Page Topics: Advanced Topics:

|

|

|

Daily Closeout

Introduction

All the receipts which were paid on each day will come under Daily Log report. As the collection cycle progresses, receipts may need to be altered to reflect a change in total due, for that new receipts should be issued. Capture will track and keep all types of receipts (like Regular, Supplement, Redemption, Insolvent, Litigation and Escape Receipts) which are paid in one location. Some county may have multiple registers to track these receipts.

Creating Daily Log

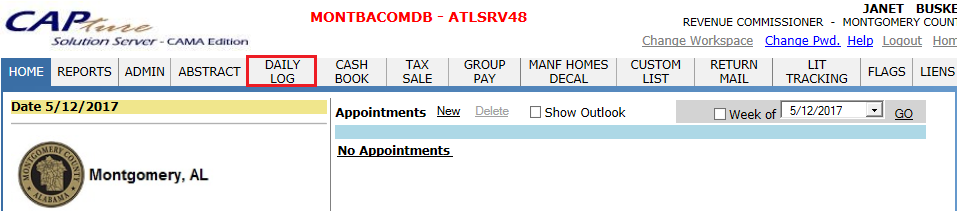

Step 1: During the collection Period, every day Collection User should create the daily log. For that, Login as Privileged user and Click on the Daily Log.

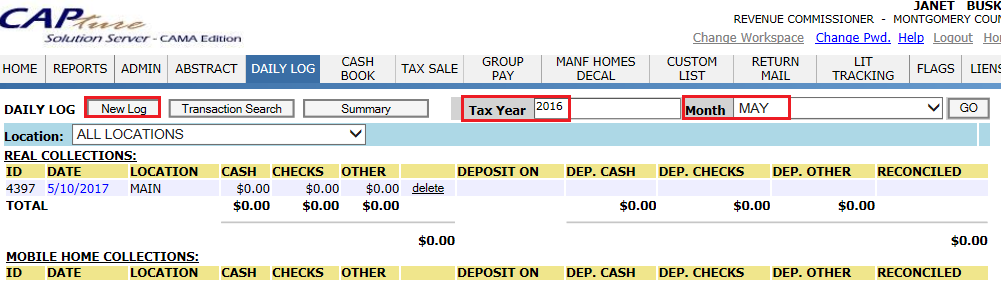

Step 2: Click on New Log button by selecting appropriate tax year and month.

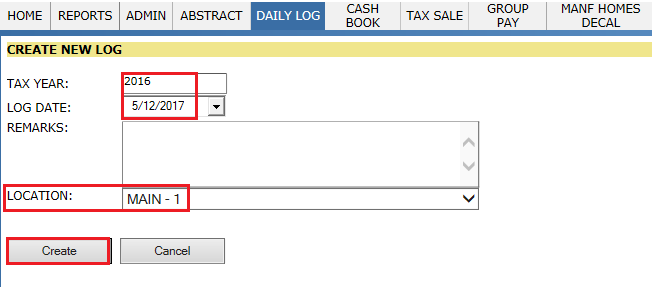

Step 3: In this page, Tax year and log date will populate automatically as per the todays date then select the appropriate Location and Click on Create.

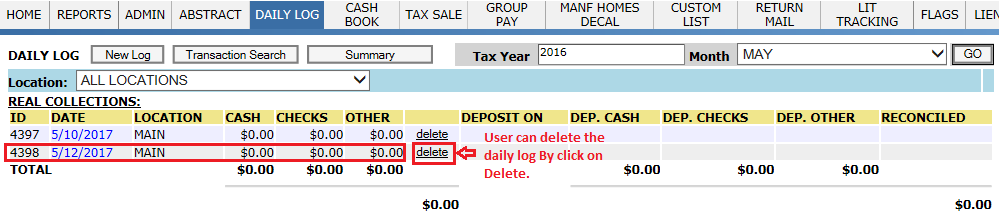

Daily log will create as shown below with respective ID.

Note: User can only Delete the Daily Log Before it got deposited in to respective Bank.

Once the User process the receipts the amount paid by tax payer will show under this daily log.

Daily Log

The Daily Log displays all money collected for a given county on a day. Each day the log is created and what each teller collects is tracked and totalled. Before close out, teller should check, whether all the checks amount is line up with amount shown by capture. If not teller can use Show Checks hyperlink located in the teller’s Daily Log (go to the Daily Log, click the appropriate date, then select the specific teller, then check payments) to compares the check image to what was entered in Capture.

Before close out, if teller’s drawer is not lined up with capture, then teller should run Transaction Error report (Daily Log > Trans Error) to see what went wrong. This report will catch any kind of error, typically, in this case tellers should contact to E-Ring Support.

The amount collected is then physically deposited at the bank after closing out at the end of the day. Once the money has been deposited at the bank, the money is marked as deposited in Capture.

If one million dollars is collected, then one million dollars should be deposited. It does not matter if overpayments, underpayments, or payments generating refunds were taken; everything that was collected should be deposited.

It is possible to close out a Daily Log and continue taking payments that same day if the second group of payments is posted to the next paid date.

Errors in the Daily Log will cause problems with disbursements and Final Settlement. It is important for the drawers to be balance the Daily Log Every day.

If the Daily Log has not yet been deposited, then a payment from that day can be voided. No refund will be given and Capture will not use the voided payment in the daily deposit.

Mapping the daily log:

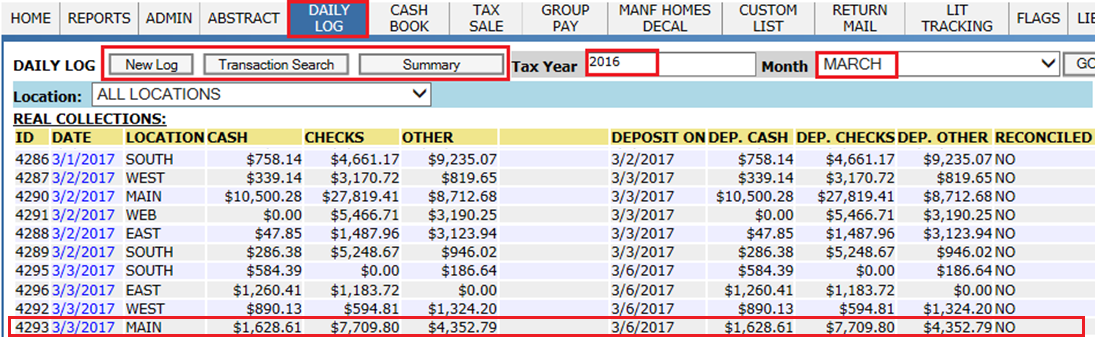

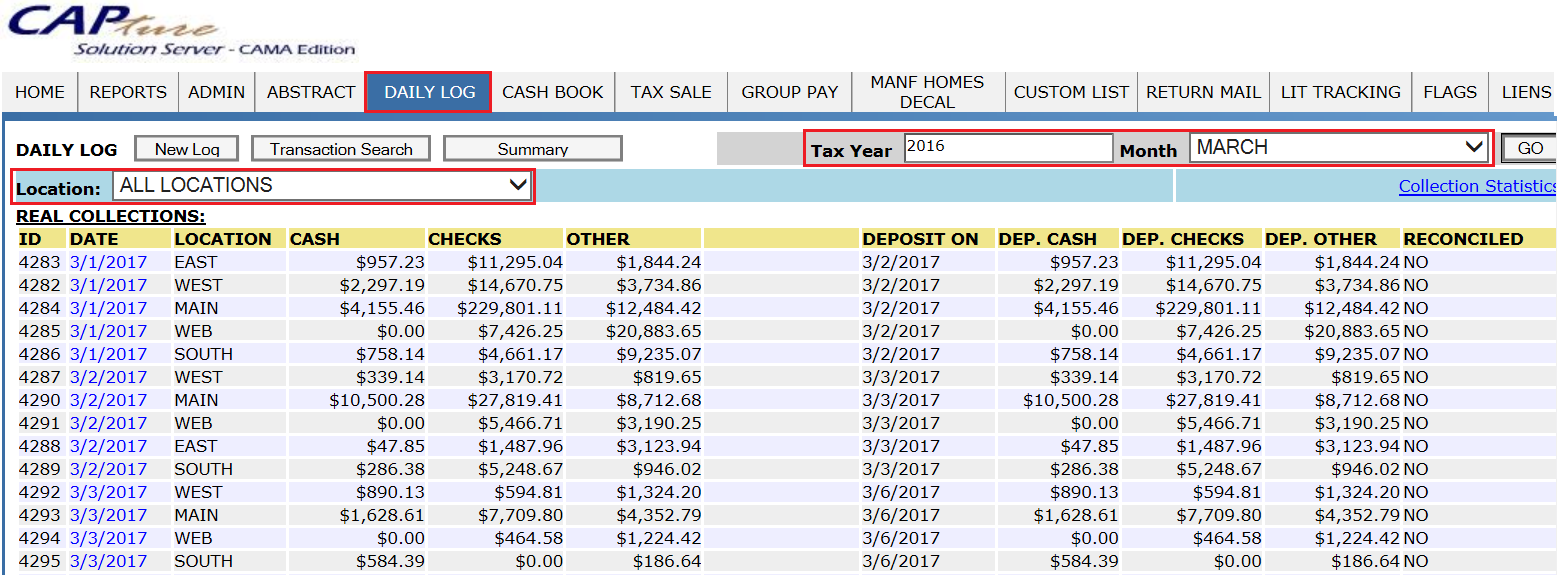

The main Daily Log page shows the amounts collected and deposited for each day in a specific location. When viewing the Daily Log, make sure to select the tax year and month along the top of the page.

New Log: New log can be created every day in collection period using New Log Button. The location can also be changed to display the Daily Log for the different locations in the county.

Transaction search: Here Individual transaction can be searched.

Summary: Deposit summaries for specific date ranges can be verified.

The location of the Daily Log is provided in the Location column. All cash, checks, and other payments are broken out in their respective columns. The day the money was deposited at the bank and what was deposited is tracked from this page. Whether the log has been reconciled against the deposit amount from the bank is also included in the Reconciled column.

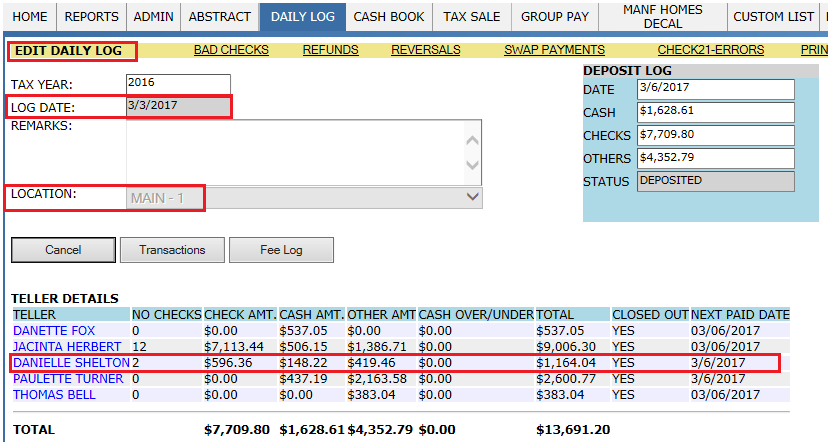

Clicking the Date hyperlink (the date entered for the Daily Log), opens the Edit Daily Log page.

Click on respective teller hyper link, it will redirect to teller log which contains all transaction details.

Teller Log: The Teller Log provides the name of the teller and general information about what was collected.

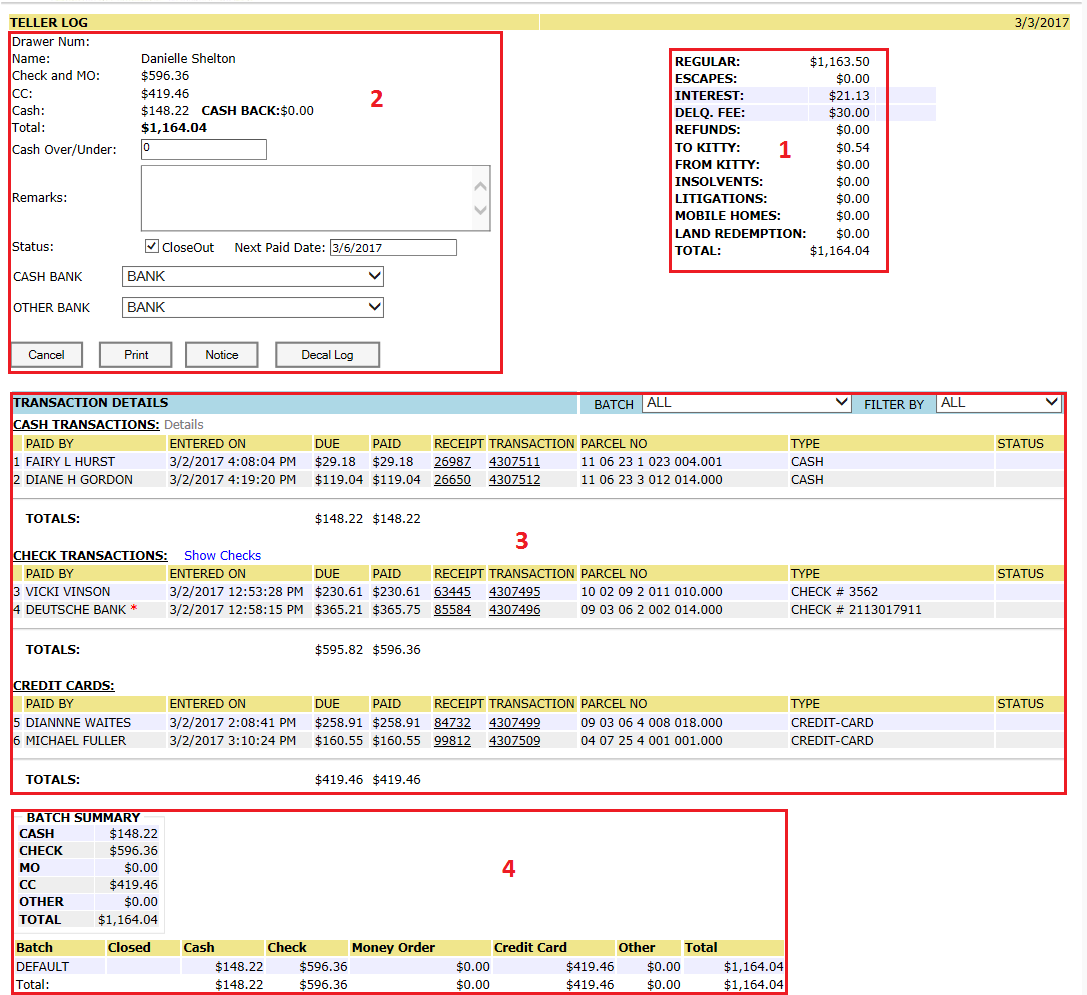

Items paid on in teller log:

This section will show breakdown of what types of items were paid on and the total collected. Regular taxes, escapes, refunds, kitty payments, insolvents, litigations, mobile homes, and land redemptions are all added to get the total collected.

Refunds are included in the total since that money will be deposited in the bank and sent to the taxpayer at the time of disbursement. Interest and delinquent fees are displayed as well, but are not added to the total because they were processed as part of the regular payment amount.

It is important to note the Kitty is a virtual account so any money from it will not affect the deposit because the amount collected is what is deposited. After each item in this section is added up, the total is shown for what that teller collected and deposited.

Total Collected by Payment type:

This section will tell about who collected the money and how much was collected in check/money order, credit card, and cash. This total must match the total on the 1st section. If cash did not balance out and was over or under, then that is entered in the Cash/Over Under box.

Any remarks about a transaction are entered in the Remarks box. It is also in this section that the teller Close Out the Daily Log and enters the next paid date. Remember, it is incredibly important that the teller enters the next paid date so when money is collected the next day, it is set to the correct Daily Log. If the next paid date is not entered and payments are collected, then it will be difficult to properly track what was paid and when.

The Cash Bank selected is where the cash collected is deposited. The Other Bank is where the other payments (check, money order) are deposited.

Cancel button returns the user to the Edit Daily Log page.

Print button prints a screen shot of the current screen.

Notice button prints a notice to the taxpayer if a check is being returned. The check is not being returned for insufficient funds, but instead, it may be returned because the account has already been paid upon.

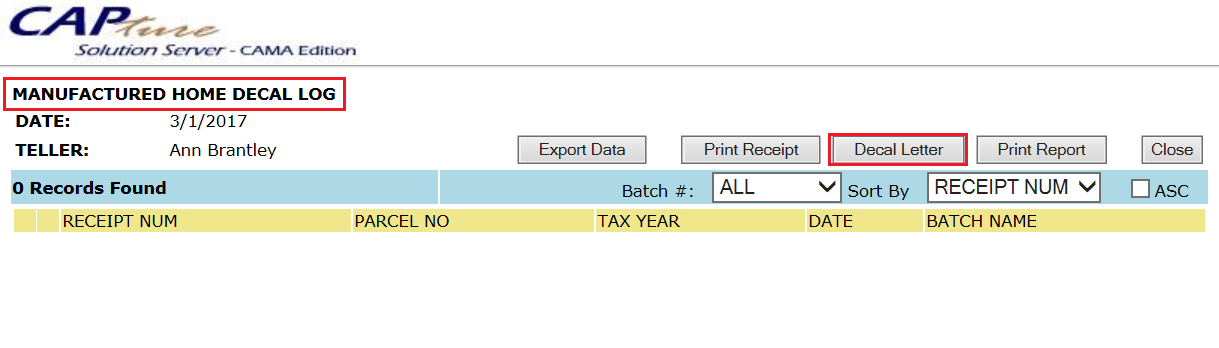

Decal Log button opens the Manufactured Home Decal Log and shows any decals that were given out after a taxpayer paid a manufactured home’s taxes. User should run this decal log to issue Decals to those parcels. And if any taxpayer walk in and want issue a decal during paying the taxes, User will issue the decal to that user along with a letter which contain all details regarding decal.

Transaction Details:

The Transaction Details section is split into sections based on payment type. Here the section is split into Cash Transactions and Check Transactions (there may be additional sections e.g. Credit Card Transactions, Money Order Transactions). Information for each of the day’s transactions is shown. The time of the transaction, amounts due and paid, receipt number, parcel number, payment type, and status (Void, returned etc.) are all displayed. The display can be filtered by using the drop-downs provided. The Transaction Details page will vary as per the types of payments taken.

An asterisk by the Paid By name indicates a transaction that has a refund on it. An asterisk by the Receipt Number indicates that the transaction is part of a partial payment.

Cash Transactions:

All tax bills that were paid in cash are grouped together in the Cash Transactions section. If receipts listed have blank values in the Paid column that means multiple receipts are paid in a group pay transaction. The total amount paid is shown with the last parcel of the transaction.

Clicking the Receipt Number opens the Collection Dashboard. Clicking the Details link opens the Teller Cash Denominations Log. This page shows a breakdown by denomination of what the teller collected, along with the total of what was collected.

Check Transactions:

All tax bills that were paid by check are grouped together in the Check Transactions section. Clicking the Show Checks link opens the Check Register where an image of each check is shown, along with the amount entered to Capture. Show Checks is one way the teller can validate that all check amounts entered to Capture and the amounts written on the check are correct and match.

Batch Summary:

The Batch Summary displays information about the batches that the teller created and to process the payments. The batches are broken down by cash payments, check, money order, credit card, and other. This teller took all payments under the batch name “Default”. That can be verified by looking at the total collected in the Batch Summary and comparing that amount to the total collected in the 1st section of the Teller Log.

If the Daily log got balanced teller should closed out the daily log for the day. All money collected must be deposited at the respective banks.

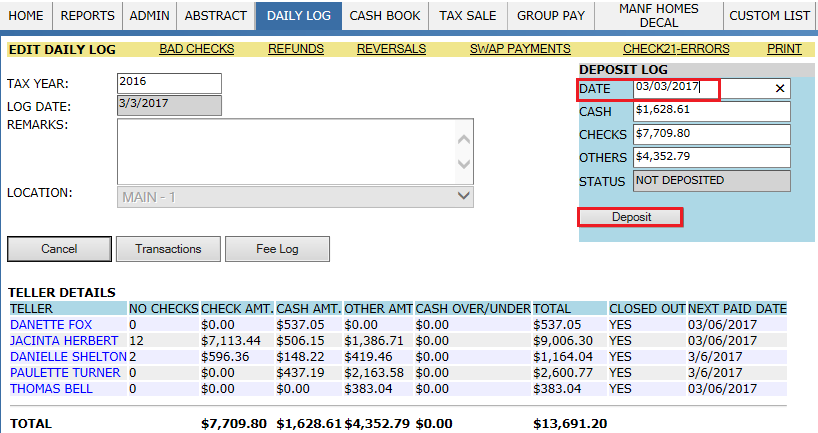

Depositing the daily collected amount:

Depending upon the county, the money may be deposited at multiple banks and into multiple accounts. At the end of the month, the county receives a statement from the bank, so it is important that the county reliably tracks the money so what was collected can then be reconciled against what was deposited in the bank.

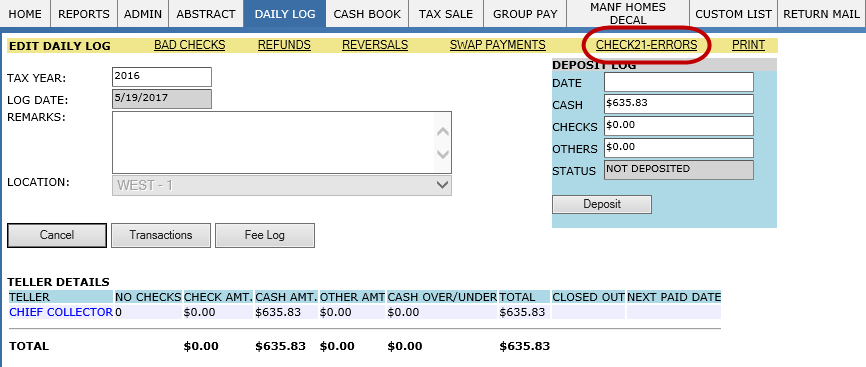

Before depositing the money into bank user should verify the reports like Bad checks, Refunds, Reversals, swap payments and Check21- Errors. If that value matches with the details in daily log user can deposit that amount. Enter the date to be deposit and click on Deposit button.

Transactions: It will display the how much amount was collected in check/money order, credit card, and cash. Also, displays Transactions list of all Check and online payments. This list will be used as reference for daily bank deposits.

Fee Log: All the receipts which are effected by any kind of fees or got paid extra than the tax due in the tax bill generated initially will come under this Fee log.

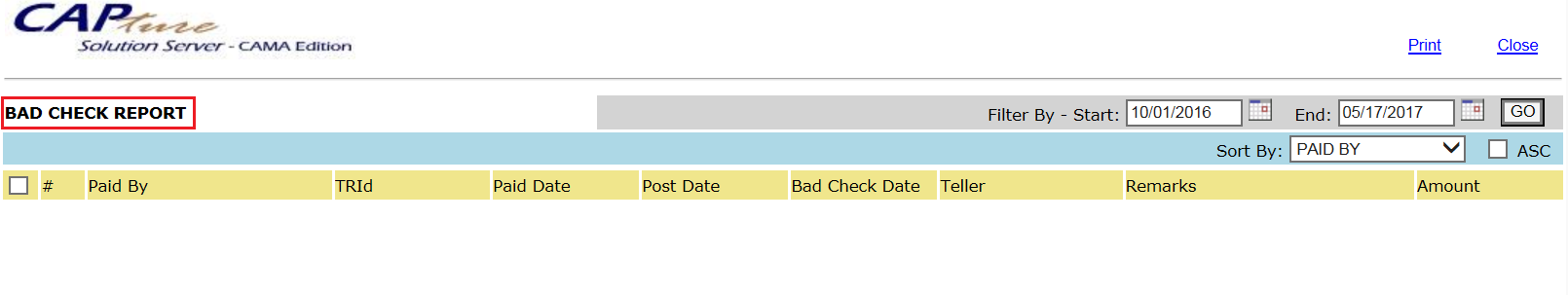

Bad Checks: After depositing the money if check goes bad, user should mark the check as Bad check. Those transactions will come under this report with respective information.

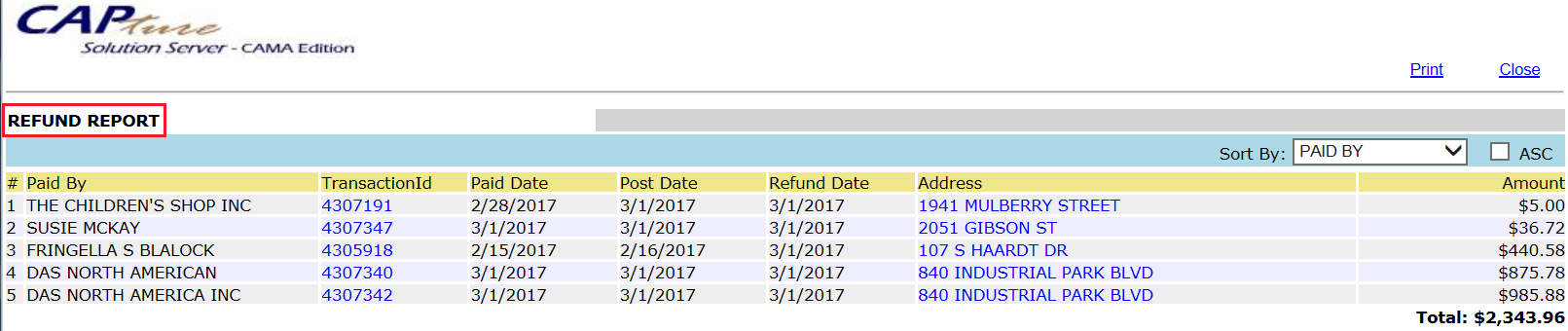

Refunds: If tax payer pays the extra amount (Not in kitty limit) than the Due, that amount will be considered as Refund and those transactions will come under this report.

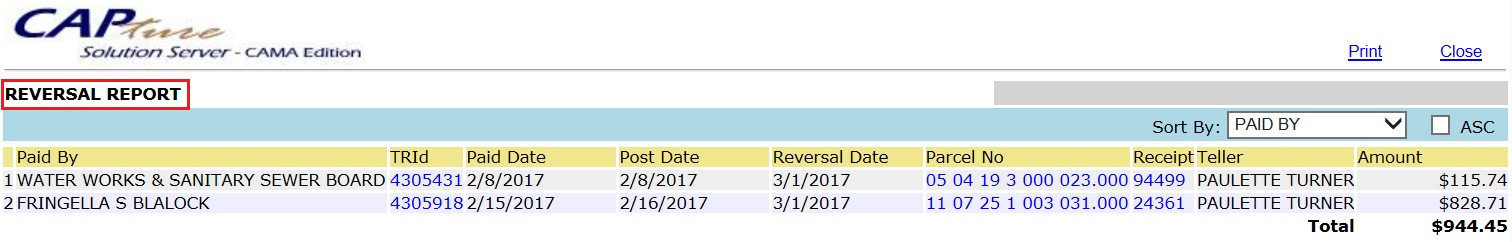

Reversals: The receipt got paid initially, but if the status of receipt got changed (Unpaid, receipt got voided etc.) that will be come under Reversals.

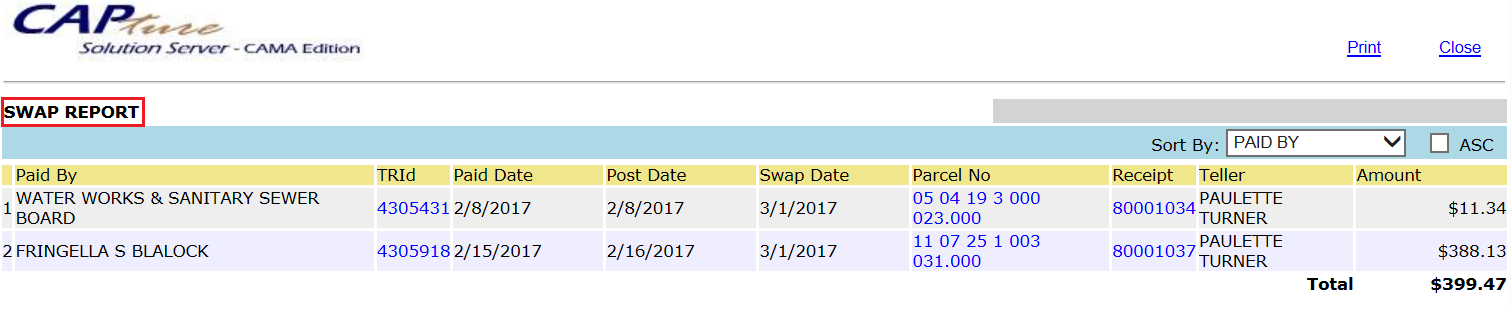

Swap payments: If one of the receipt got removed from previous transactions and new receipt is added to that transaction will be treated as Swap payment and those transactions will come this report.

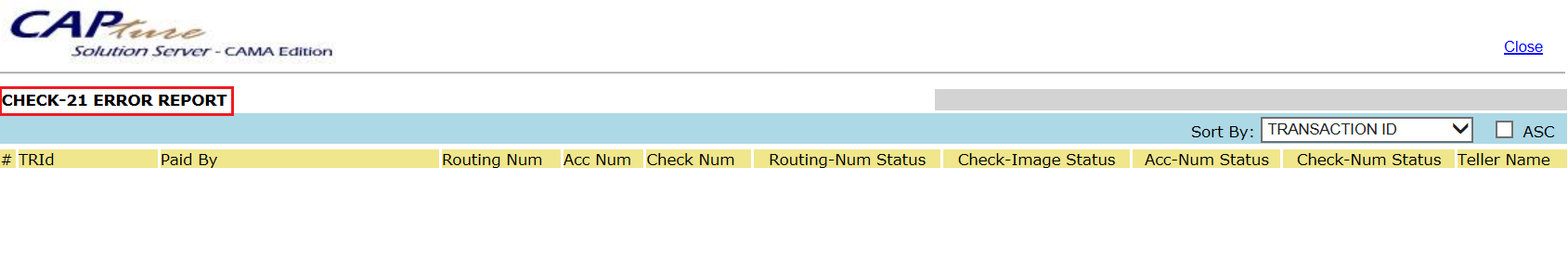

Check21- Errors: If any of details (Acc. Num., Check Num., Routing Num., Check Image status etc.) regarding Check are bad those transactions will come under this report. Then user should re-scan those checks.

Capture tracks and displays the deposits in the ledger after the semi-monthly (Disbursement) is run and money is disbursed. When setting up the ledger, it is important to reconcile the ledger to the bank statements. To reconcile, the money deposited in the bank and the amount in Capture’s ledger must match the bank statement that is sent at the end of the month.

ACH Processing

ACH (Automated Clearing House) payments are the collection method generally referred to as E-Checks. Customers using Citizen Access and willing to make payments directly from their checking account will use this method. They are required to enter their account and routing numbers and some additional information. This information is then bundled into a file at the end of the day with other e-check payments and submitted to the bank. The file is in a format called NACHA (National Automated Clearing House Association) which is an industry standard. The bundling and sending of information can be fully automated.

Capture will automatically check the routing number entered by the customer. If it is invalid, the payment will be instantly refused. The account number cannot be checked by Capture. This along with whether the customer has sufficient funds to cover the payment will be discovered by the bank when the payment is processed. E-checks that cannot be processed will be treated the same as any other returned check.

ACH processing must be set up with the bank. Some banks do not handle ACH payments directly and will require the county to submit payments through a separate vendor.

Check 21 Processing

The check 21 system is the method of making manual deposits for checks that were collected in the office. When users scan checks into Capture, the system collects not only an image, but also a routing number, account number, and check number. Together this information is all that is required for the bank to process a check. Once each business day, the information for all checks collected by all tellers are bundled together in the check-21 file and sent to the bank. The sending of the file may be automated or may require a user to send it manually based on the individual bank’s procedures. The file itself in the ANSIX9.37-2003DSTU format.

For the check-21 file to be generated, all checks in the file must include the correct information. At times the check scanner cannot read a check correctly and will enter bad data into Capture. To catch these errors, the user should check the Check-21 Error Report. This report will list checks with problems in the image, routing number, account number, or check number. Checks that appear on this list must be re-scanned or otherwise corrected before Capture generates the check-21 file. Because this is a scheduled process, users should check the error report regularly to allow time to make the corrections.

To locate the Check-21 Error Report, create a daily log for that day. On the EDIT DAILY LOG page, click the CHECK21-ERRORS link.

If there are errors in the file, or in case some other error prevents the file from being created or sent, the timeliest alternative is to deposit the checks manually. In other words, create a deposit slip and take the actual checks to the bank.

Check-21 processing must be set up with and outside vendor approved by the county’s bank.

Automated Credit Card Processing.

Capture allows users make credit cards payments which directly access the county’s credit card vendor. This functionality requires the vendor to have an online gateway which can be tied into Capture. Credit card payments submitted in this manner are processed in the same manner and time frame as all other online credit card transactions without the need to enter information on a credit card machine and balance the tape it produces. The only hardware needed is a wedge through which cards can be scanned. The vendor’s own website will provide a payment log which can be balanced against Capture’s daily log.

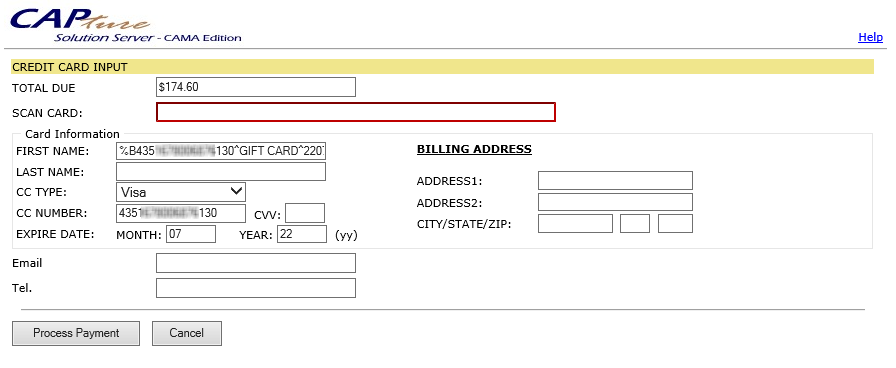

When this functionality is set up, the user just check-marks the Credit Card payment method. This will open the CREDIT CARD INPUT window. There the user will scan the credit card and enter the CVV number and zip code, then click Process Payment.

Reports

Daily Log Report: User will use this report to create a new daily log or to check the details of existing daily log transactions happened on that day. The main Daily Log page shows the amounts collected and deposited for each day in a specific location. User should select the appropriate options from the drop-downs.

Navigation: click on DAILY LOG

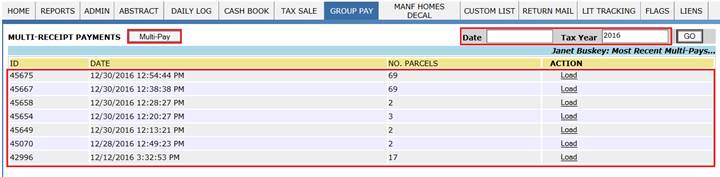

Group Pay Report: User will use this report, to create a new group in Group Pay by clicking on the Multi-Pay button. Also, report displays all groups that have been created and shows when they were created and the number of parcels in the group. Each group is assigned a unique ID number. Groups can be searched by date and tax year by entering the appropriate information in their respective fields.

Navigation: click on GROUP PAY

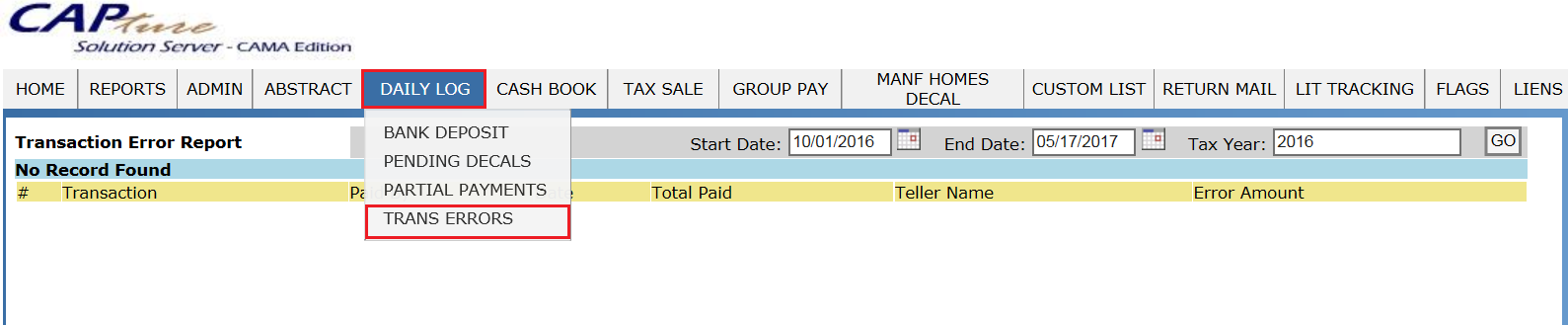

Transaction Error Report: Teller will use this report, if teller’s drawer is not lined up with capture, before closing out daily log, teller should run Transaction Error report (Daily Log > Trans Error) to see what went wrong. This report will catch any kind of error, typically, in this case tellers should contact to E-Ring Support.

Navigation: Hover over DAILY LOG and click on TRANS ERRORS

Manufactured Home Decal Log Report: User will use this report to check decals that were given out after a taxpayer paid a manufactured home’s taxes. User should run this decal log to issue Decals to those parcels. And if any taxpayer walk in and want issue a decal during paying the taxes, User will issue the decal to that user along with a letter which contain all details regarding decal.

Navigation: DAILY LOG > Select the daily log date > click on respective teller > Decal Log button .

Bad Check Report: User will use this report to check is there any check which is after depositing goes bad. Those transactions will come under this report with respective information.

Navigation: click on DAILY LOG, Select the daily log date, click on BAD CHECKS hyperlink.

Refund Report: User will use this report to check is there any tax payer pays the extra amount (Not in kitty limit) than the Due and those transactions will come under this report.

Navigation: click on DAILY LOG, Select the daily log date, click on REFUNDS hyperlink.

Reversal Report: User will use this report to check is there any receipt which got paid initially, but later because of some reason that receipt is marked again unpaid (void, stopping payment etc) those transaction’s will be come under Reversals.

Navigation: click on DAILY LOG, Select the daily log date, click on REVERSALS hyperlink.

Swap payments Report: User will use this report to check is there any receipt which got paid initially, but later because of some reason that receipt is removed and another receipt is added (payment on wrong receipt) those transaction’s will be come under Swap Payment report.

Navigation: click on DAILY LOG, Select the daily log date, click on SWAP PAYMENTS hyperlink.

Check-21 Error Report: User will use this report to check If any of details (Acc. Num., Check Num., Routing Num., Check Image status etc.) regarding Check are bad those transactions will come under this report. Then user should re-scan those checks.

Navigation: click on DAILY LOG, Select the daily log date, click on CHECK21-ERRORS hyperlink.

Out of Balance

Occasionally, the user who creates the daily log and performs the Daily Close Out at the end of the day will receive a message that one or more of the tellers are Out Of Balance. A two-step process of elimination can be performed by the user and usually the issue will be rectified. First, delete the current daily log of the day in question, and then recreate the daily log. Sometimes payments are taken after the original daily log is created. This will create a discrepancy between what Capture thinks was collected on the day in question and what has actually been collected in Capture for that day. Recreating the daily log will create an up to date log that contains the payments taken after the initial daily log was created. If the daily log is still out of balance, the second step is to determine how much the daily log is out of balance by. Do this by comparing the totals in each teller’s Teller Log. The Teller Log total, the total of the column to the right of the Teller Log with Regular, Escapes, Interest, etc. as fields, and the Batch Summary total should match. If they don’t match, take note of the difference. Take the difference and do a Transaction Search from the Daily Log Report page for that amount. Sometimes transactions don’t make it into the daily log for whatever reason, but the Transaction Search will help you find the transaction if there is only one.

Tellers Not Listed

Sometimes the user will create the daily log prior to a teller taking a payment. When this happens, the user will get a message when trying to create the Cash Book that tells them to “please check the daily deposit.” In this scenario, delete the daily log of the day in question, and then recreate it. The teller whose name didn’t appear should show up in the Teller Details section. Also, new tellers may not show up in the Teller Details section if they haven’t been added to that location from the Admin tab of the Collections workspace. Add new tellers to locations by hovering over the Admin tab and selecting Tellers. Use the Loc Teller button to add the teller to a location.