January 1, 2017. Capture will keep track of the interest to be applied on accounts. When considering insolvent tax bills, a receipt must be generated automatically by the system for each year. An account which has been insolvent for multiple years will have multiple insolvent tax receipts and the current year receipt as well. When processing current year’s receipt, partial payments for insolvent won’t be considered. If a partial payment has been made, then un disburse it before Final Settlement and mark the original receipt insolvent so that in next year, an I- Insolvent receipt will be generated. Once the new insolvent receipt is created for the next tax year, the partial payment (due amount) can be applied to that receipt. Each year, insolvent receipts are carried forward to next tax year. Only the total tax for the receipt is brought forward because any fees and interest are recalculated and moved to the new receipt. The total amount to be carried forward is determined by taking all the taxes brought forward from the previous year and adding any pickups that were created during the current tax year. Current year receipt can’t be marked as Insolvent.

Carry Forward = Amount Brought Forward + Pickups - Paid – Final Credit

Brought Forward: The sum of all insolvents for prior years.

Pickups: When final credit has been taken on a previous year insolvent and then a person comes and pays the taxes, a pickup is created. If a business does not have an account in the current year, then an escape cannot be created so a pickup must be created.

Paid: The total amount paid towards any brought forward insolvents.

Final Credit: The amount written off because it is realized that it will not be collected. The amount being written off may be a full receipt or a partially paid receipt.

Workflow

Login as privileged user to process insolvent receipts.

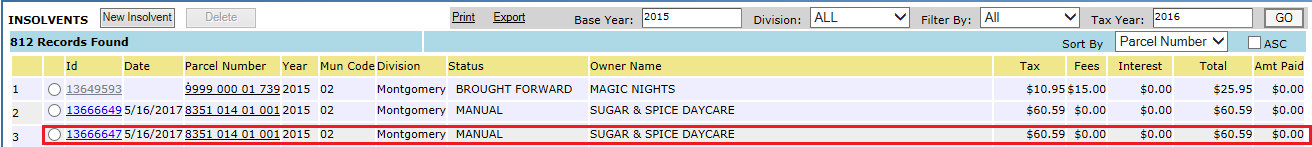

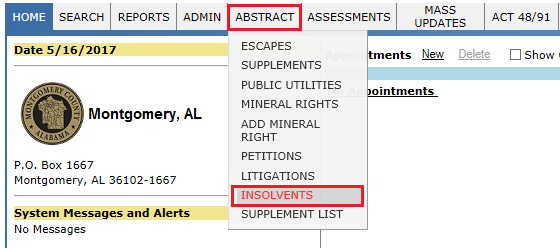

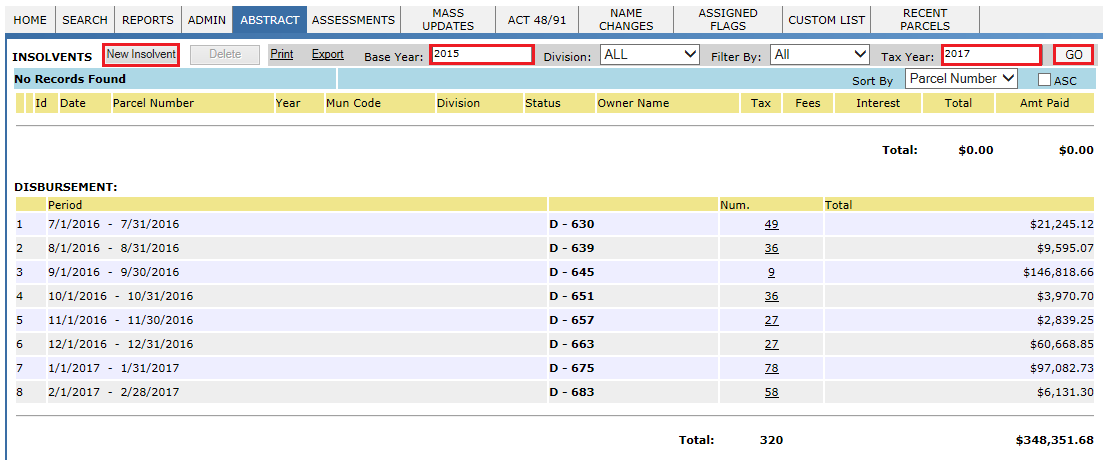

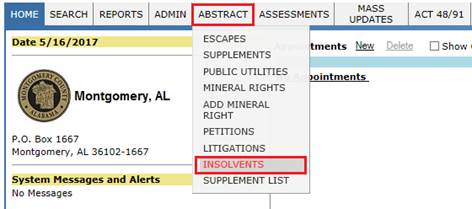

Hover over ABSTRACT and click on INSOLVENTS. Then INSOLVENTS page will be opened.

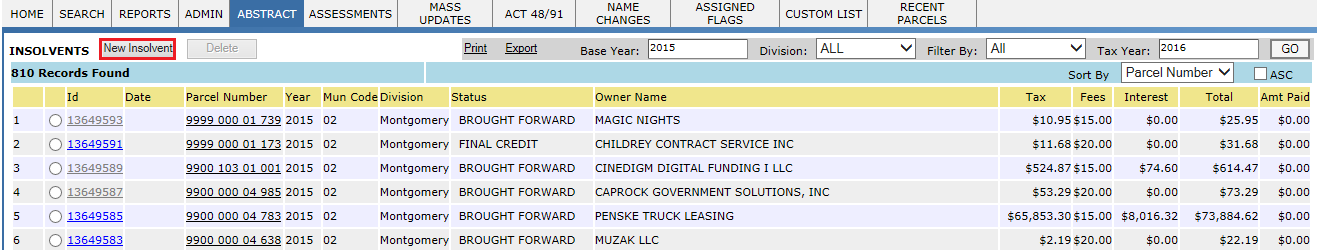

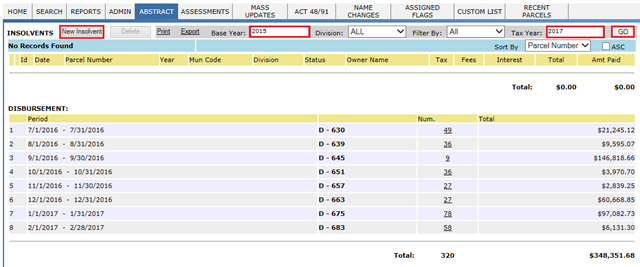

Here, if the user wants to create New Insolvent, click on New Insolvent button. If the user wants to verify the existing Insolvents, select Base year and Tax year and click on GO.

Final Credit

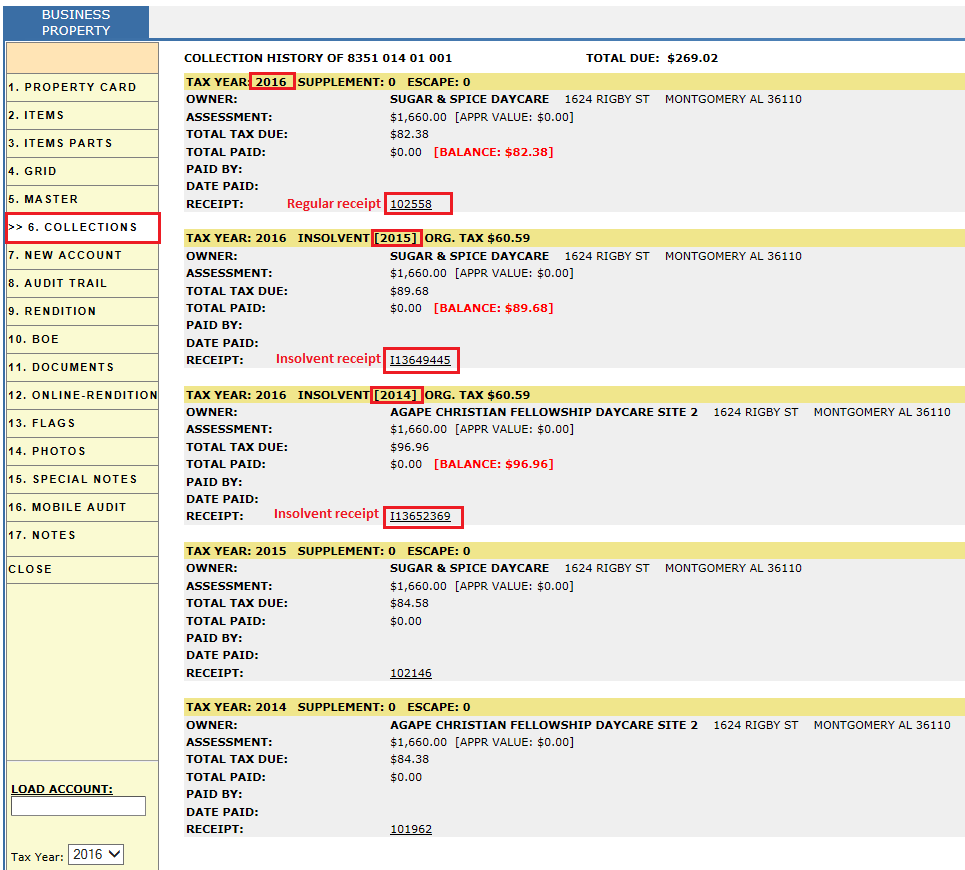

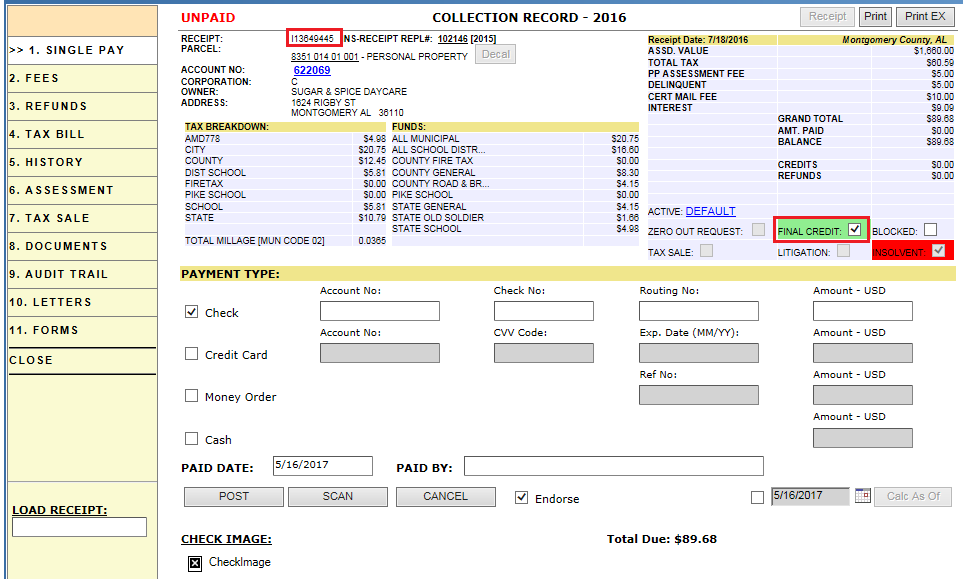

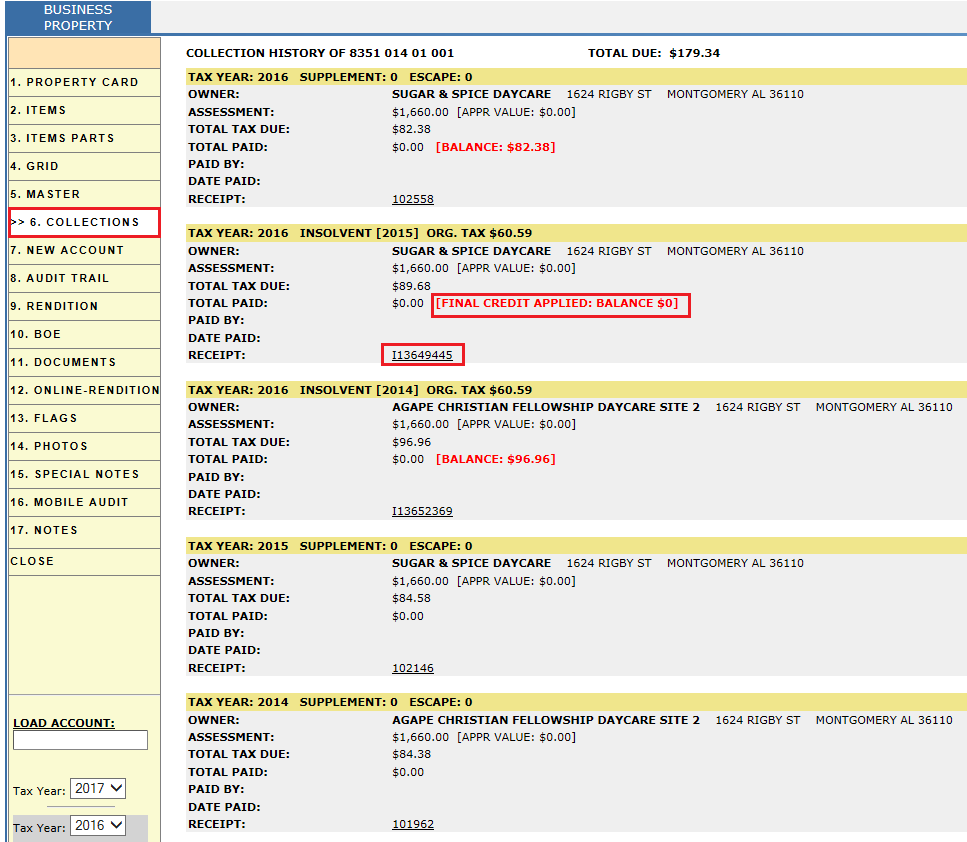

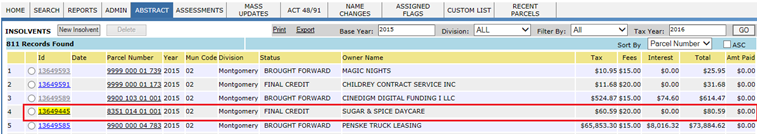

Case-1: When the County is not able to collect money from tax payer, after some years the receipt will be marked as Final credit. Considering the parcel/account 8351 014 01 001 and marking final credit for the receipt I13649445.

Open the respective receipt from parcel - Collections tab and mark Final Credit.

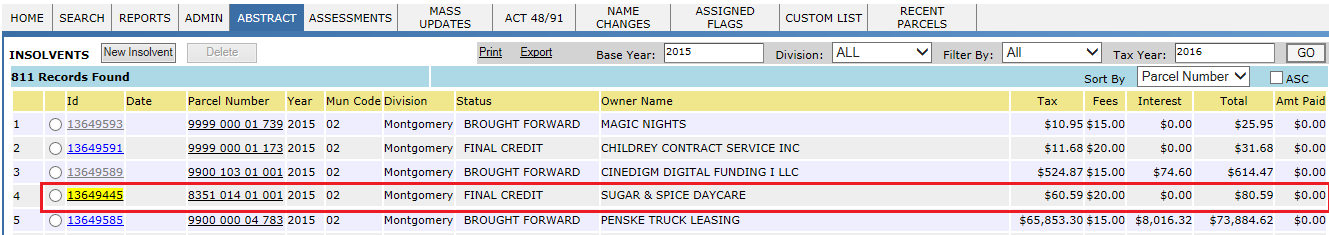

After marking the receipt as Final Credit, the status will be shown as Final Credit for the respective receipt.

Pickups

Case-2: When final credit has been taken on a previous year insolvent and then a person comes and pays the taxes, a pickup is created.

Creating New Insolvent receipt

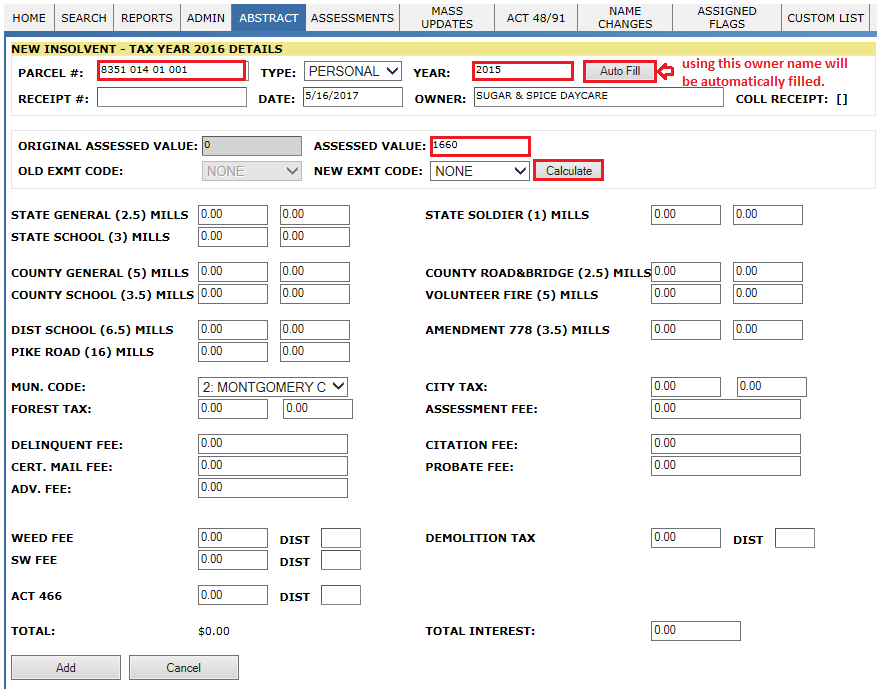

Hover over ABSTRACT -> INSOLVENTS. In Insolvents page, to create New Insolvent, click on New Insolvent button.

Enter Parcel No., Year and click on Auto Fill will fill the owner name automatically. Enter assessed value and click on Calculate.

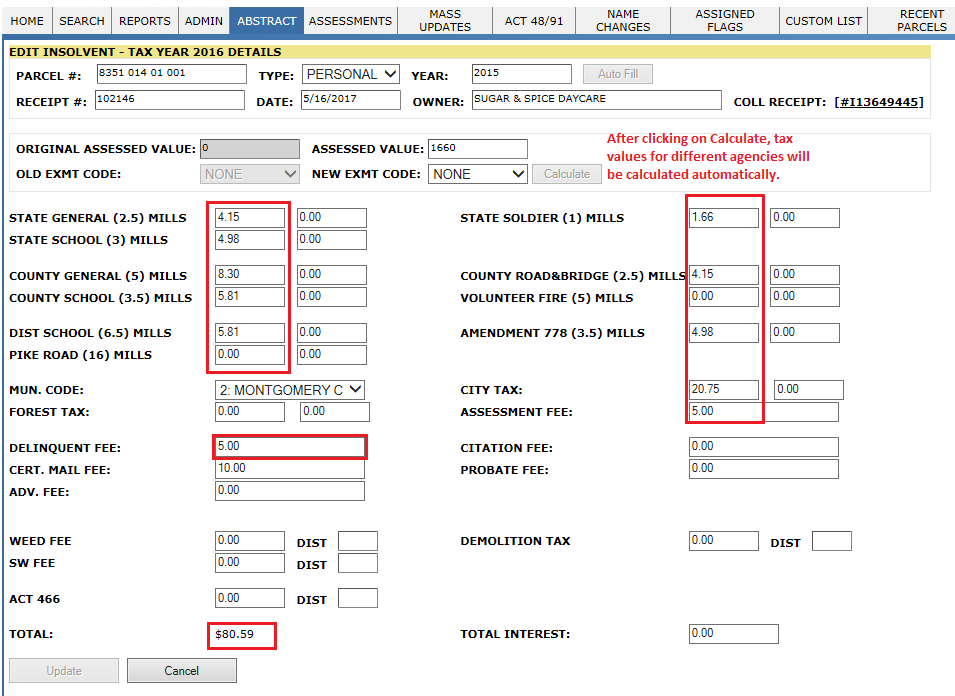

After clicking on Calculate, tax will be automatically applied to each agency.

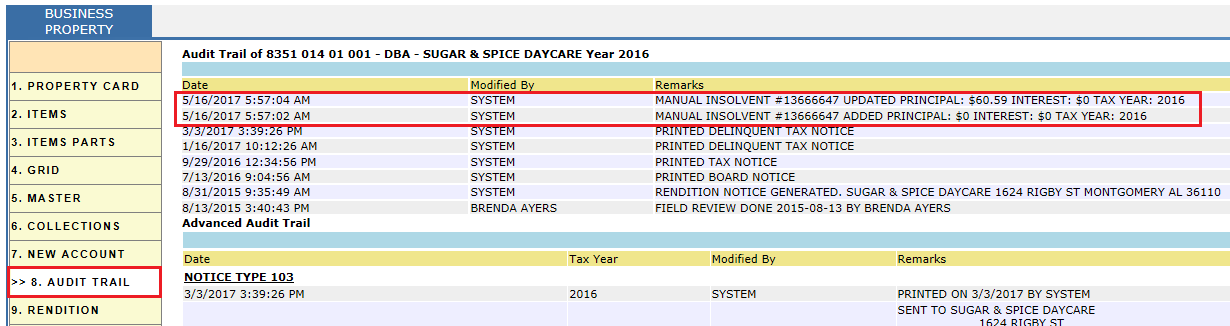

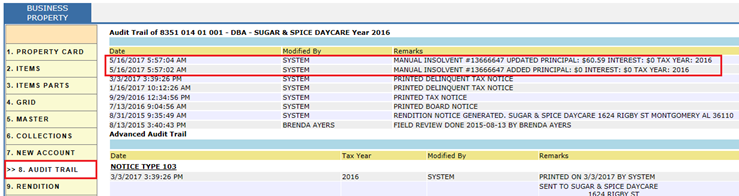

Very Parcel Audit trail which contains added and updated insolvent information.

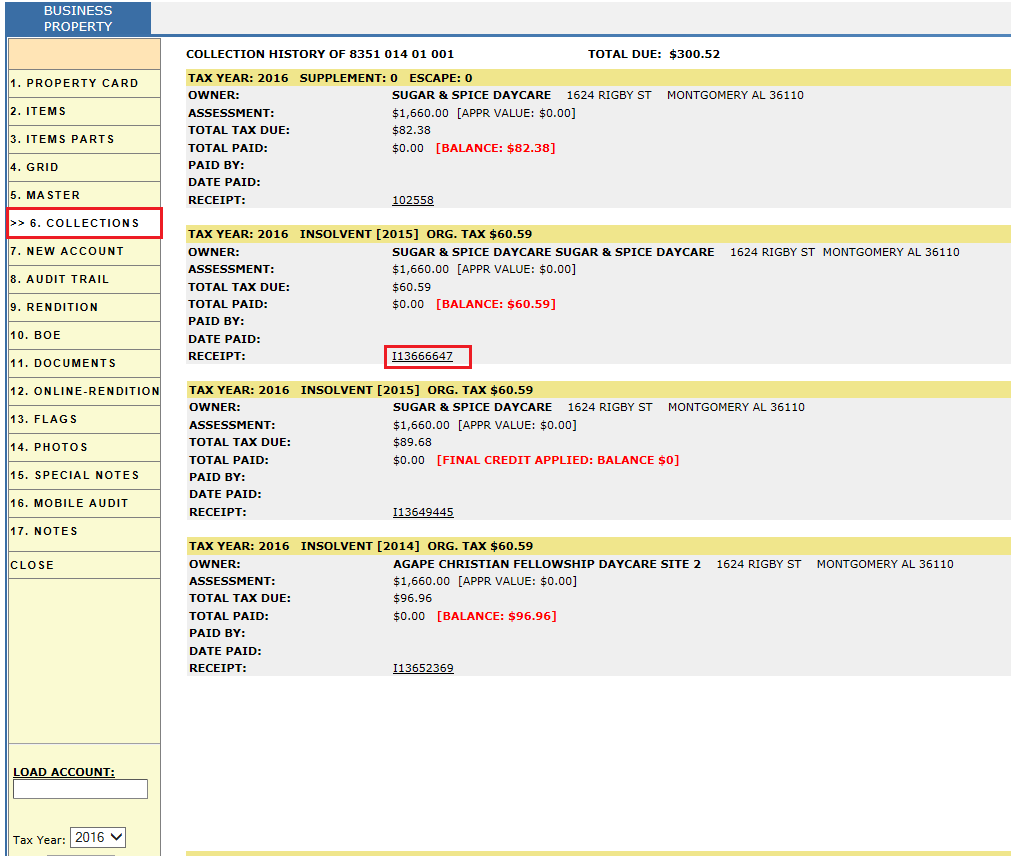

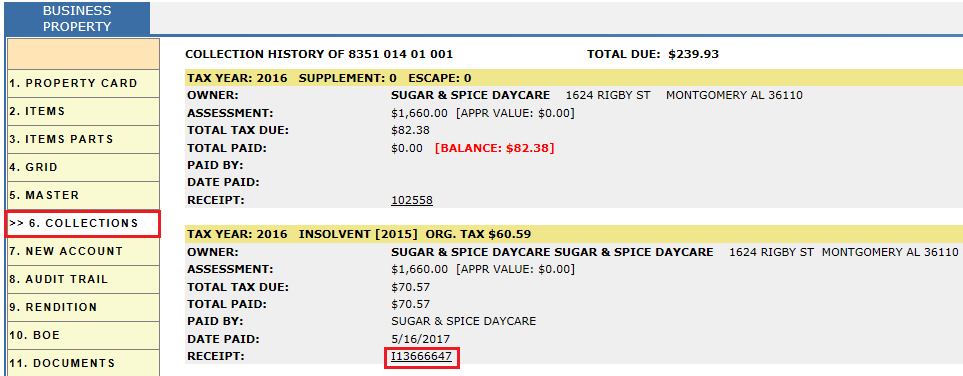

New Insolvent which is created will be shown under parcel – Collections tab.

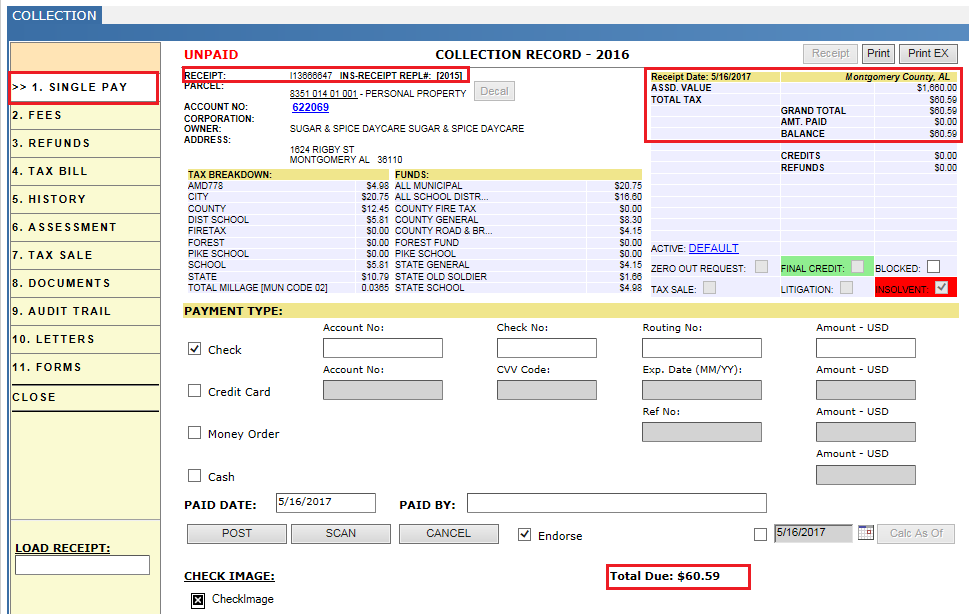

Processing Payment to Newly Created Insolvent Receipt (As the taxpayer wishes to pay the taxes)

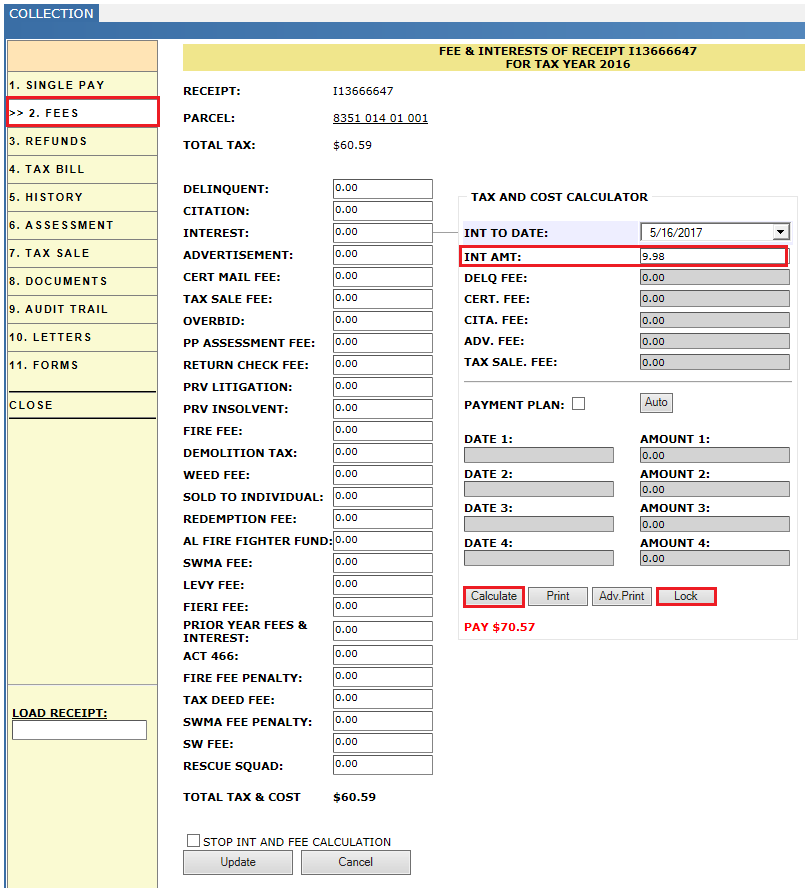

In Fees tab, click on Calculate and then Lock. This will lock the fee and interest applied to the receipt.

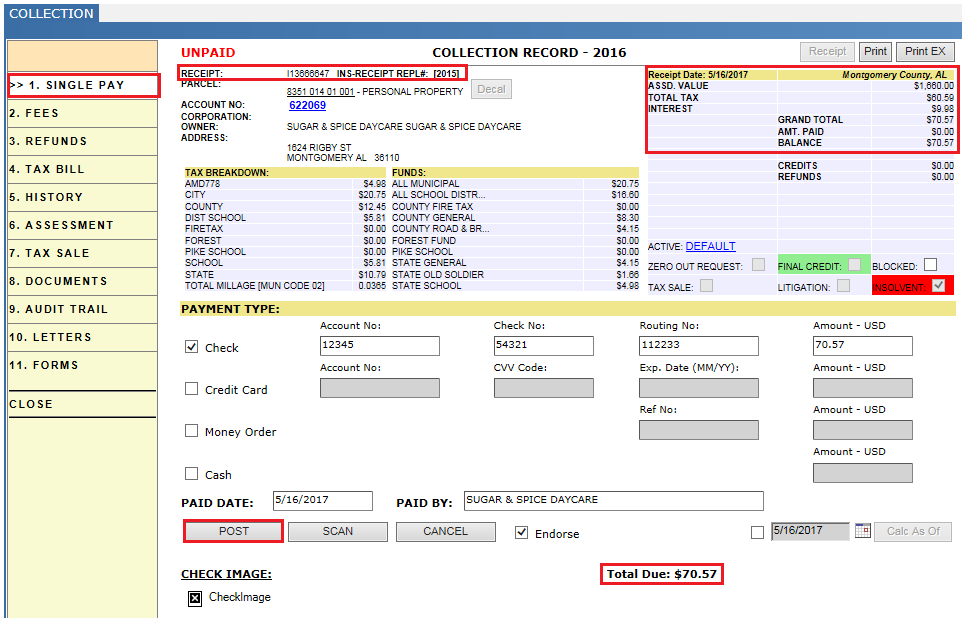

Once fee and interest were locked, Select the payment and click on post by filling required fields like amount, account no., check no. and paid by etc.

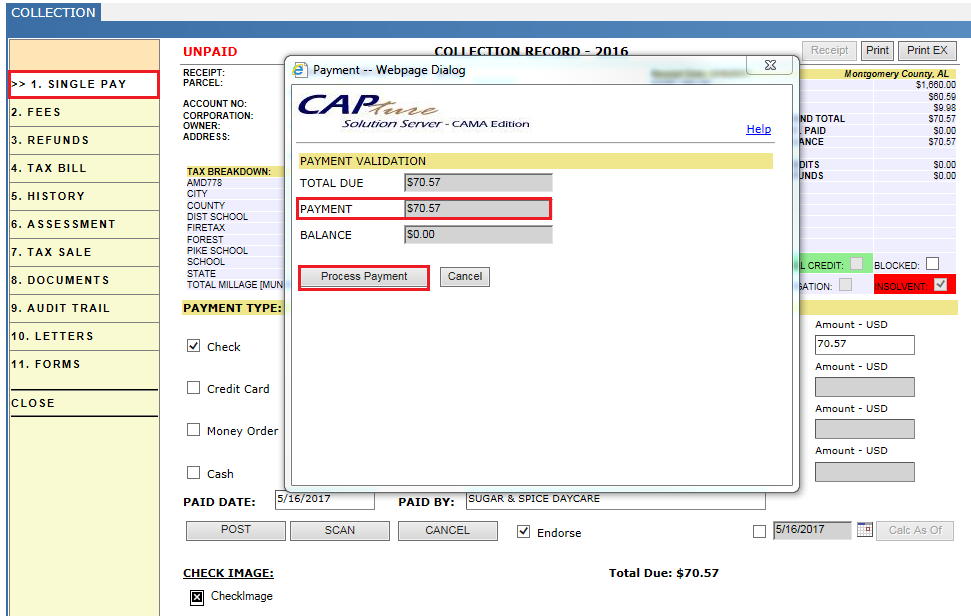

Click on Process Payment to proceed.

Verify Audit trail once the user lock the fee and interest.

After processing the payment, verify parcel Collections tab.

Audit Trail

Audit Trail- Account/Parcel:

Very Parcel Audit trail which contains added and updated insolvent information.

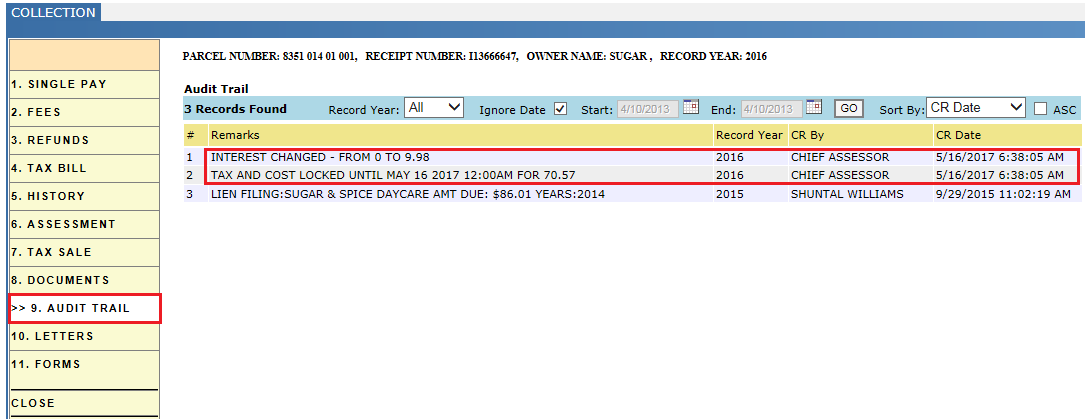

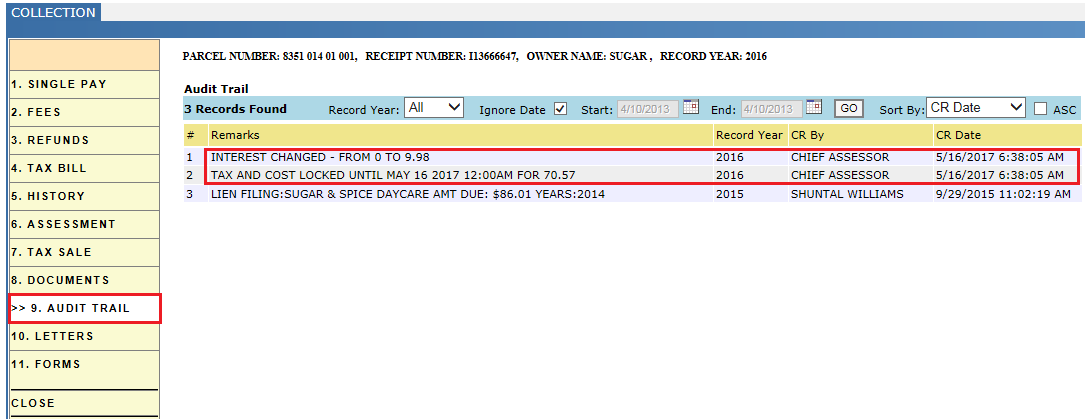

Audit Trail- Collection dashboard:

Verify Audit trail once the user lock the fee and interest.

Reports

Login as privileged user to process insolvent receipts.

Hover over ABSTRACT and click on INSOLVENTS. Then INSOLVENTS page will be opened.

Here, if the user wants to create New Insolvent, click on New Insolvent button. If the user wants to verify the existing Insolvents, select Base year and Tax year and click on GO.

After marking the receipt as Final Credit, the status will be shown as Final Credit for the respective receipt.

Once the new insolvent receipt has been created, then the status of receipt will be shown as MANUAL.