Page Topics:

Disbursement

Introduction

· Disbursement or Semi-Monthly, is a report that displays the money that has been disbursed to various agencies from payments collected during a specific period.

· Starting in October, the disbursement is run twice a month, for the periods from 1st through 15th and 16th through the end of the month. Everything the County has collected and disbursed must be accounted for.

· The goal is to have a zero difference, meaning the balance is zero with no overage or underage. When the funds are disbursed, money is sent to all the agencies that have an assigned millage (money collected within that disbursement period).

· When the funds are disbursed, money is also sent to the taxpayers who have a refund issued on their name.

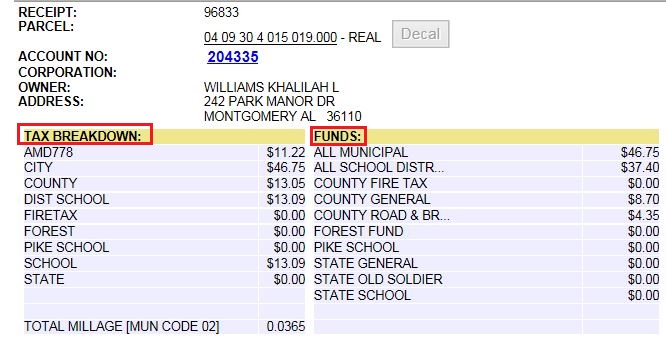

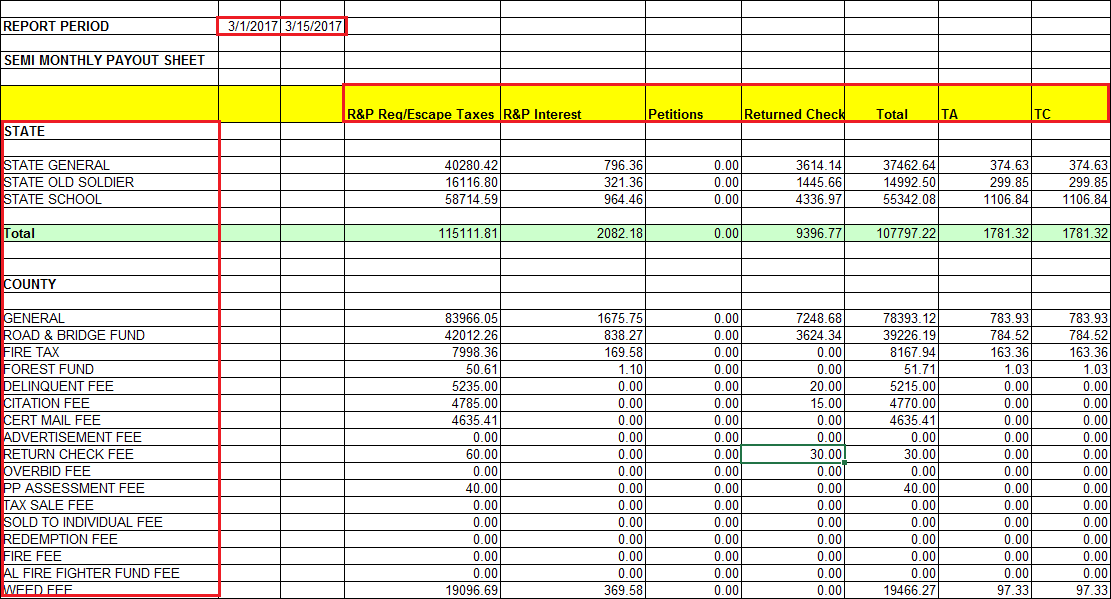

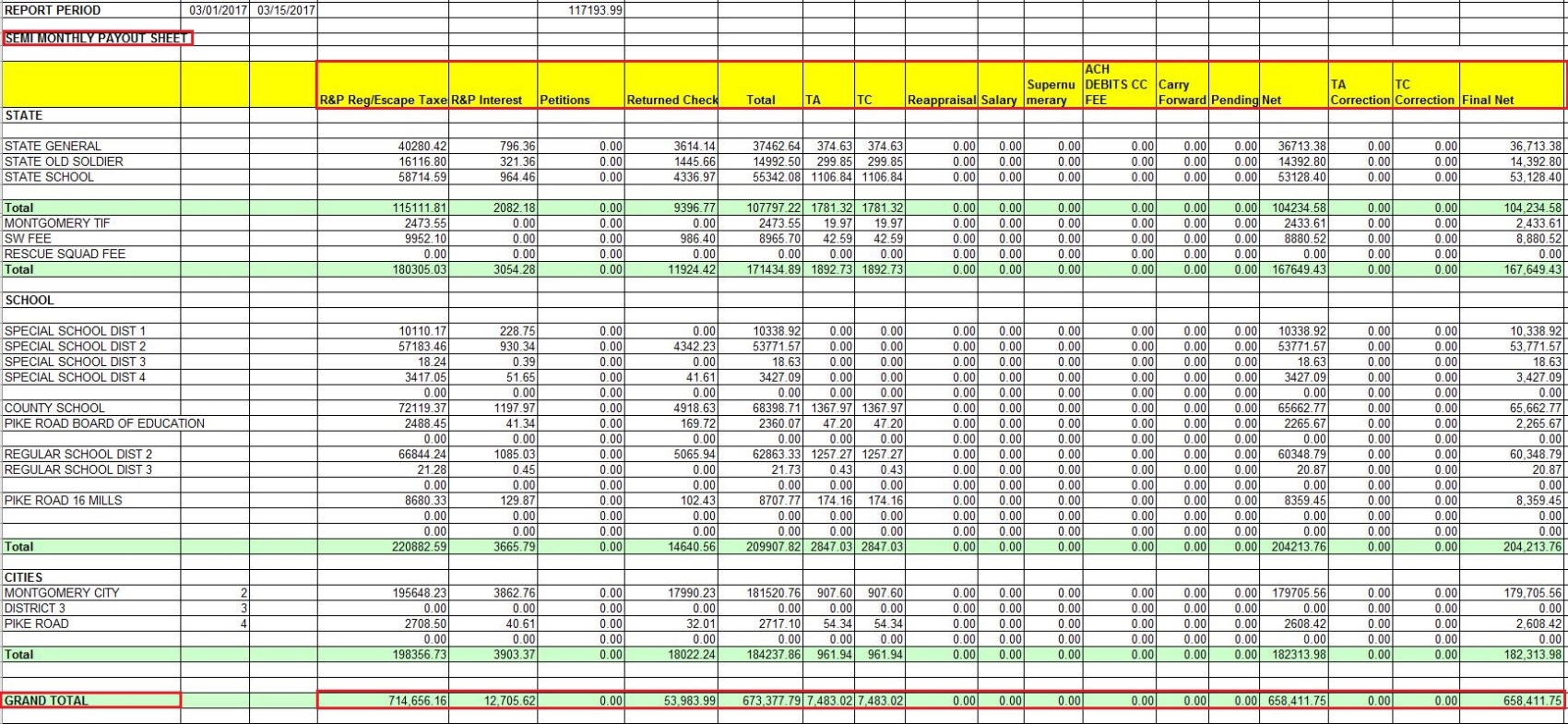

· The following screenshot shows the receipt breakdown of how much each fund receives from the total taxes collected before commissions.

· The above image shows what was collected and how it was disbursed to the various funds. The image on the left shows the overall total of what was owed to each agency. The image on the right then provides a breakdown within each fund.

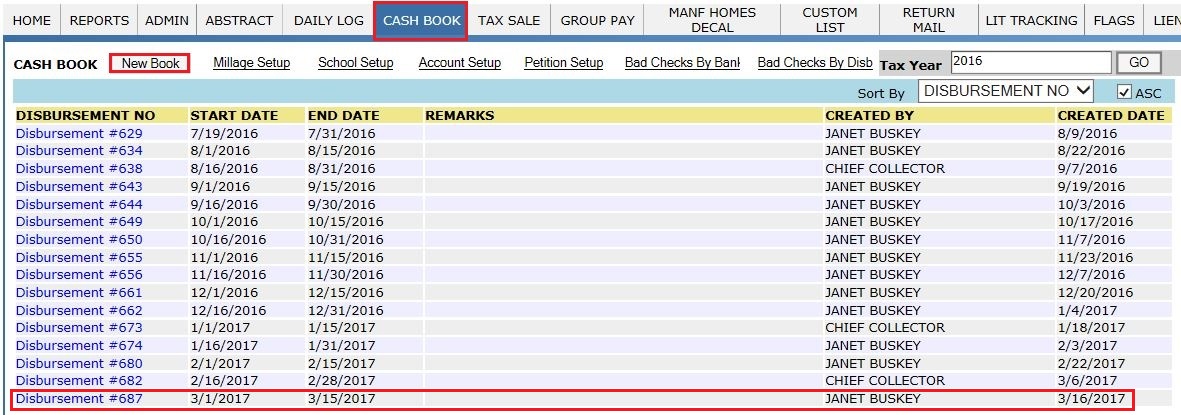

Creation Of New Cash Book

· Login as a Collection supervisor who is privileged to create a New Cash Book.

· For creating a new disbursement, make sure all the daily logs in that disbursement period are deposited. Only then, Capture will allow to create a cashbook for that period.

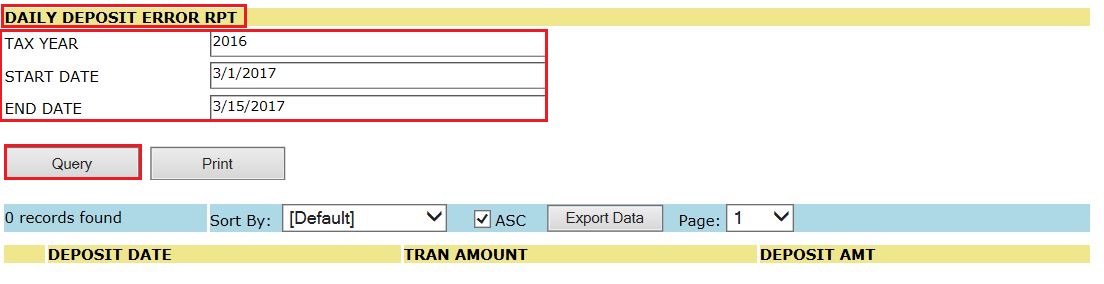

· Before running a semi-monthly report, users should check the DAILY DEPOSIT ERROR RPT to create the semi-monthly without any errors. Navigation: Reports -> Daily Deposit Error Rpt.

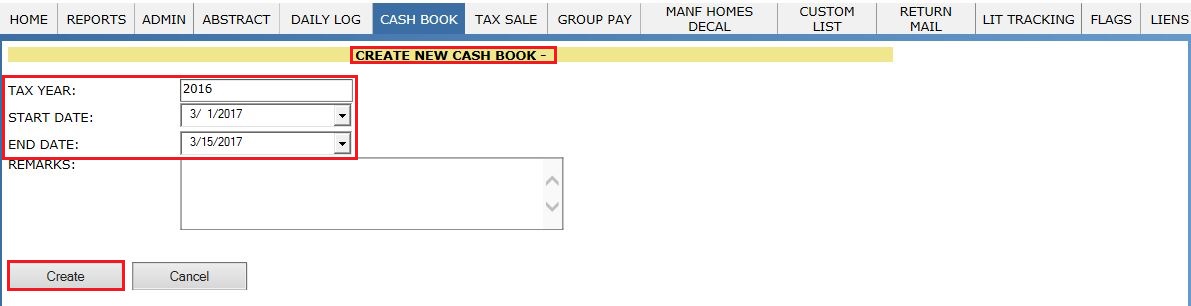

· To create a New Cash Book, click on CASH BOOK then go to New Book.

After clicking on New Book, user should give the Start & End dates for the Period they want to create a Disbursement.

After clicking on Create button it will create the new Disbursement with Start date 3/1/2017 & End date 3/15/2017. Also, it creates a Unique Disbursement No.

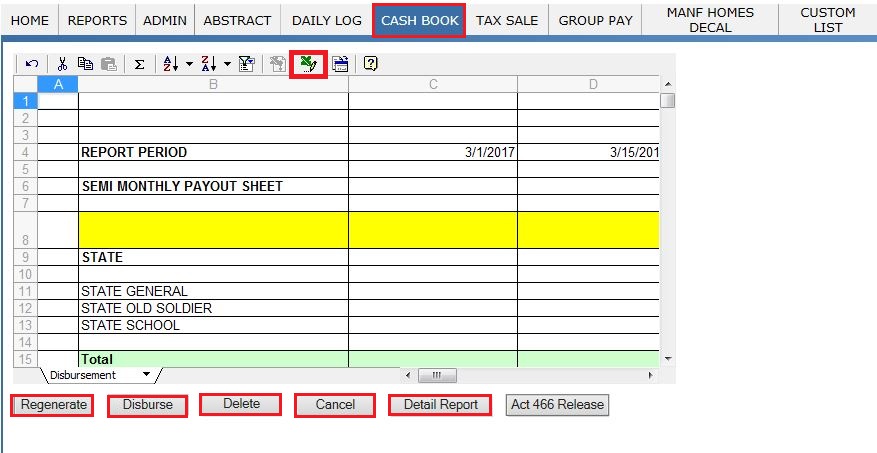

Click on Disbursement#687.

Export: Click on the symbol highlighted in the above image, it will export to the Excel Spreadsheet with all the information regarding Disbursement#687.

Regenerate: It will recalculate all the values.

Disburse: It will disburse the money to the agencies.

Delete: It will delete the disbursement.

Cancel: It will redirect to the Previous Page.

Detail Report: This report gives the detailed information about all the individual parcels list which are included in this disbursement & how much taxes are contributing to the disbursement.

Understanding The Disbursement

· The disbursement must be validated to ensure that all the money collected and all the money paid out has been accounted for.

· To validate the total collected during a specific period, the daily deposits must be added up. The daily deposits are balanced because, the Daily Log must be in balance each day before it is closed out.

· If the Daily Log is in balance, it is then closed out and the money is deposited and the daily deposit is available for viewing.

· When balancing the semi-monthly, it is important to know what each column is and how that value is handled. When looking at the disbursement, the following equation helps in validating the totals:

Net Taxes Collected + Interest – Petitions – Returned Checks = Disbursed Amount

Then

Disbursed Amount – Commissions – Budgets + Pending = Remittance

1. Breakdown of the whole disbursement is explained in the following:

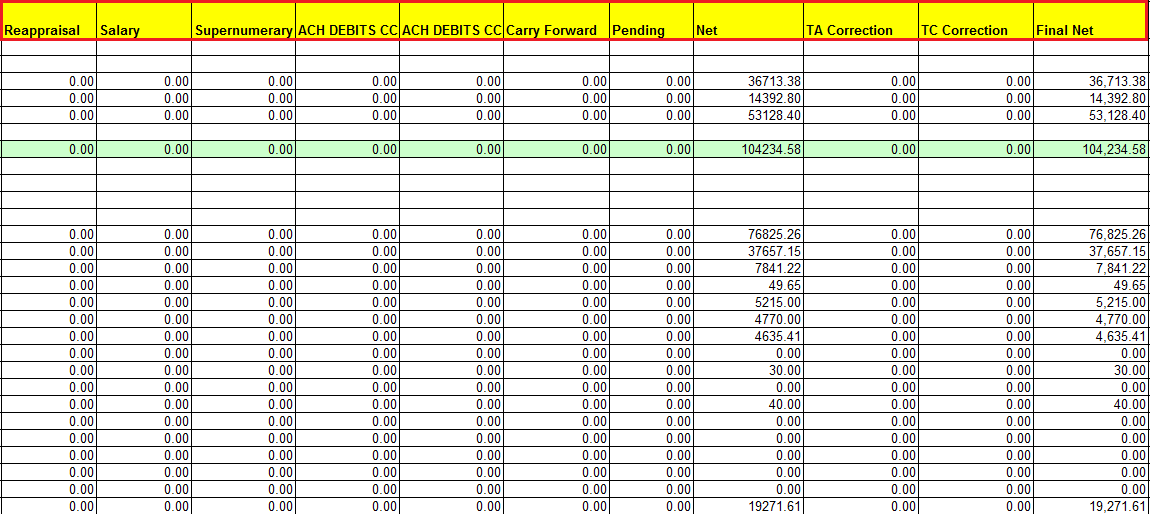

Sideways continuation to the above image:

· R&P Reg/Escape Taxes: Real & Personal property Regular/Escape taxes. All the taxes collected in that specific period will be shown along with the agency wise breakdown and with the millage. All the fees collected will also be shown under respective fee rows in the sheet.

· R&P Interest: Real & Personal property interest. All the interest amount collected in that specific period will be shown as per the agency wise breakdown.

· Petitions: When validating the disbursement, petitions must be examined. Petitions are refunds issued on a previous year’s taxes. Taxpayers may apply petition for refunds in cases where they have overpaid for a property, paid for a property they no longer own or paid on a doubly assessed property. In the disbursement, petitions are withheld from the total deposit amount before commissions are calculated. In the Final Settlement, petitions are counted as a credit and subtracted from the amount owed.

· Returned Checks: The checks which are Marked as Returned in the disbursement won’t be disbursed to the agencies because the money was not actually collected.

· Total: R&P Reg/Escape Taxes - R&P Interest - Petitions + Returned Checks.

· TA & TC: These are the commission amounts paid to the tax collecting and tax assessing agencies for services rendered during the tax collections cycle. The county has two commissions, TA and TC, one for assessment and one for collections. Commissions are withheld from the various funds and paid to the TA and TC funds. The standard commission rate is 2% for the TA commission and 2% for the TC commission, however, municipalities can determine their own commission rates based on a local legislation. Here, County receives the whole commission amount. In the Final Settlement, commissions are counted as a credit and subtracted from the amount owed.

- When working with the State and County General funds, calculating commissions is slightly complicated because the funds do not calculate commissions based on a flat 2% rate. The amount sent to the TA and TC is based on a sliding scale. For the first $15,000 collected in the collections cycle, a sliding scale is used for distributing money to the commissions.

- After the first $15,000 has been collected, a flat 1% is withheld for each commission for the remainder of the collection cycle from the State and County General funds.

|

Sliding Scale |

|||

|

Disbursed Amount |

Commission Percentage |

Commission Amount |

|

|

$5,000 |

10% |

$500 |

|

|

$4,000 |

5% |

$200 |

|

|

$3,000 |

4% |

$120 |

|

|

$3,000 |

1.5% |

$45 |

|

|

Total |

$865 |

||

· Reappraisal/ Salary/ Supernumerary/ ACH DEBITS CC FEE/ ACH DEBITS CC FEE 2: All these funds together are called as Budget. Each year, money is reserved for certain budgets in the County. The budget amounts are provided by the State and entered in Capture. Once entered, the amount set for each budget is withheld from the agencies and paid to the county commission. The budget amount is withheld from the taxes collected for the agency after the commissions are taken out. If the budgets are not fully satisfied for an agency through one disbursement, the remaining amount will be pending until the next disbursement. The budgets continue to be withheld until the full amount is met. In the Final Settlement, budgets are counted as a credit and are subtracted from the amount due.

· Net: Total – (TA +TC + Reappraisal + Salary + Supernumerary + ACH DEBITS CC FEE + ACH DEBITS CC FEE 2 + Carry Forward) + Pending.

· Final Net: Net - TA Correction -TC Correction. This is the final amount which will be remitted to the individual agencies through that disbursement.

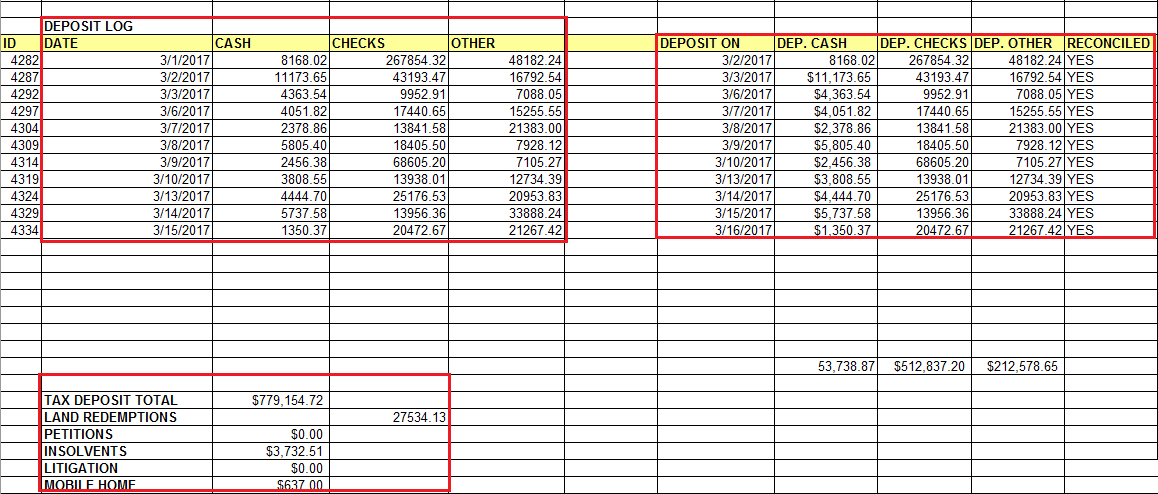

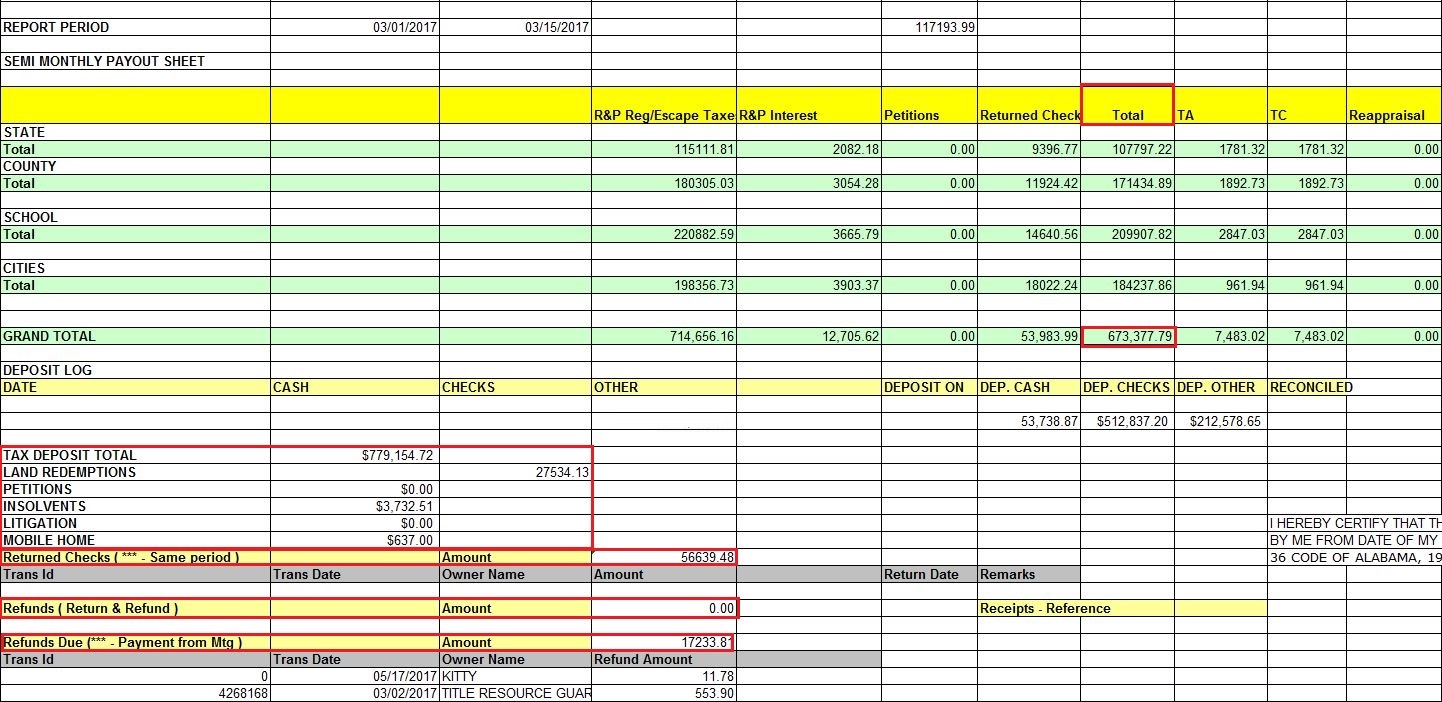

2. Deposit Log: This will show all the daily logs and respective deposited amounts with the breakdown of cash, check & other for that disbursement period with system generated ID’s. It will also show the total amount collected on Land Redemptions, Petitions, Insolvents, Litigations & Mobile Homes.

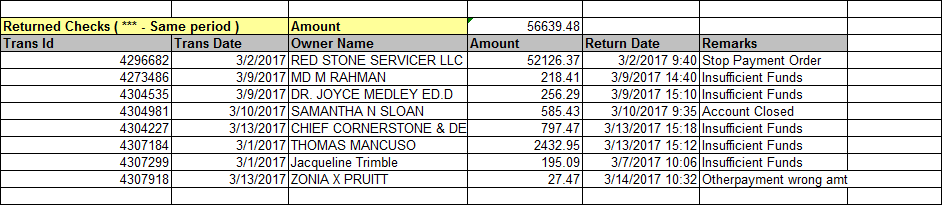

3. Returned in the Same Period: This will show all the transactions which are marked as returned checks in the same disbursement with return date and remarks. These should be subtracted from the total tax deposited.

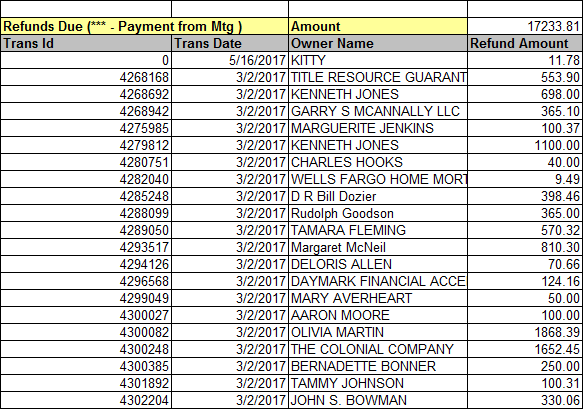

4. Refunds in that same disbursement will also be shown in the semi-monthly report. These should be subtracted from the total tax deposited.

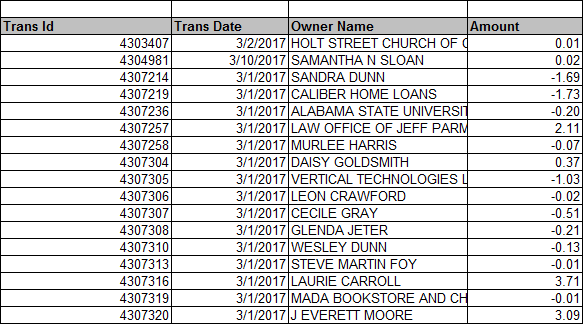

5. Into Kitty and from Kitty transactions will also be shown under the semi-monthly report.

Refunds

· On each disbursement, any refunds that have been issued to the taxpayers or to Kitty, are listed. Refunds are most commonly issued to taxpayers who overpaid (except in cash payment) their tax bill.

· A taxpayer may pay the correct amount initially, but later he adjusted the bill to a lower amount through a supplement. For such reasons, even cash payments can initiate a refund. If an overpayment by check exceeds the Kitty threshold, then the County must pay back the difference after the check clears.

· If a taxpayer files a petition for overpayment in a previous year, then a refund may be issued for the previous year in the current collection cycle. Taxpayers may petition for a variety of reasons, including overpayment on property, payment on property no longer owned or payment on a doubly assessed property. When the money is issued back to a taxpayer, then the amount is withheld from the agency’s remittance in that current disbursement.

Returned Checks

· When checks are deposited at the bank and do not get cleared (Bad checks), those checks are returned to the collecting agency and the associated transactions are marked as returned check. Checks are returned for a variety of reasons including insufficient funds or payment stopped by the person who wrote the check. Regardless of the reason why the check was returned, it must be accounted for in the disbursement.

· When handling returned checks, the period in which it went bad is incredibly important. Checks are either returned In Period, meaning the check was returned within the same disbursement period as the payment was made or Out of Period, meaning the check was returned after the original payment was disbursed. Whether a check was returned in or out of period will dictate how it is handled.

Returned Checks in Period

· If a returned check is sent back in period i.e. the period in which the initial payment was made, then the teller will mark the payment as returned in Capture and the funds will not be included as taxes collected in the disbursement.

Returned Checks Out of Period

· When a check is returned in a period other than the one in which it was collected, the funds have already been disbursed to the proper agencies. Since the money has already been disbursed, it must now be withheld from the disbursement period that the check is returned to account for overpaying in the previous disbursement.

Returned Checks and Refunds

· As previously noted, refunds are issued to the taxpayers who have money owed from a previous transaction. When a current year refund is issued, it typically means the tax bill was overpaid and the taxpayer will receive the overage amount. It is important to note that the overage must exceed the Kitty amount set by the county.

Note: The taxpayer can request for the overage sent to the Kitty to be returned, but it will not automatically happen.

The following information covers returned checks with refunds in and out of period, and when checks have been either printed or not.

Returned Checks with Refunds

· Typically, a refund will be issued on a check payment where the check is eventually returned. This scenario can be handled in a few different ways depending on when the returned check was received.

In Period

· If the returned check is received in the same period as the original payment, then the normal process for an in period returned check is run. No refund will be created at disbursement and the tax amount will not be disbursed.

Out of Period, Checks Not Printed

· If the returned check is received out of the disbursement period and the actual checks have not been printed and mailed, then the bad refund check should not be sent to the taxpayer. This money can be extremely difficult to recollect from a taxpayer, so it is best to stop this payment from going out. The refund check should be voided in the ledger and recreated with the County revenue commissioner or tax collector as the recipient. This check can then be deposited back into the County’s bank. The refund amount is entered as a cash overage to balance out the amounts deposited and disbursed.

· The money disbursed to the agencies will be undisbursed appropriately and handled like any other out of period returned check.

Out of Period, Checks Printed

· If the returned check is received out of the disbursement period but the actual checks have already been printed and mailed, the refund amount must be collected from the taxpayer. The money that was disbursed to the agencies will be undisbursed, but the only way to get the refund check amount back is to collect it directly from the taxpayer.

Note: The Refund Bad Checks report shows the refund checks that have been created on records that are now marked returned. This report can help catch bad refund checks and prevent them from being sent out.

Verification Of Semi-Monthly

To Calculate the Total Amount:

R&P Reg/Escape Taxes + R&P Interest – Petitions – Returned Checks = Total Amount

$714,656.16 + $12,705.62 – $0.00 – $53,983.99 =$673,377.79 (Total collected amount)

To Calculate the Net Amount:

Total– TA – TC – Reappraisal – Salary - Supernumerary – ACH DEBITS CC – Carry Forward + Pending = Net Amount

$673,377.79 – $7,483.02 – 7483.02 – $0.00 –$0.00 – $0.00 – $0.00 – $0.00 – $0.00 + $0.00 = $658,411.75

To Calculate the Final Net Amount:

Net Amount – TA Correction – TC Correction = Final Net

$658,411.75 – $0.00 – $0.00 = $658,411.75

Note: The Final Net Amount should be disbursed to the different agencies like State, County, School, Cities etc. based on millage.

User can verify the Total Collected Amount by another way.

TAX DEPOSIT TOTAL = DEP. CASH + DEP. CHECKS + DEP. OTHER

= $53,738.87 + $512,837.20 + $212,578.65 = $779,154.72

To Calculate the Total Amount:

TAX DEPOSIT TOTAL – Land Redemptions – Petitions – Insolvents – Litigations – Mobile Home – Returned Checks – Refunds (Return & Refund) - Refunds Due = Total Amount

$779,154.72 – $27,54.13 – $0.00 – $3,732.51 - $0.00 – $637.00 – $56,639.48 – $0.00 – $17,233.81 = $673.377.79

Daily Deposits

Daily deposits are deposits made to the bank(s), of all money collected each day by the county. Depending upon the county, the money may be deposited at multiple banks and into multiple accounts. At the end of the month, the County receives a statement from the bank, so it is incredibly important that the County reliably tracks the money, so that the amount collected can then be reconciled against what was deposited in the bank.

Ledger

· This gives summarized financial information. System tracks and displays the deposits in the ledger after the semi-monthly is run and the money is disbursed.

· When setting up the ledger, it is important to mirror the ledger to the bank statements. By setting up similar fields in the ledger, it is easier to read the deposits and track at the ledger level and therefore reconcile the deposit slips with what the ledger shows.

Note: To reconcile, the money deposited in the bank and the amount in Capture’s ledger must match the bank statement that is sent at the end of the month.

· For example, if the bank statement has a separate listing for each teller's drawer, then the ledger should also contain a separate listing for each teller. If the bank statement is broken down only by daily deposits per location, then the ledger should appear this way as well. Ideally, the tax collector should be able to make a 1-to-1 comparison between the bank statement and Capture when performing reconciliation. Samples of the County's statement should be used during the setup of the system to initiate this process.

· Keeping up with payments and deposits is incredibly important in Capture, because twice a month, all the money collected is disbursed to various agencies in the county.

Reports Used

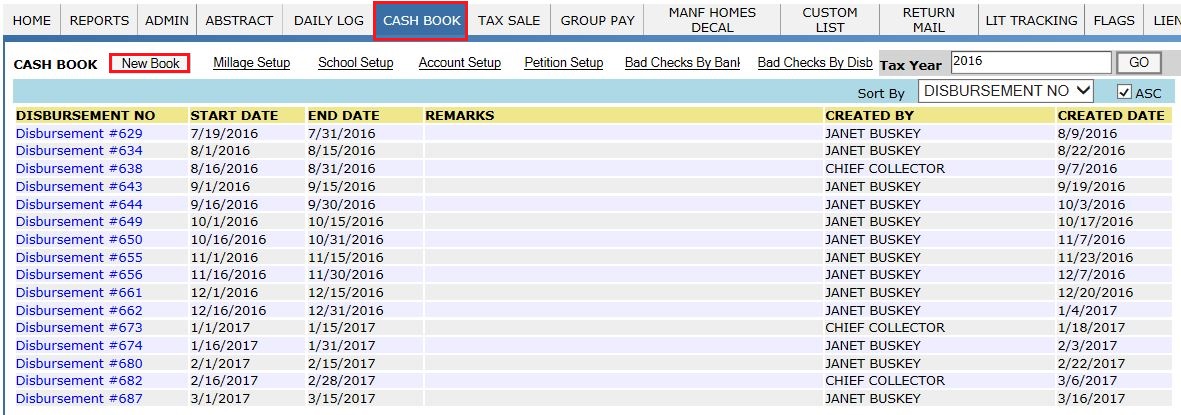

Cash Book:

This report displays all the Disbursements with respect to start, end dates & tax year. This report is also used to create a New Cash book by respective users.

Daily Deposit Error Report:

Before running a semi-monthly report, users should check the DAILY DEPOSIT ERROR RPT to create the semi-monthly without any errors.

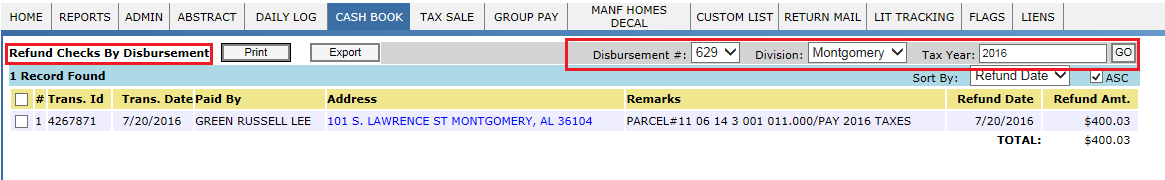

Refund Checks by Disbursement:

This report is used to check the refunds issued in a specific disbursement with respect to Disbursement No. & Tax year.

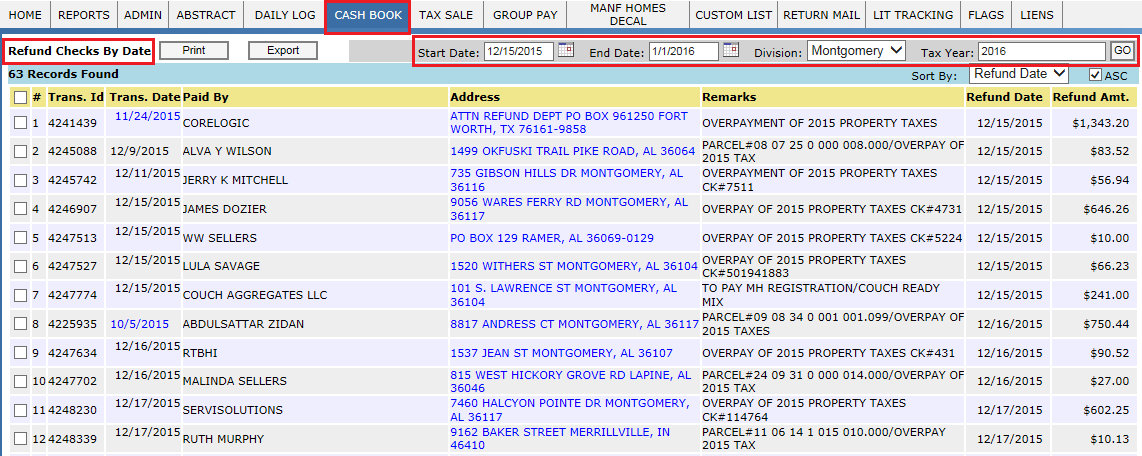

Refund Checks by Date:

This report is used to check the refunds issued on a specific date in a disbursement with respect to start, end dates & Tax year.