Page Topics:

Abstract

Introduction

The abstract, or tax roll, shows the amount due from taxpayers for the upcoming collection year. Real property, personal property, public utilities, and mineral rights are taxed each year. The abstract is a state mandated document that must be delivered from the assessor to the collector by the beginning of August. It is from the abstract that tax bills are generated and sent for the tax collection cycle. Without an abstract, taxes cannot be collected. Once the abstract is created, it cannot be changed. The Abstract can be generated at any time in Capture. Once the county is ready for the abstract to be created they will contact E-Ring to generate it. From there the county will verify the Abstract report, if necessary the abstract may be recreated to fix any mistakes. The abstract is finalized after being verified and the tax bills are also created when finalizing occurs.

Data Validation

Validating the abstract is one way to help eliminate or lessen errors in the tax collection cycle. When checking the abstract for accuracy, it is necessary to remember that the abstract is a report. It is compiled data from multiple locations. It would be impractical to verify every individual piece of data that makes up the totals on the abstract (this would involve verifying thousands and thousands of parcels), so it must instead be validated based on its own merit. The main way users validate the abstract in Capture is by comparing the New Abstract to the Old abstract.

Assessment and Appraisal Edit Checks

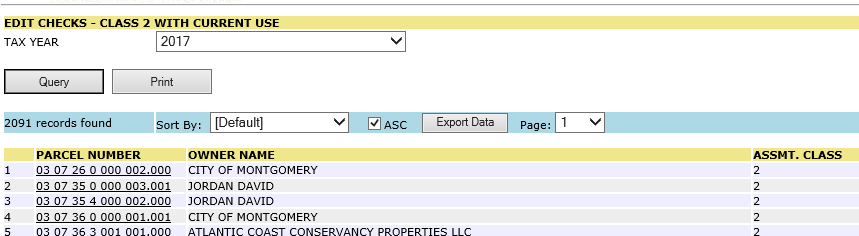

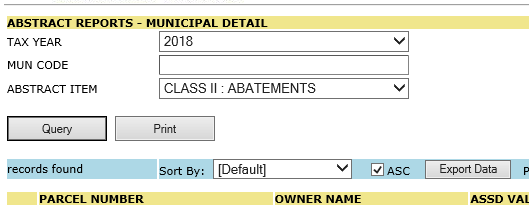

Assessment and Appraisal Edit check reports should be run before the abstract is created. These checks find errors that users can correct, most are parcel level errors. An example of such a report is class 2 parcels that have current use. The locations of these reports and brief description on how to use them is discussed in the following steps.

In the Appraisal Supervisor Workspace hover over the Reports tab to access the reports. Click on one of the report Categories.

A list of reports appears as links. Click on a report link to use the report. Each report will require the user to enter or select criteria to run the report against. Certain reports require more criteria than others.

Example 1: Class 2 with Current Use Report.

Only requires the Tax Year.

Example 2: Municipal Detail Report

Requires 3 Criteria.

3. The user will continue to run the various reports of their choosing and verifying the data of each report.

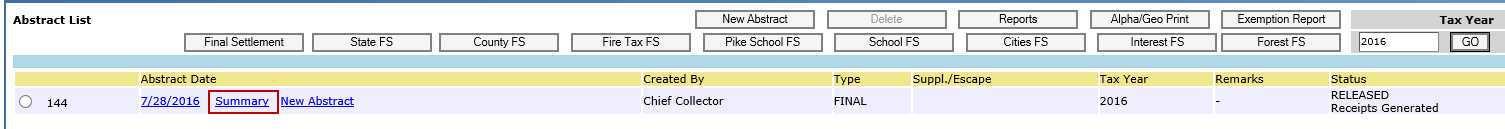

Verify and Print the Old Abstract

The Old Abstract is the Abstract in the old standard State Abstract format. Printing the abstract is recommended to make it easier for the user to compare the Old abstract against the New. The idea being, having the printed Old Abstract in hand and the New Abstract on the Computer screen. The following steps go over this recommended process.

Click the Summary link to access the Old Abstract.

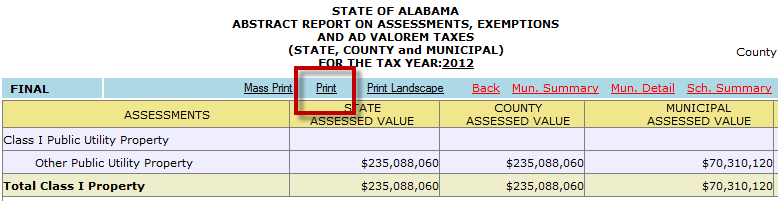

Click Print to print the summary for reference.

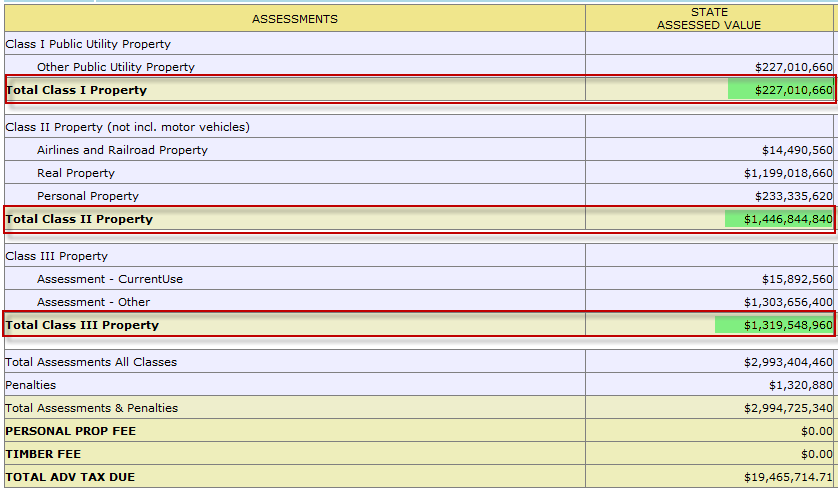

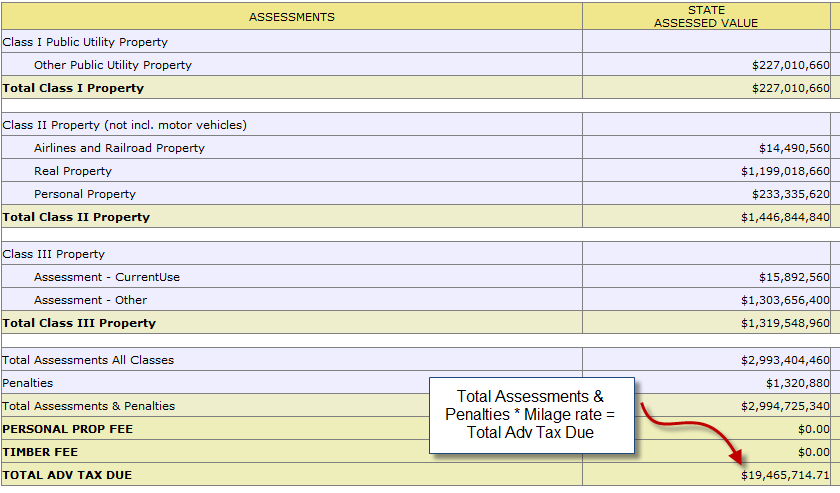

Verify the calculations, beginning with “State Assessed Value”.

Make sure that each Property Class Total is correct

Verify the Total Adv Tax Due

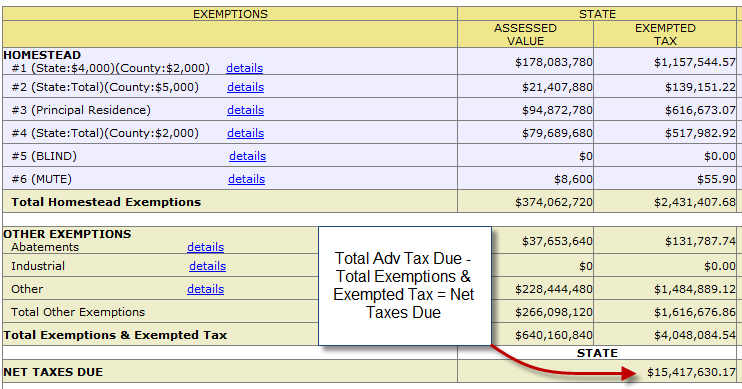

Include Homestead and Other Exemptions to verify the Net Taxes Due

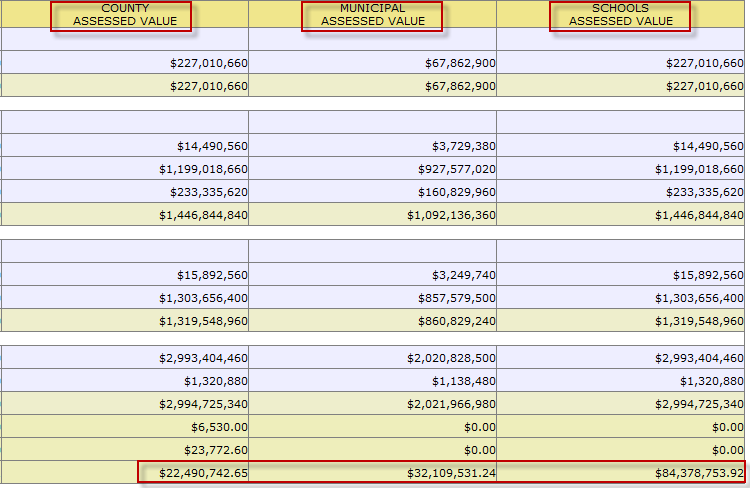

Continue validation for County Assessed Value, Municipal Assessed Value, and Schools Assessed Value.

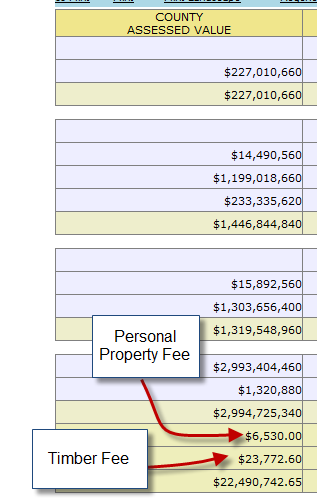

Note: When checking “County Assessed Value,” make sure the Forest and Personal Property fees are applied appropriately.

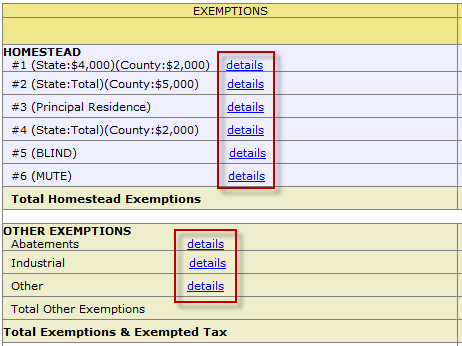

Click the Details link for each exemption type and verify the exemptions.

Validate the Net Taxes Due on the City III report. Be sure to include Personal Property and any other extra fees.

Comparing Old and New Abstracts

In Capture comparing the New and Old abstracts is the largest part of validating. The Old Abstract is the old State Abstract format and the New Abstract is the updated format of the State required Abstract. The reason to compare the two is that they are created differently, such pulling data from different data tables, etc. The two abstracts should still match even though the creation methods are different.

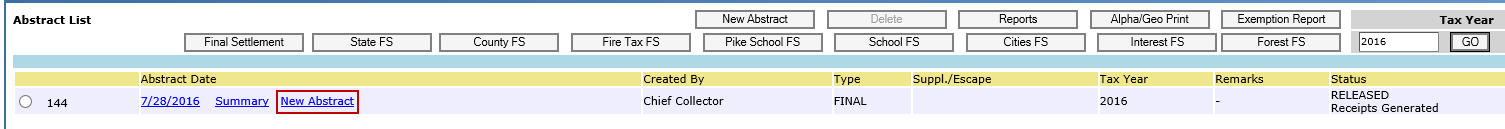

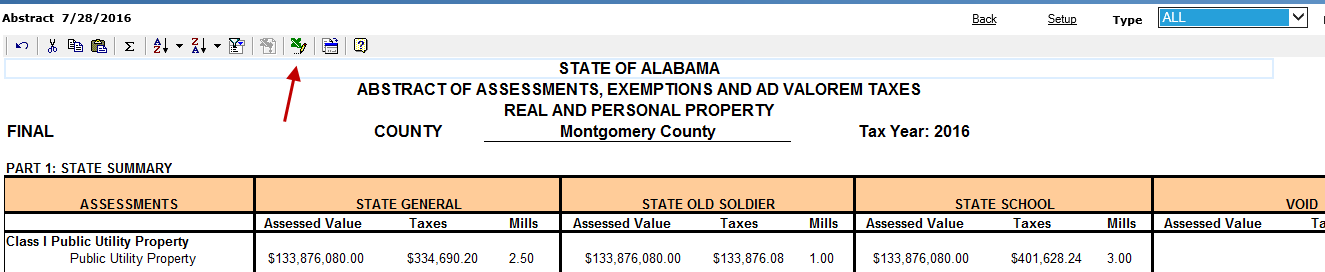

From the Abstract page locate the regular abstract and click New Abstract.

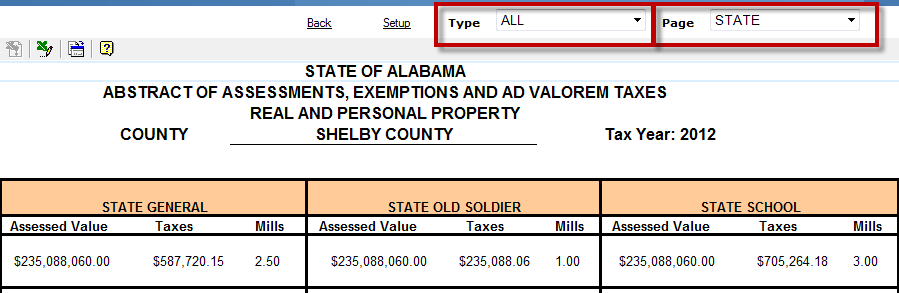

When the New Abstract opens note that Type is set to ALL and Page set to STATE.

The user may Export the current report to Excel by clicking the Excel button at the top of the page.

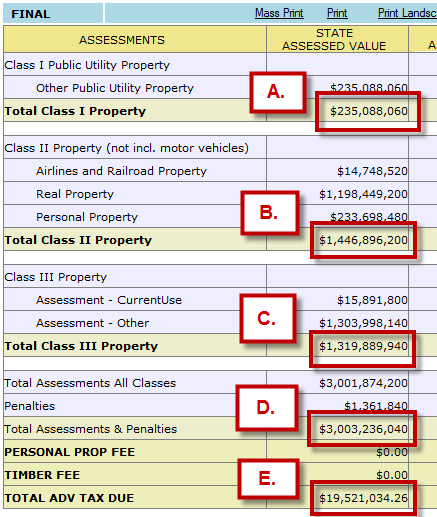

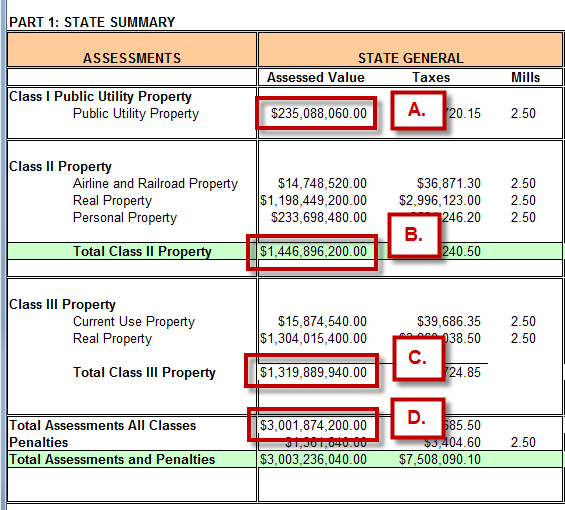

Compare the following values from the State column of the Summary to the STATE page of the New Abstract.

-

Total Class I Property & Public Utility Property (Assessed Value).

-

Total Class II Property (Assessed Value).

-

Total Class III Property (Assessed Value).

-

Total Assessments & Penalties (Assessed Value).

-

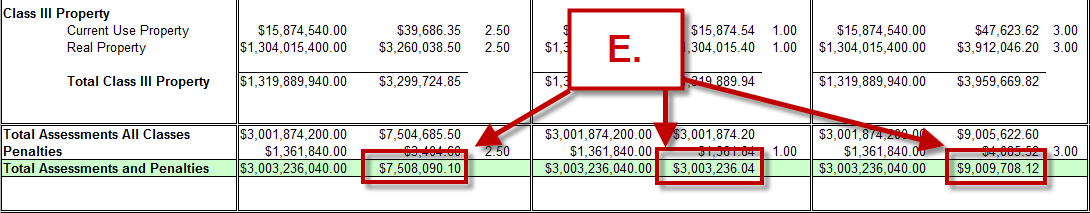

TOTAL ADV TAX DUE and Total Assessment and Penalties (STATE GENERAL + STATE OLD SOLDIER + STATE SCHOOL) from the Taxes column.

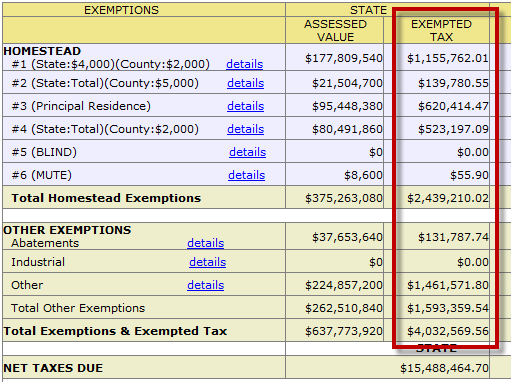

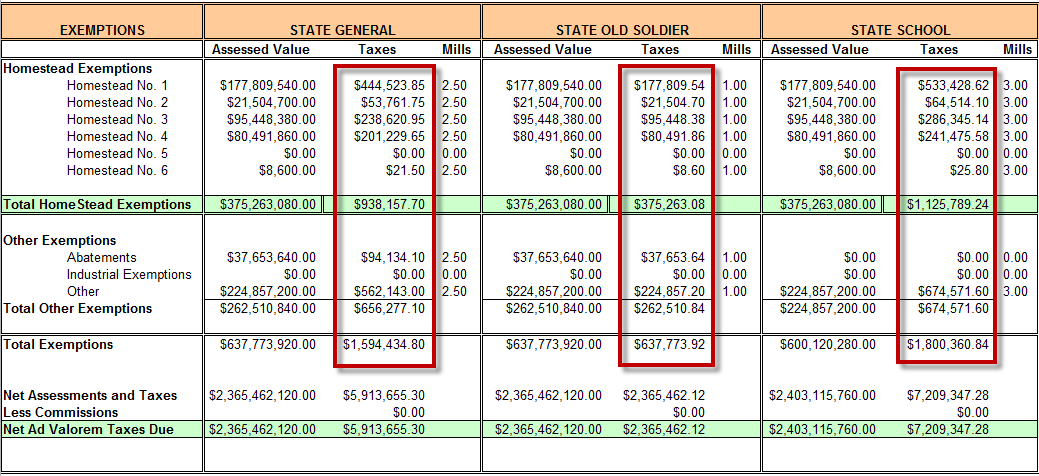

For each exemption (Homestead and Other), compare the EXEMPTED TAX listed on the Summary to the sum of Taxes listed for State General, Old Soldier, and School for that exemption in the New Abstract.

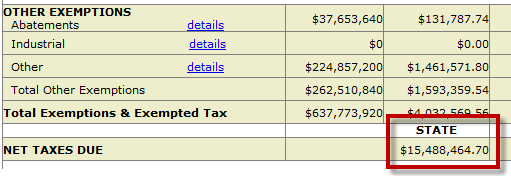

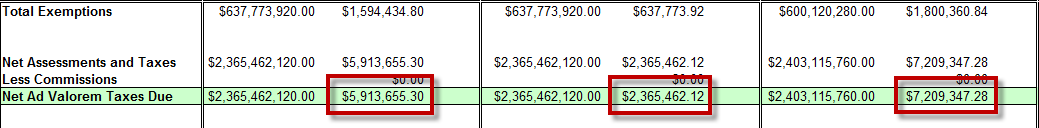

Compare NET TAXES DUE (STATE) to the total Net Ad Valorem Taxes Due for State General, Old Soldier, and School.

Finalize Abstract and Generate Tax Bills

Once the abstract has been verified and signed off by both the County and E-Ring, it is time to finalize and release the abstract. Finalizing the abstract also creates the tax bills. Finalizing is completed by E-Ring once given permission by the county and usually takes a couple hours. The finalization and generation of the tax bills typically occurs after hours to ensure the system is not slowed down by users. Tax Bills in Capture are referred to as Receipts.

Tax Increment Financing (TIF)

TIF is a way for future gains in taxes to subsidize current improvements or developments in a specified area. Through these improvements, it is projected an area will generate more business and income, and therefore raise property values and bring in more tax dollars. The hope is that when money is put into a TIF district, then more money will go into the area and spur growth, yielding more tax dollars for the funds. TIF applies to both real and personal property and districts may overlap.

TIFs are usually set up as a district, so a county may have TIF district 1, TIF district 2, etc. City, County, and School funds will send tax money to the TIF districts based on the tax increase that was generated. The amount each fund gives to the TIF district varies and TIF districts are only created for a limited time.

If there is no increase, then the funds typically do not pay any money to the TIF. The TIF factor must be found in order to calculate what will be paid to the TIF district. The TIF factor is the percent increase in property value between the current tax year and the TIF base year.