Page Topics:

Adding New Accounts

Introduction

Business Personal Property includes all the assets that are used in the Business-like furniture, fixture, office and industrial equipment, machinery, supplies, tools etc.

To establish a Business, Owner should apply for Business license. Then Business License office will issue Business License which is the starting point of establishing any business. Business License indicates the type of business.

County will collect the licenses from License department and create Account for that Business. After creating account, County Assessor’s office will generate and send rendition notice to Owners which is an empty form. Then Owners should submit the rendition notice which includes all the information about the assets like Date of Acquisition, cost, Type and description of the Assets used in the business. Owner can submit the rendition notice through online or offline.

As the rendition notice comes through offline, Assessment clerk will scan the notices using barcode and then go through the rendition log to verify the details. Audit can be performed through Desk, phone, Detailed, Field and Physical Inspection. Clerk can also change address information (if necessary) and go through the items listed and adjust the depreciation schedule manually. Depreciation schedule of an item depends on business type, equipment type and acquisition year. New depreciation schedule will be set up for new assets. Once the depreciation schedule was set up, Clerk will regenerate values. Supplies (stationary) do not have any depreciation schedule. For certain equipment’s, county will provide abatements to avoid taxes. Salvage value is the value of item after the completion of its depreciation cycle.

If it is online rendition notice, pin no. and key no. will be sent to customer. Then customer access our portal and fill the rendition form with the respective details. Online rendition notice contains Base line items and Filed items. Base line items include the items which are already existed in last year whereas Filed items shows the items which are acquired in the current year.

Generally, county will send rendition notices for the business which is established on or before October 1st. Once the rendition notice was sent, Owner should submit the rendition form through offline on or before December 31st and online rendition by end of March. If the rendition notice was not sent by the owner with in the dead line, then owner will be penalized with 10 % of final assessed value and late assessment fee of $5.

If the county didn’t receive any rendition notice from Owner, then county will bring forward last year item values without any depreciation. If it is a new business, County will use grid approach on which tax is calculated based on sqft value of the land. Owner should pay higher taxes than regular taxes if the county goes through Grid approach.

This document will guide the user through adding new business account, adding new items to the account, modifying existing items, regenerate values for items and setting up depreciation schedule.

Adding New Accounts

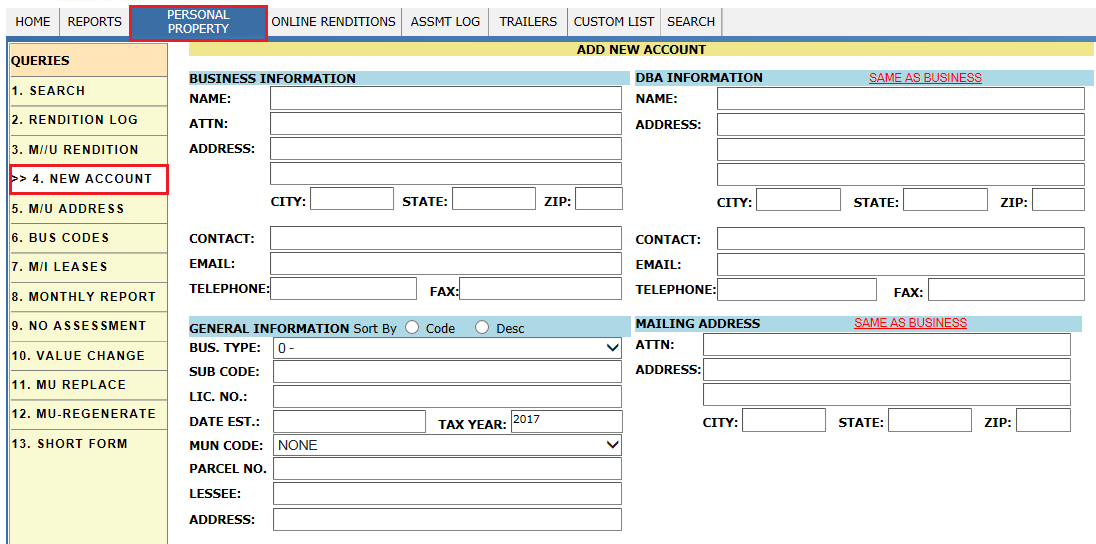

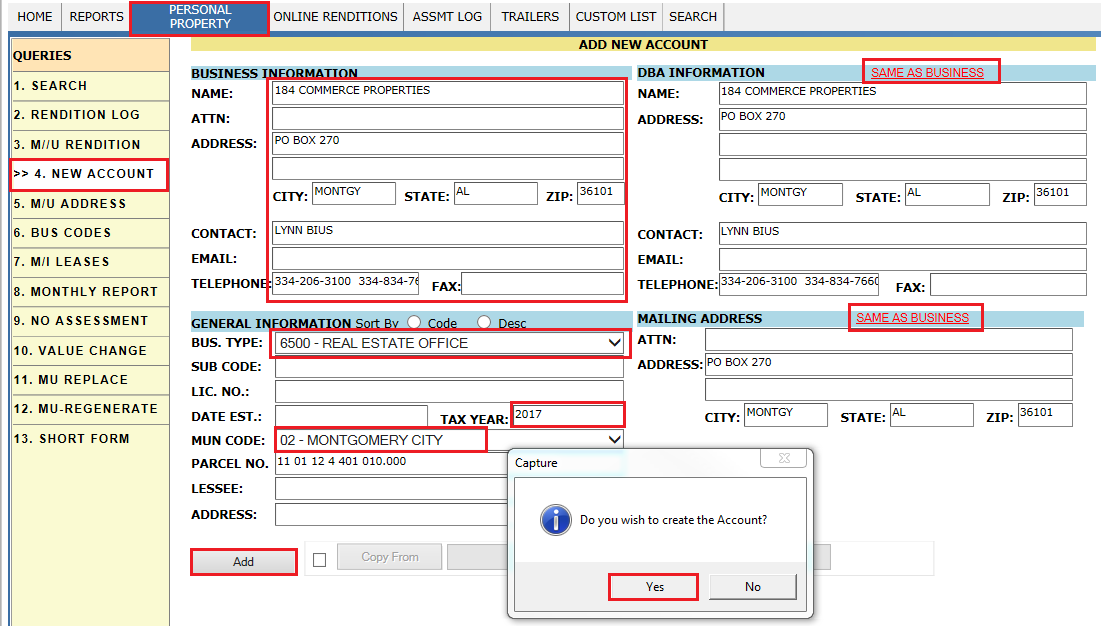

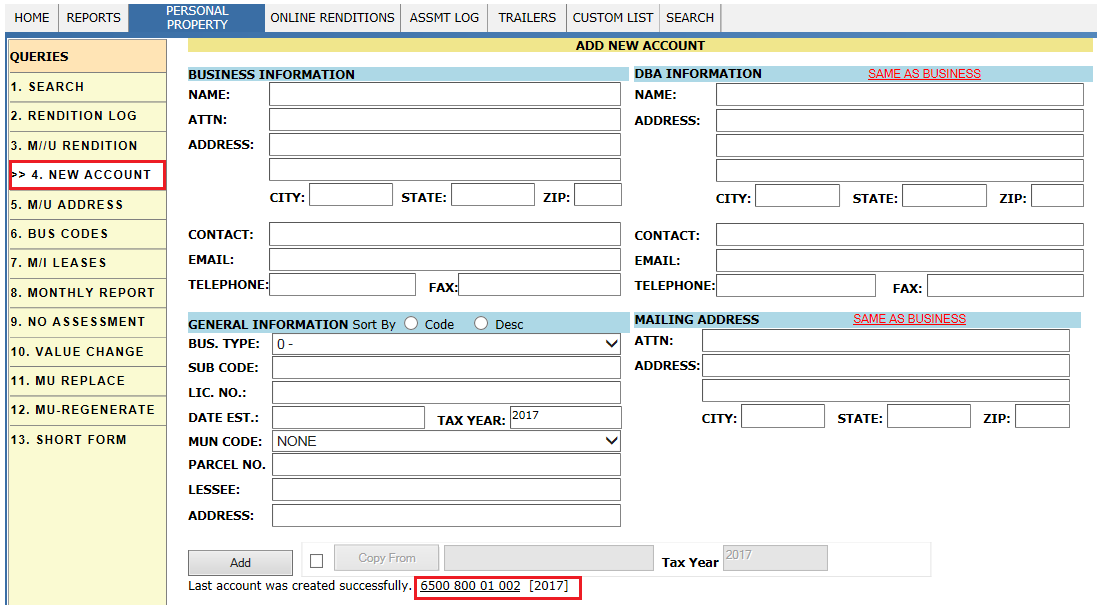

To add new business personal property account, Login as privileged user (Personal Property user) and click on PERSONAL PROPERTY. In that, click on NEW ACCOUNT. It will display Add New Account window.

Fill the Business information, DBA information (If it is same as business info click on SAME AS BUSINESS) and General Info like Business type and Municipality code. Then click on Add button.

Note: To add new business account from the existing account (same business type), check the Copy From check box and enter account number from which all the account information (items, owner and DBA information) should be copied. This will create an account for current year (also for future year but not for previous years) with link. By clicking on the hyperlink will open the account dashboard. Verify audit Trail after creating an account.

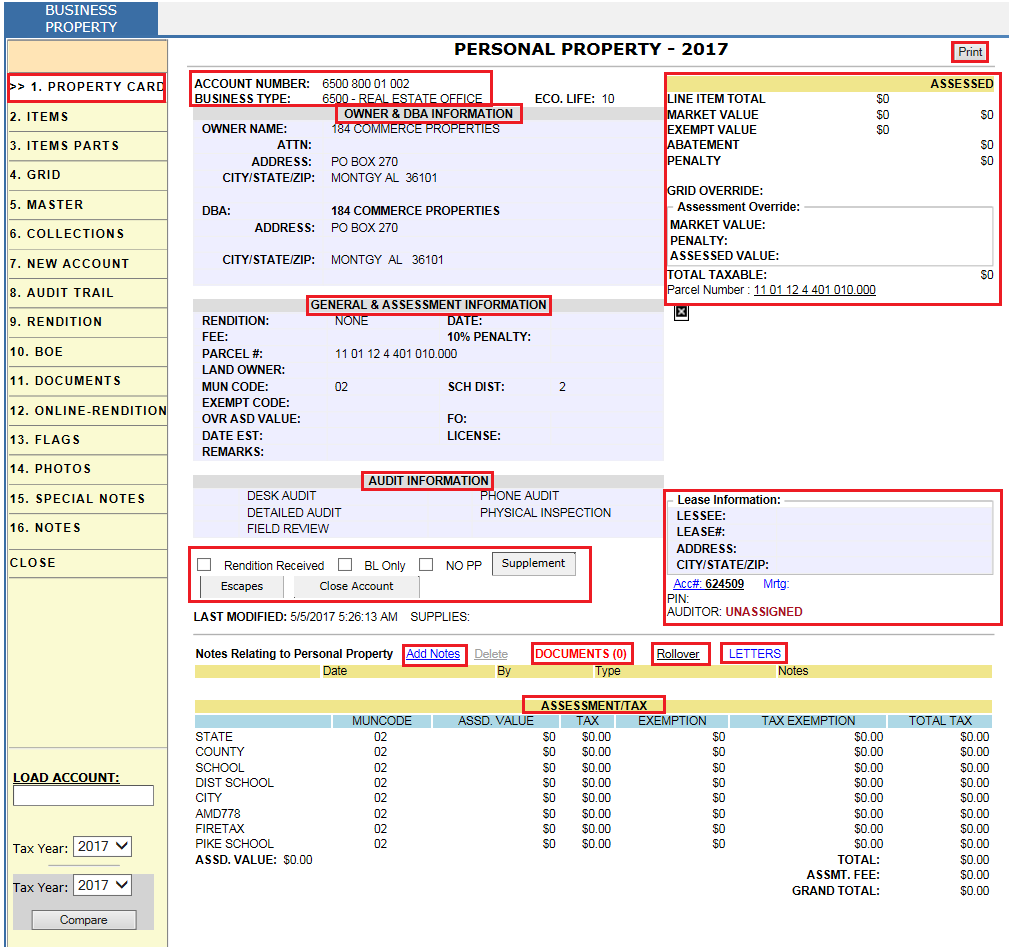

Property Card

The property card contains the Account no, Business type, Owner and DBA (Doing Business As) – franchise name information, General and Assessment information and Audit information.

General & Assessment Information: It contains rendition status. Initially the status is NONE when the county sends rendition notice to owner then status will be SENT and if the rendition was returned to county then the status will be changed to RECEIVED. If the owner doesn’t return rendition notice with in deadline, then applied fee and penalty will be shown here.

Audit information:

-

Desk Audit: Once the county receives rendition notice, desk audit will be done.

-

Phone Audit: If the Assessment clerk needs any clarification, then the clerk calls to Owner and gets the information through phone.

-

Physical Inspection: When the county receives rendition notice from owner, if they want to inspect the items or assets then they will go for physical inspection.

-

Field Review: This will be performed to check whether the business is existed or not.

Rendition received checkbox will be marked when county receives rendition notice from property owner.

BL Only: If the property contains only Business License but not items.

NO PP: If the business doesn’t exist then it will be NO PP.

Escapes are collected during the year from items that have escaped from taxation in previous years.

Supplements are charges, result in corrections made to existing tax bills. Since the abstract cannot be adjusted, if a tax bill is adjusted, then a supplement is created. A supplement may cause an increase or decrease in taxes owed.

Close Account: It is used to close the account.

Add Notes: Used to add all notes associated with account.

Documents: When owner uploads any documents, document count will be available here.

Roll Over: If the business exists in Future year, then Roll over is used to show the Account in Future Year.

Letters: It contains different types of letters like Rendition Form, Request information etc. If County requires any information of business, it will send the respective letter and it will be audited in the Audit Trail.

Print – Print button will print the assessment page of account.

Assessed: It shows the Market value, Abatement, penalty information and Total Taxable value of the Property. As the account was newly created, hence the values are shown as ‘0’.

Lease information: It contains Lessee, Lease# and Address information. Lessee-A business that holds the lease.

Acc#: It indicates key no./ Account No.

Assessment/ Tax: It contains all the tax information along with assessed value of the property.

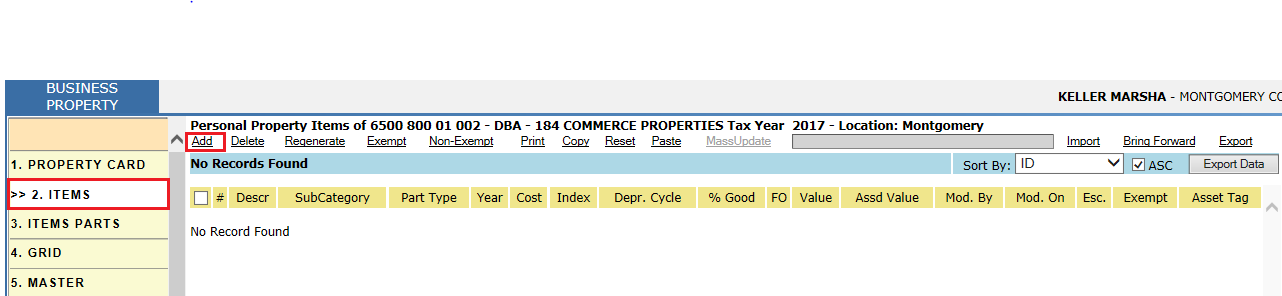

Adding New Items

To add a New Item, Click on Add.

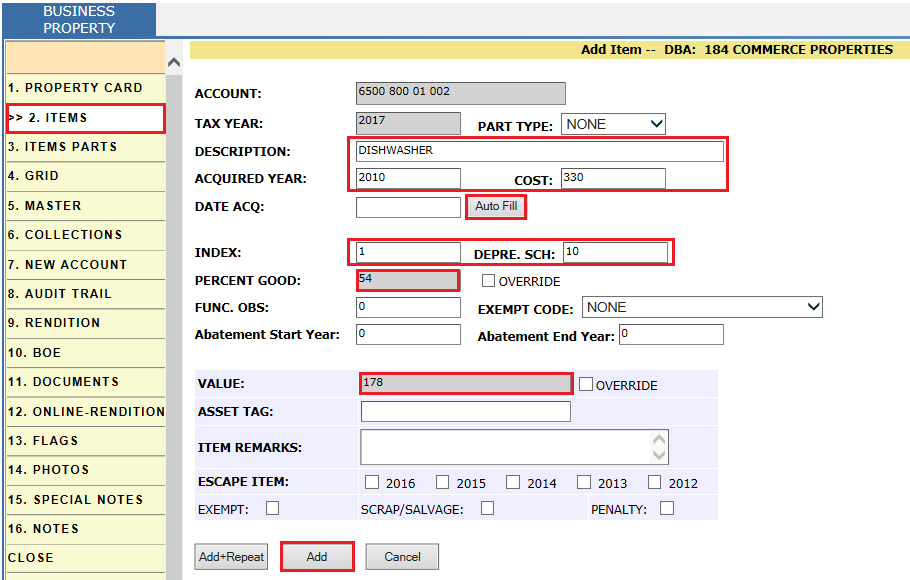

After clicking on Add button, Description of an Item, Acquired Year, Cost of the Item and Depreciation Schedule should be entered. When we click on Auto Fill, %Good and value will be generated automatically based on Depr.Sch. Then click on Add.

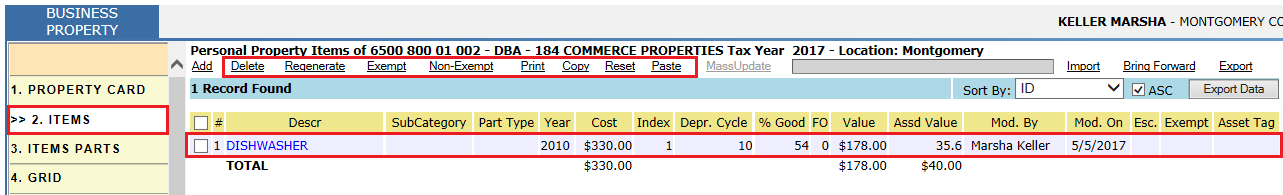

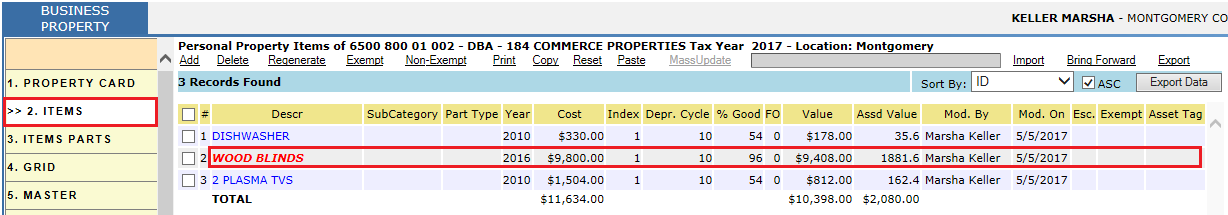

Added new item will be shown here.

Verify Audit Trail after adding an item.

Calculations:

Value = Cost of the Item *(% Good /100)

= $330*(54/100)

= $178.2 ~ $178

Delete: To delete any item from the List, click on delete hyperlink.

Copy: It is used to copy Items from Existing account to new account.

Paste: After copying items from existing account, click on paste to show the copied items.

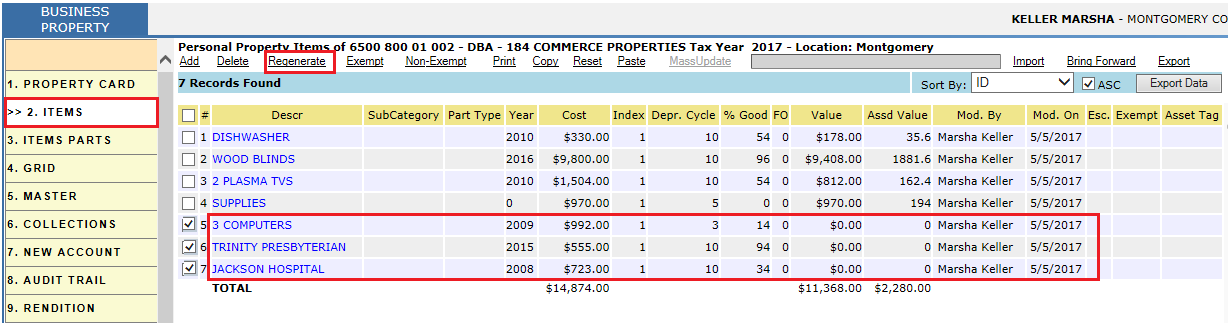

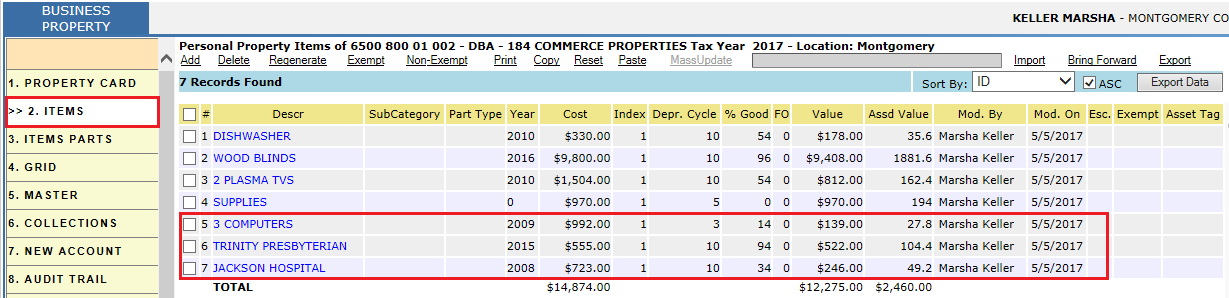

Regenerate: After pasting the items from existing account, the value for those items are ‘0’ initially. Select the items and then click on regenerate to generate values for respective items.

Select the items which should be regenerated.

Note: Supplies won’t have any depreciation schedule (% Good).

After Regenerating:

Assessed Value = Total Market Value * (20/100)

= $12,275 * 0.2

= $2455 ~ $2460

Exempt: If there is any exemption, then select the item and click on Exempt.

Non-Exempt: If any item was exempted, then select the item and click on Non-Exempt.

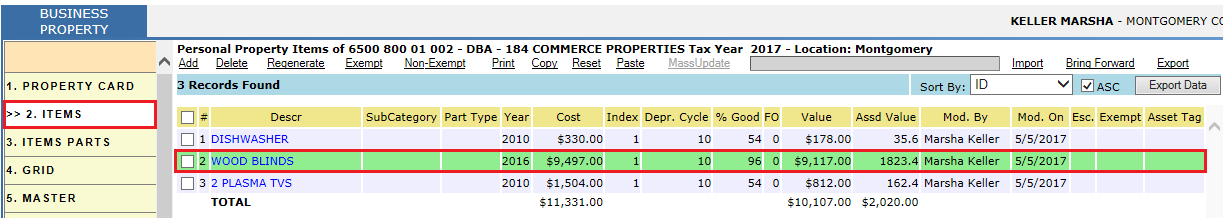

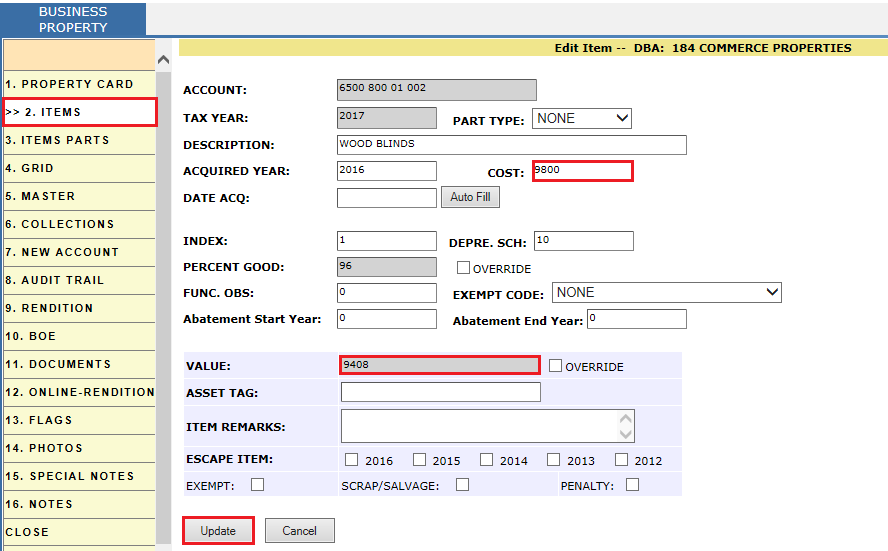

Modifying Existing Items

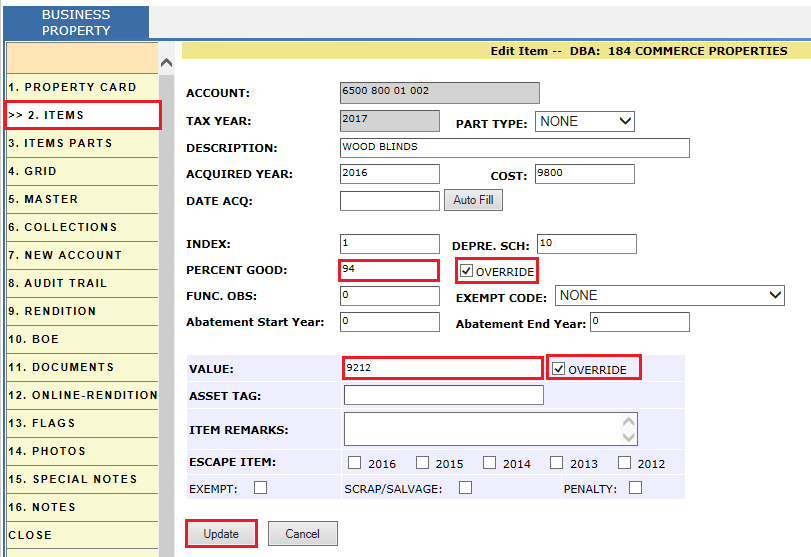

Click on the item to modify the information.

Edit the required information and click on Update button.

After updating existing item, it will be shown with updated value under items list.

Value & % Good Override

Click on override check box and change % Good and Value as per the requirements and click on Update.

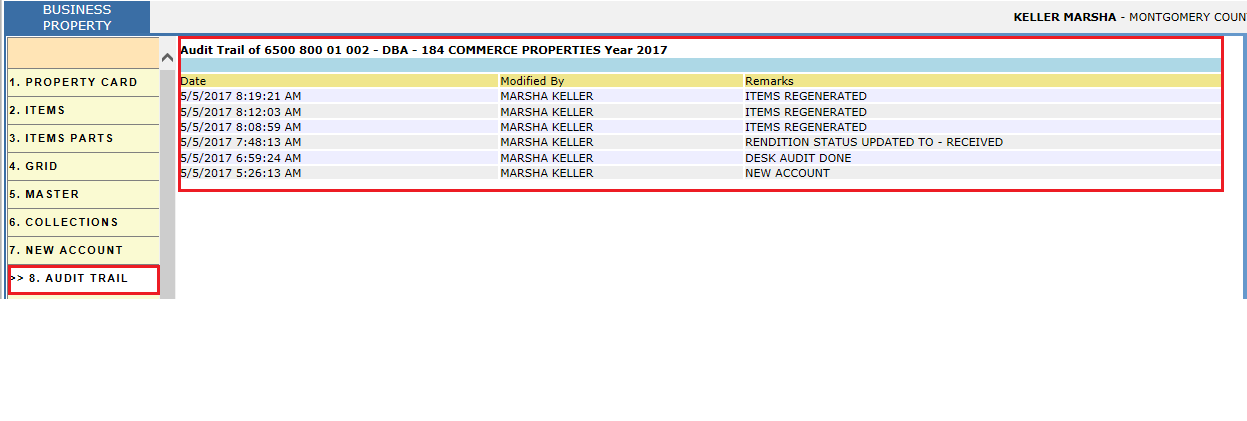

Audit Trail

Whenever a new account was created, it should be audited.

Rendition status should be audited.

Regeneration of items should be audited in Audit Trail.