Page Topics:

Supplements

Introduction

Supplements are used to correct records after the abstract has been created. Assessors or appraisers may find that an abstracted parcel has and incorrect exemption or owner information, lost an improvement due to fire or weather, or may have been split into new parcels which themselves need to be taxed. These and any other changes can be handled through supplements.

When a supplement is opened on a parcel, a new record is created for that tax year. All necessary changes can be made to this record from any department (Assessment, Appraisal, Mapping, etc.) In Capture, the process can be entirely automated or divided across the departments involved based on the county’s preference.

Supplements can be created from the time the abstract is created up the point when certified mail is sent. Creating supplements past this point may leave a parcel in an unpaid state without leaving enough time to inform the taxpayer or advertise the parcel.

Simple Case

The following steps describe the addition of homestead and disability to a parcel that has already been taxed in the current collection year.

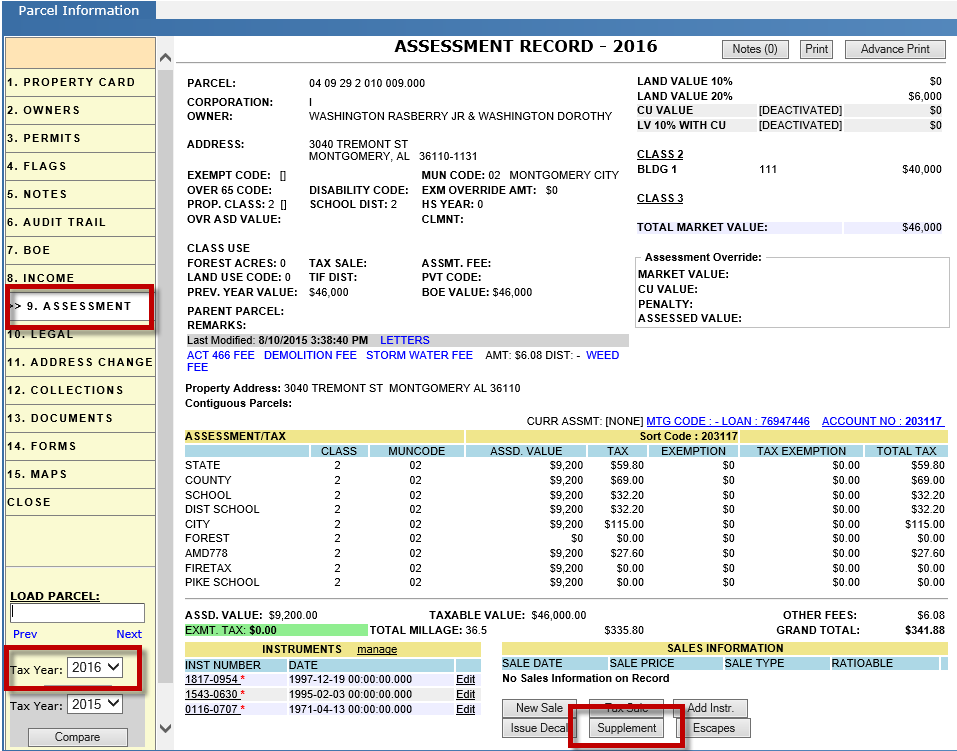

1. Open the Property Card and change the tax year to the prior year (current collection year).

2. On the Assessment Tab, click the Supplement button.

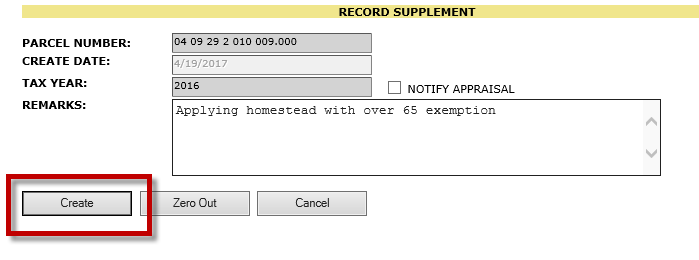

3. On the create supplement page, type the purpose of the supplement in the Remarks field and click Create. Confirm in the dialog box that appears afterward.

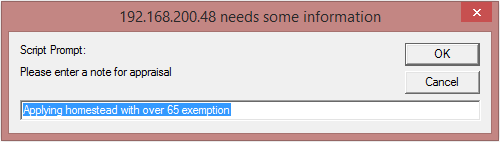

4. A dialog box will appear showing the Remarks previously entered. This is a second opportunity to enter the remarks. Click OK to continue.

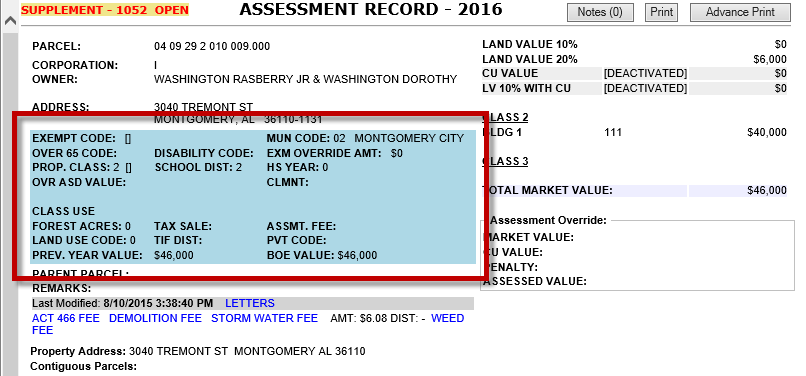

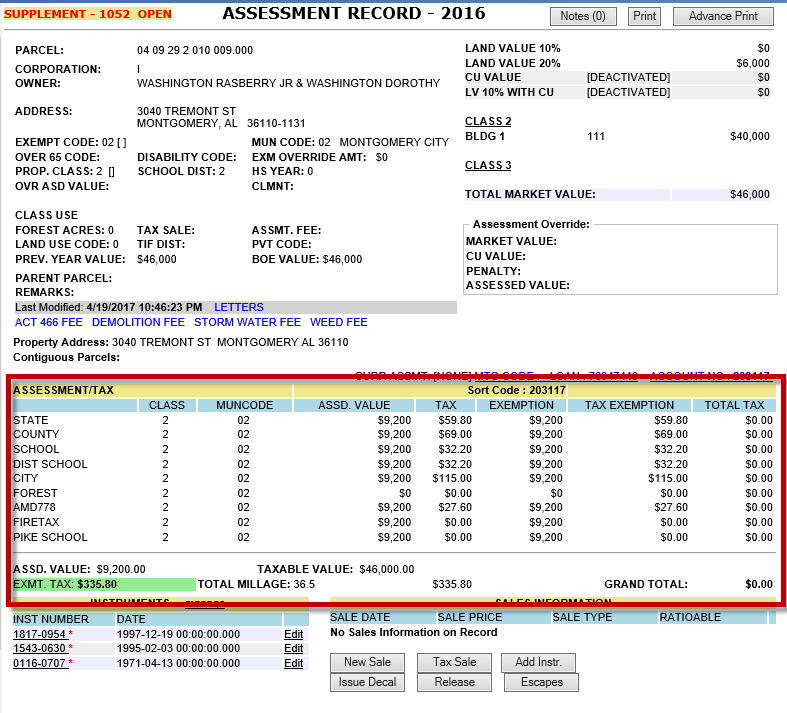

The supplement is now open and changes can be made to any part of the parcel in the prior year. This includes Appraisal, Assessment, and Mapping changes.

5. On the Assessment page, open the Exempt Code hyper-region and apply an Act 48 exemption to the parcel. Click Update to apply the changes.

6. On the Assessment page, note the tax calculation has changed to account for the Act 48 exemption.

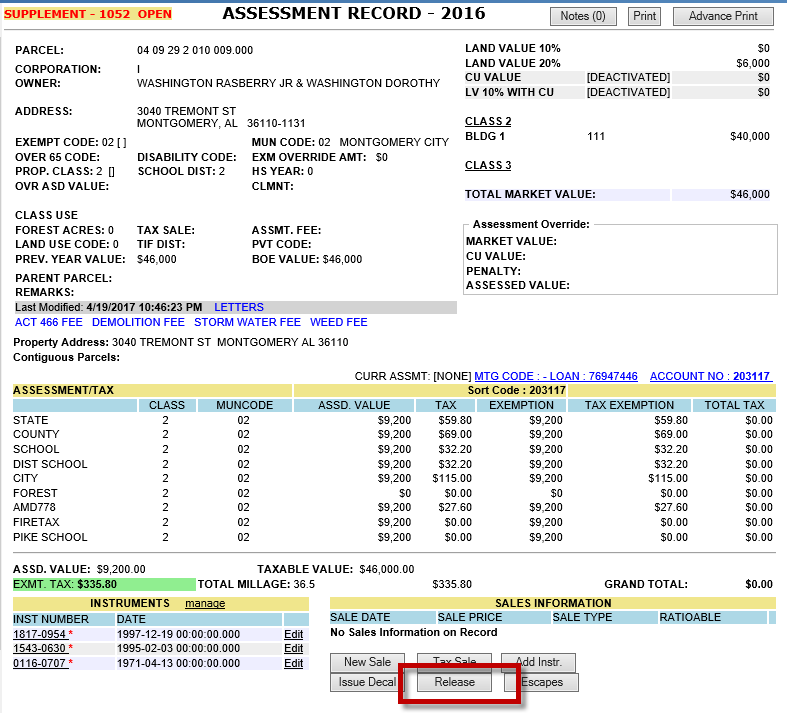

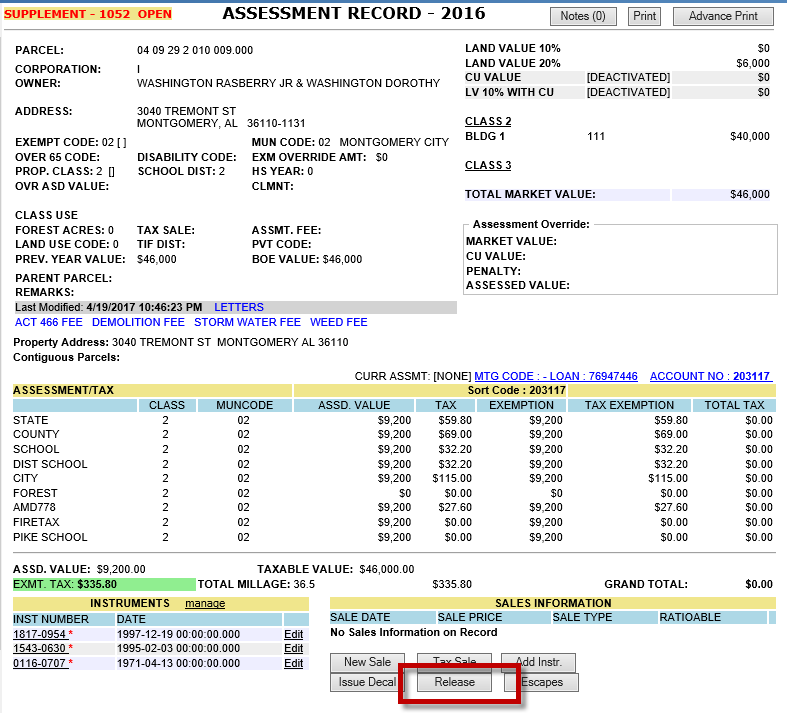

7. To close the supplement click the Release button which replaced the Supplement button. This step will release the supplement to collections and may automatically generate a receipt depending on the county’s settings. Confirm in the dialog boxes that appear afterwards.

Creating Receipts

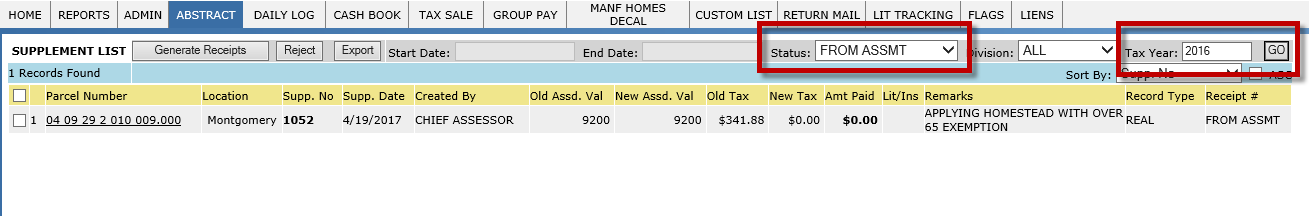

The county’s settings may not allow receipts to be automatically created when a supplement is released. In this case, the collectors will need to generate the receipts manually. Those supplements requiring attention will be found listed on the Supplements page with a status of FROM ASSMT. The collectors can review the supplements from this list and generate receipts or reject them as required.

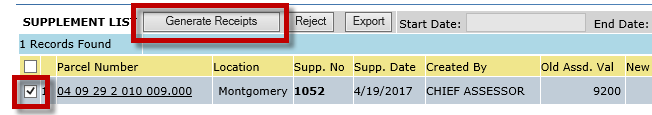

1. In the Collections workspace, hover the ABSTRACT tab and select SUPPLEMENTS.

2. Set the Status drop-down to FROM ASSMT, and the Tax Year to the current collection year.

3. Checkmark the parcel and click the Generate Receipts button.

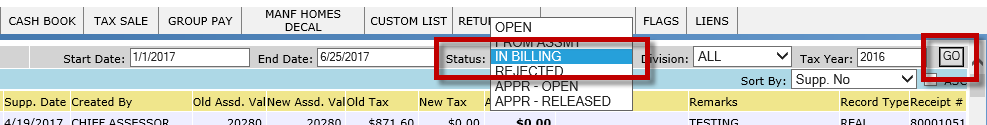

4. Change the Status drop-down to IN BILLING and set the Start and End Dates to the date of the supplement. Click GO.

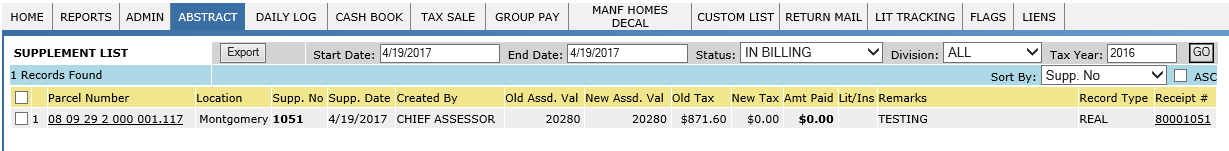

5. The parcel will be listed along with its new receipt number and pertinent information. Click the Receipt # to access the Single Pay screen.

If the receipts were automatically created when the parcel was released, the parcel will still appear on the supplements page under the IN BILLING status. The new receipts can also be accessed from the Parcel Dashboard.

Sketching in Supplements

Sketching is disabled for all but current year records. However there is a way to get a new or updated sketch into a supplemented record. Sketches can be copied and pasted from one year to another or from one parcel to another. In the simplest case, the parcel can be sketched in the current year first, then the sketch can be copied into the previous year.

Supplementing Paid Receipts

If a supplement is required on a parcel that has already been paid, Capture will automatically handle any adjustment required to the payment. In the case of a reduction in taxes, Capture will create a refund for the difference. If the taxes are increased, Capture will leave the parcel partially paid. This applies whether the parcel was originally paid in full or partially paid.

Errors

When creating supplements, it is implied that the original abstracted records are incorrect. Capture automatically creates an error record which can be accessed through the property card. The values on this record are also added to the Error Abstract automatically.

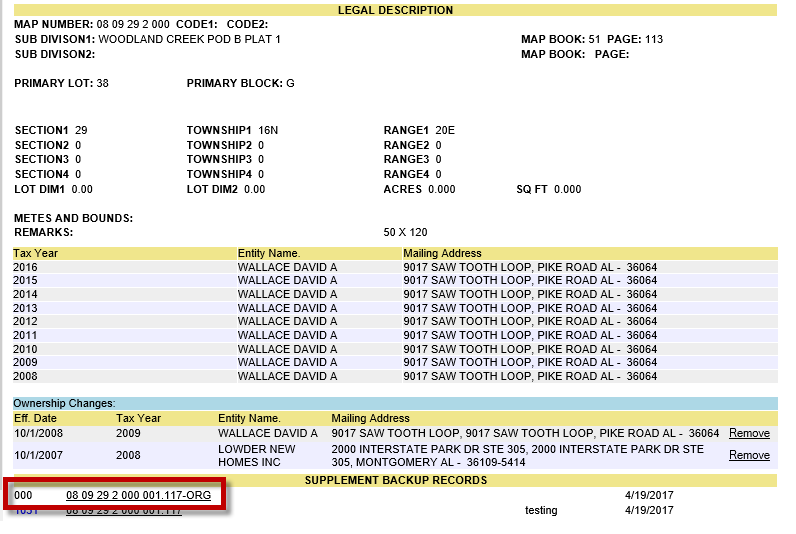

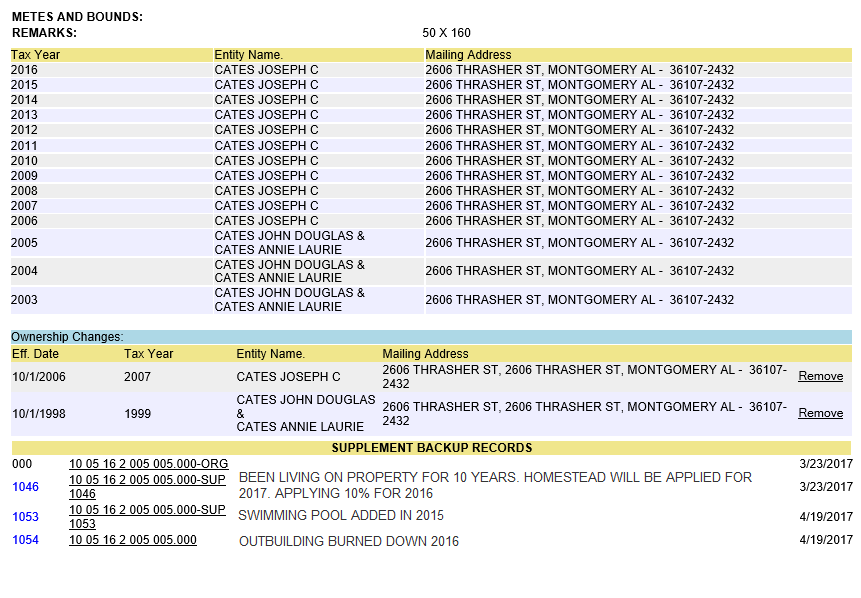

To access the error record for any supplemented parcel, open the property card to the prior year. On 9.Assessment, at the bottom of the page is a section labeled SUPPLEMENT BACKUP RECORDS. The record listed with “-ORG” is the error record. Clicking this link will open a property card with its original, abstracted values.

Multiple Supplements on a Single Parcel

Any number of supplements can be created on a single parcel. For example it may happen that a taxpayer should have received an exemption and only realizes it was not applied after collection begins. A supplement is done to correct this but later it is discovered that a new improvement has been added to the property. A second supplement can be done to account for this. Capture allows the users to create as many supplements on a single parcel as required.

Each supplement created adds a new record to the SUPPLEMENT BACKUP RECORDS section at the bottom of 9.Assessment. These can be used to track changes if they were not adequately explained in notes or remarks.

Zero Out

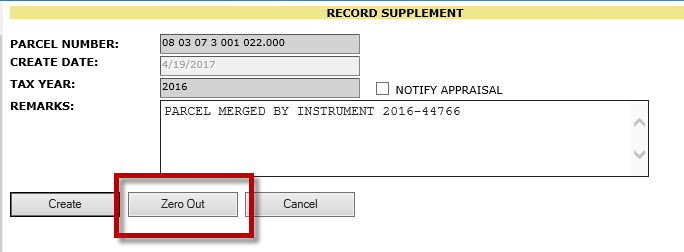

Occasionally a parcel that should have been delete will instead be abstracted and taxed. These parcels MUST NOT be deleted from the prior year as this will essentially destroy an abstracted record. Instead Capture has a special supplement type called a Zero Out. Zeroing out a parcel creates an error and leaves the record intact but essentially makes it un-taxable for that year. The parcel should still be deleted for the current year.

To Zero Out a parcel, click the Supplement button on 9.Assessment. On the Record Supplement screen, click the Zero Out button. All information will be removed from the Assessment/Tax section. The parcel must then be Released as usual.

Non Ad Val Fees

Many counties collect fees for outside agencies such as Fire Fees, Storm Water Fees, and Weed Fees. The agencies receiving these fees may require reports of how much was paid and for which parcels. For this reason Capture can be set up to require supplements when adding or changing fees. By locking these fees in such a way Capture creates a trail that can be followed to find what fees may have been added or removed from the parcel. This is not possible for fees that can be updated directly from the receipt. This feature is optional and can be disabled for any individual fee type.

Creating Parcels in the Prior Year

In some cases new parcels that did not appear on the abstract at all will need to be created and taxed simultaneously. These parcels should be created in the current year, then supplemented to create a prior year record. Parcels created in the current year are the only ones which will have a Supplement button in the current year. Creating the supplement here will automatically create a prior year record and open it for appraisal, assessment, and mapping.